It starts with a rumble in the distance. Then, the wind picks up, whistling through the trees. Suddenly, it sounds like someone is throwing marbles—or worse, baseballs—at your ceiling. When the storm passes, you step outside to find shingles scattered on your lawn or, even more terrifying, a dark water stain forming on your living room ceiling.

In that moment of panic, one question likely dominates your thoughts: “How am I going to pay for this?”

If you are wondering how to claim a new roof on homeowners’ insurance after a brutal storm, you are not alone. In fact, millions of homeowners find themselves in this exact position every single year. According to the Insurance Information Institute, about 40% of all homeowner insurance claims are related to wind and hail damage.

Here is the good news: Your insurance policy is there for exactly this reason. However, the process of filing a claim can feel like navigating a maze blindfolded. If you wait too long or say the wrong thing, you risk having your claim denied or underpaid.

Understanding Roof Coverage in Homeowners Insurance

Before you pick up the phone to call your insurance agent, you need to understand what you actually bought when you signed your policy. Many homeowners assume a “full coverage” policy means a blank check for a brand-o. Unfortunately, it is rarely that simple.

To successfully navigate how to claim a new roof on homeowners’ insurance, you need to speak the language of the insurance adjusters.

Types of Coverage: ACV vs. RCV

This is the single most important distinction in your policy. Your declaration page (the summary of your policy) will specify whether you have Actual Cash Value (ACV) or Replacement Cost Value (RCV) coverage.

- Replacement Cost Value (RCV): This is the gold standard. It pays to replace your roof today, minus your deductible. It doesn’t matter if your roof is 10 years old; if it costs $20,000 to replace, they pay that amount (less the deductible).

- Actual Cash Value (ACV): This takes depreciation into account. If your roof is 15 years old and nearing the end of its lifespan, the insurance company will deduct value for that age and wear. You might only get paid a fraction of the replacement cost.

Here is a quick breakdown to help you visualize the difference:

FeatureReplacement Cost Value (RCV)Actual Cash Value (ACV)

Definition: Pays the cost to replace with new materials at current prices. Pays the value of the roof at the time of loss (Current cost minus depreciation).

Payout Amount: Higher payout (covers full repair/replacement). Lower payout (you pay the difference out of pocket).

Premiums are typically higher, but monthly premiums are lower.

Example ($20k Roof) Insurance pays $19,000 (minus $1k deductible). Insurance might pay $12,000 (depreciated value minus deductible).

Common Exclusions

Insurance covers sudden and accidental damage. It does not cover maintenance issues. If your roof leaks because it is 30 years old and the shingles are simply disintegrating from old age, your claim will likely be denied.

Furthermore, standard policies cover wind, hail, and fallen trees. They usually do not cover flood damage (rising water from the ground). For that, you would need a separate flood insurance policy.

The Deductible Impact

Your deductible is the amount you must pay before the insurance kicks in. Be careful to check if you have a separate wind/hail deductible.

In many storm-prone areas, insurers have shifted from a flat dollar amount (like $1,000) to a percentage of your home’s insured value (usually 1% to 5%).

Here is the math: If your house is insured for $300,000 and you have a 2% wind/hail deductible, you are responsible for the first $6,000 of the repair. Knowing this number in advance is crucial to your budget.

Signs Your Roof Needs a Full Replacement After Storm Damage

You don’t always need to climb a ladder to know you have a problem. In fact, for safety reasons, we strongly recommend you stay off the roof unless you are experienced. However, there are plenty of signs you can spot from the ground or inside your home that indicate you should start the process of filing a homeowners’ insurance claim for a new roof.

Visual Cues from the Ground

Take a walk around the perimeter of your house. Binoculars can be very helpful here. Look for:

- Missing Shingles: This is the most obvious sign of wind damage. If you see bare spots on your roof, the seal has been broken, and water can get in.

- Granule Loss: Check your downspouts and gutters. If you see a pile of black grit (granules) at the bottom, your shingles have been stripped. These granules act as sunscreen for your roof; without them, the shingles become brittle and fail.

- Lifted or Creased Shingles: High winds can lift shingles and crease them, breaking the seal. These might look like horizontal lines across the shingle tabs.

- Dented Metal: Look at your roof vents, flashing, or metal gutters. If they have dings or dents, your shingles likely have hail damage too, even if you can’t see it clearly.

Interior Warning Signs

Your ceiling can tell you a lot about your roof.

- Water Stains: Yellow, brown, or gray rings on your ceiling or running down walls.

- Peeling Paint: Moisture trapped in the walls can cause paint or wallpaper to bubble and peel.

- Light in the Attic: Go into your attic during the day. If you see pinholes of sunlight coming through the roof deck, you have a serious problem.

When to Call a Pro vs. DIY

If you see any of the signs above, it is time to call a professional. Storm damage can be subtle. A professional roofer knows how to distinguish between a hail hit and a blister caused by heat. They can document damage that an untrained eye would miss.

Safety First: Never go up on a roof that might be structurally compromised or wet. It is not worth the risk.

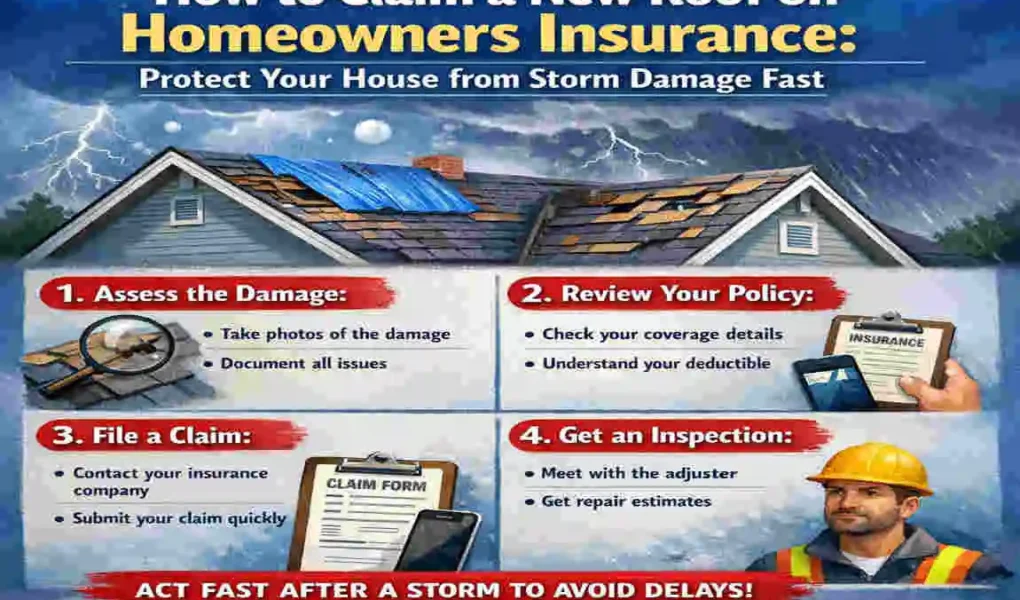

Step-by-Step Guide: How to Claim a New Roof on Homeowners Insurance

This is the core of our guide. Following these steps in order is the best way to ensure your claim is handled fairly and efficiently. Here is exactly how to claim a new roof on homeowners’ insurance like a pro.

Document the Damage Immediately

As soon as the storm passes and it is safe, become a detective. You need proof.

- Take Photos and Video: capturing the damage from every angle. Photograph the missing shingles, the hail dents on your car (to prove hail size), and any interior leaks.

- Use Timestamps: Most smartphones do this automatically, but ensure your photos have metadata showing the date and time.

- Mitigate Further Damage: This is a requirement in most policies. If there is a hole in your roof, you must tarp it to prevent rain from destroying the interior. Keep receipts for the tarp and any labor costs; the insurance company should reimburse you for these “emergency repairs.”

File the Claim Promptly

Do not wait weeks to call. Most policies require you to report loss “promptly.”

- Call Your Agent: Have your policy number ready.

- Stick to the Facts: When they ask what happened, keep it simple. Say, “My home sustained damage during the storm on [Date] at [Time]. I have observed missing shingles and leaks.”

- Don’t Guess: Do not say “I think my roof is totaled.” Let the inspection determine that. Just report the damage you can see.

- Get a Claim Number: Write this down immediately. You will need it for every interaction moving forward.

Schedule a Professional Inspection

This is the step most people skip, and it costs them money. Before the insurance adjuster comes out, you should hire a reputable, local roofing contractor to inspect the roof.

- Why? The insurance adjuster works for the insurance company. You need someone in your corner who works for you.

- Get a Detailed Estimate: Ask your roofer to use Xactimate (the same software insurance companies use) to write an estimate. This makes it much easier to compare the insurance offer to the contractor’s price.

- Verify Credentials: Ensure your roofer is licensed, insured, and certified by major manufacturers (like GAF or Owens Corning).

Work with the Adjuster

Your insurance company will send an adjuster to inspect the damage.

- The Golden Rule: Have your roofing contractor present during this meeting.

- Why this matters: If your roofer is on the roof with the adjuster, they can point out specific damage—like subtle hail hits or wind-lifted shingles—that the adjuster might overlook. It is much harder for an adjuster to deny damage when a qualified professional is standing right there, pointing it out.

- Be Polite but Firm: Treat the adjuster with respect, but remember they are protecting the insurance company’s bottom line.

Review and Negotiate the Estimate

You will receive a “Scope of Loss” or estimate from the insurance company.

- Compare Line by Line: specific items. Does the insurance estimate include the cost of removing the old roof? Dumpster fees? Building permits? Ice and water shield code upgrades?

- Spot the Discrepancies: If the insurance offer is $10,000 and your roofer says it will cost $15,000, do not panic. This is normal.

- Supplementing: Your contractor can file a “supplement” with the insurance company, providing photos and code requirements to justify the extra cost. This is a standard part of filing a claim for a new roof under homeowners’ insurance.

Approve Repairs and Get Paid

Once the price is agreed upon, the work begins.

- The Payment Structure: You will likely receive two checks.

- Check 1 (ACV): The actual cash value (depreciated amount). You use this to start the work.

- Check 2 (Recoverable Depreciation): Once the work is complete and you provide an invoice showing you paid the full amount, the insurance company issues the second check (if you have an RCV policy).

- Beware of “Waiving Deductibles”: If a contractor says they will “eat” or waive your deductible, run away. This is insurance fraud and is illegal in many states. You are legally required to pay your deductible.

Common Mistakes to Avoid When Claiming a New Roof on Homeowners Insurance

Even with the best intentions, homeowners often make errors that result in denied claims. When learning how to claim a new roof on homeowners’ insurance, knowing what not to do is just as important as knowing what to do.

- Delaying the Report: Many policies have a statute of limitations (often one year) from the date of the storm. If you wait too long, your valid claim could be denied simply due to timing.

- Signing a “Contingency Agreement” Too Early: Some storm-chasing roofers will ask you to sign a document before they even look at your roof. Read the fine print. Ensure you aren’t locking yourself into a contract before you know if insurance will pay.

- Accepting the First Offer: The adjuster’s first estimate is not the final word. It is an initial offer. If it is too low, you have the right to appeal and negotiate.

- Ignoring Supplements: Industry data suggests that a large share of initial insurance estimates omit key line items. If you accept the check and close the claim without letting your roofer review it, you could be leaving thousands of dollars on the table—money you need for a quality installation.

- Filing Too Many Claims: Do not file a claim for minor cosmetic damage that costs less than your deductible. Filing a claim goes on your CLUE report (your insurance “permanent record”) and can raise your premiums, even if they pay out $0.

What to Expect: Payouts, Timelines, and Costs for Roof Replacement

Managing your expectations is key to reducing stress during this process.

Average Costs and Payouts

The cost of a new roof varies wildly based on size, material, and location. However, for a standard asphalt shingle roof on a moderate-sized home, costs typically range from $10,000 to $25,000.

When you successfully navigate how to claim a new roof on homeowners’ insurance, your payout should cover this total cost, minus your deductible. For example, if the roof is $15,000 and your deductible is $1,000, the total insurance payout should be $14,000.

The Timeline

This is not an overnight process.

- Week 1: Damage occurs, inspections happen, and a claim is filed.

- Week 2-3: Adjuster meeting and initial estimate processing.

- Week 4: Negotiations and supplements (if needed).

- Week 5-8: Material delivery and roof installation.

Premium Impact

A common myth is that “one claim will double my rates.” Generally, insurance companies cannot single you out for a rate hike due to an “Act of God,” such assuch as a storm. However, if a massive storm hits your entire region, everyone’s rates might go up slightly the next year to cover the significant losses, regardless of whether you filed a claim.

Choosing the Right Roofing Contractor for Your Insurance Claim

Finding a roofer is easy. Finding a roofer who understands insurance claims is harder. You need a partner who can advocate for you.

What to Look For

- Local Physical Address: Avoid “storm chasers” who travel from state to state after disasters. If a warranty issue pops up in two years, you want a company that is still in town.

- Insurance Experience: Ask them directly: “Do you use Xactimate software?” and “Are you willing to meet the adjuster on site?”

- Manufacturer Certifications: This proves they are trained to install the roof correctly, ensuring your manufacturer’s warranty is valid.

Questions to Ask Before Hiring

- Can you provide references from the last 6 months?

- Are you licensed and insured in this state?

- Will you handle the supplement process with my insurance company?

- Do you require a deposit before materials arrive? (Reputable pros usually don’t ask for huge cash upfront).

- What kind of artistry warranty do you offer?

Our Business Angle: As experienced roofing professionals, we understand that we aren’t just construction workers; we are problem solvers. We handle claims end to end, so you only have to worry about choosing the color of your new shingles.

Frequently Asked Questions (FAQs) About How to Claim a New Roof on Homeowners Insurance

Does homeowners’ insurance cover a full roof replacement?

Yes, if the damage is caused by a covered peril (like wind or hail) and is extensive enough that repairs are not feasible. However, the amount you get paid depends on whether you have ACV or RCV coverage.

How long after storm damage do I have to file a claim?

This depends on your specific policy and state laws, but it is typically one year from the date of the loss. It is always best to file as soon as possible.

What if my claim is denied?

Don’t give up. Ask for a written explanation of the denial. You can hire a Public Adjuster or ask your roofing contractor to provide new evidence (photos/code requirements) to ask for a re-inspection.

Can I choose my own contractor?

Absolutely. The insurance company cannot force you to use its preferred vendor. You have the right to hire the contractor you trust most to work on your home.

Will the insurance company send the check to the contractor or me?

Often, the check is made out to both you and your mortgage company (if you have a loan). You will need to get the mortgage company to endorse it. Sometimes, if you sign a “Direction to Pay,” they may send funds directly to the roofer, but usually, the funds flow through you.