Home insurance is a safety net that protects your most valuable asset—your home. But when it comes to plumbing and drainage issues, many homeowners wonder whether their policy covers them. These problems can cause significant damage and costly repairs, making it crucial to understand what your home insurance really covers.

Understanding Home Insurance Policies in 2025

Home insurance policies can seem complex, but breaking down the key parts helps clarify what’s covered.

What Does a Typical Home Insurance Policy Cover?

- Dwelling Coverage: Protects the physical structure of your home, including walls, roof, and built-in appliances.

- Personal Property Coverage: Covers belongings inside your home, like furniture, electronics, and clothing.

- Liability Coverage: Protects you if someone is injured on your property or you cause damage to others.

- Additional Living Expenses: Pays for temporary housing if your home becomes uninhabitable due to damage.

Where Do Plumbing and Drainage Issues Fit?

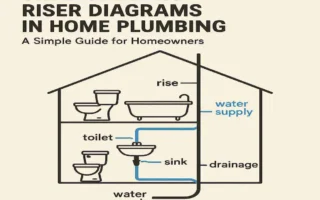

Plumbing and drainage problems usually relate to dwelling coverage because they affect your home’s structure. However, if water damage ruins personal belongings, personal property coverage may also apply. Understanding these distinctions is key to knowing when you can file a claim.

Standard Plumbing and Drainage Problems in Homes

Let’s look at typical issues that homeowners face:

- Pipe Bursts: Sudden breaks in water pipes cause flooding.

- Leaks: Dripping pipes or slow leaks that can lead to water damage.

- Blockages: Clogged drains or toilets causing backups.

- Sewer Backups: Wastewater flowing back into your home due to blockages or heavy rains.

- Water Damage: Damage caused by any of the above, affecting walls, floors, and ceilings.

What Causes These Problems?

- Age of Plumbing: Older pipes corrode and become fragile.

- Weather: Freezing temperatures can cause pipes to burst.

- DIY Damage: Incorrect repairs may worsen plumbing.

- Wear and Tear: Over time, plumbing naturally degrades.

These issues not only threaten your home’s safety but can also reduce its market value if left unchecked.

Does Home Insurance Cover Plumbing and Drainage?

Now to the heart of the question.

What Is Usually Covered?

Most standard home insurance policies cover sudden and accidental damage. For example, if a pipe unexpectedly bursts and floods your home, the damages are typically covered.

What Is NOT Covered?

- Gradual Damage: Slow leaks causing mold or rot are usually excluded because they result from neglect.

- Wear and Tear: Damage due to aging pipes or poor maintenance is your responsibility.

- Maintenance Issues: Insurance doesn’t cover fixing old or faulty house plumbing that wasn’t regularly maintained.

Policy Exclusions to Watch For

Many policies explicitly exclude damage from sewer backups or flooding unless you purchase additional coverage.

Types of Home Insurance Policies and Coverage Variations

Insurance isn’t one-size-fits-all, especially when it comes to plumbing.

Standard vs. Specialized Coverage

- Standard Homeowners Insurance: Covers sudden plumbing failures but often excludes sewer backups.

- Endorsements or Riders: Add-ons that provide extra protection for sewer and drain backups.

- Separate Flood Insurance: Covers water damage from natural flooding, which is not included in most home insurance.

How to Verify Your Coverage for Plumbing and Drainage

Don’t guess what your policy covers—check!

Steps to Review Your Policy

- Read your policy document carefully.

- Look for terms like “water damage,” “sewer backup,” and “plumbing.”

- Check exclusions or limitations related to gradual damage or maintenance.

Questions to Ask Your Insurance Agent

- Does my policy cover sewer backups or drain blockages?

- Are burst pipes covered regardless of cause?

- Can I add endorsements for extra plumbing protection?

Updating your policy or adding endorsements can save you headaches later.

Filing a Claim for Plumbing and Drainage Issues in 2025

If you face plumbing problems, here’s how to file a claim smoothly.

Step-by-Step Guide

- Document the damage: Take photos and videos immediately. Get a plumber’s report if possible.

- Notify your insurer promptly: Don’t delay reporting the issue.

- Work with the adjuster: Be available for inspections and provide all necessary documents.

- Keep receipts: Save invoices for repairs and replacements.

Common Mistakes to Avoid

- Waiting too long to file.

- Failing to document damage properly.

- Making major repairs without insurer approval.

Following these steps helps ensure your claim is processed quickly.

Tips to Prevent Plumbing and Drainage Problems and Reduce Claims

Prevention is better than a cure!

- Regular inspections: Hire a plumber once a year to check pipes and drains.

- Avoid DIY fixes: Some problems need professional care.

- Winterize pipes: Insulate or drain pipes before cold seasons.

- Keep drains clear: Avoid flushing grease or debris down the sink.

Preventive care reduces the chance of claims and might lower your insurance premiums.

Understanding Deductibles and Claim Limits for Plumbing Issues

Knowing your financial responsibility is essential.

What Is a Deductible?

It’s the amount you pay out-of-pocket before insurance kicks in. For example, with a $1,000 deductible, you pay the first $1,000 of a plumbing claim.

Claim Limits

Policies often cap how much they will pay for water damage or plumbing issues, so check your coverage limits carefully.

Impact of Multiple Claims

Frequent claims can increase your premiums or lead to policy non-renewal. Use claims wisely and focus on prevention.

What To Do If Your Plumbing Claim Is Denied

If your claim is rejected, don’t panic.

Common Reasons for Denial

- Damage resulted from poor maintenance.

- The problem was gradual, not sudden.

- Lack of proper documentation.

How to Appeal

- Review your policy to understand coverage.

- Contact your insurer to request a detailed explanation.

- Provide additional evidence or get a second opinion.

If needed, consult a public adjuster or legal professional to help dispute the denial.

Future Trends in Home Insurance for Plumbing and Drainage (2025 and Beyond)

The insurance landscape is evolving.

Smart Plumbing and IoT

New devices monitor leaks and pipe health in real time, alerting homeowners before significant damage occurs. Insurers may offer discounts for using these technologies.

Policy Changes Due to Climate and Aging Infrastructure

Insurers are adjusting policy terms to address increased flooding and aging plumbing systems, potentially changing coverage and premiums.

Getting ahead of these trends means staying informed and adapting your coverage accordingly.