Choosing the right roof construction type isn’t just about curb appeal or durability. It can significantly affect your home insurance premiums. In fact, homeowners can save 20-30% on insurance costs simply by opting for a roof that insurers favor due to its resistance to weather damage and fire hazards.

Why Roof Types Impact Insurance Costs

Understanding why your roof affects your insurance premium is the first step to smart savings. Insurance companies evaluate your roof based on risk factors that influence the likelihood of a claim.

Key Factors Insurers Consider

- Material Durability: Some materials withstand hail, wind, and fire better than others. For example, asphalt shingles are common but tend to wear faster, increasing the likelihood of a claim.

- Class Ratings: Roofs with Class 4 impact resistance are rated for excellent damage resistance, often qualifying for discounts up to 26%.

- Regional Risks: Insurers look at local climate dangers; hail is common in the Midwest, while coastal areas face hurricanes. A roof suited for regional threats can lower premiums.

Why Age Matters

Older roofs, especially those made with traditional asphalt shingles, often face higher rates or outright denial of coverage. This is because wear and tear make them vulnerable to storms and leaks.

Table: Premium Impact by Roof Type

Roof Type: Premium Impact Key Reason

Asphalt Shingles Moderate Popular but deteriorates faster

Metal Roofing Low (10-30% off) Strong wind resistance (up to 160 mph)

Wood Shakes High High fire risk

This table shows how your choice directly influences your insurance costs. The better your roof holds up against natural threats, the lower your premiums.

Top Roof Construction Types for Savings

Let’s break down the most common roof construction types, their pros and cons, and how they affect your insurance rates.

Asphalt Shingles: Affordable Baseline

Asphalt shingles are the most common roofing material in the U.S., mainly because they’re affordable and easy to install. There are two main types:

- Standard 3-tab shingles: Cost-effective but less durable.

- Class 4 impact-resistant shingles: These withstand hail much better and qualify for insurance discounts.

Lifespan: 20-30 years

Insurance premiums: Typically $1,300–$1,500 per year

While asphalt shingles are budget-friendly, opting for the Class 4-rated version can save you money on premiums and help protect your investment longer.

Metal Roofing: Premium Discount Leader

Metal roofs are gaining popularity, and for good reason. They last 40-70 years, resist fire, and can withstand winds over 140 mph.

Why insurers love metal roofing:

- It reduces the risk of damage claims.

- Homeowners often save 10-30% on premiums.

In fact, metal roofing often costs more upfront but saves money in the long run through reduced insurance payments and fewer repairs.

Feature Asphalt Shingles Metal Roofing

Lifespan 20-30 years 40-70 years

Wind Resistance Up to ~110 mph Up to 160+ mph

Fire Resistance Moderate High

Typical Premium Impact Moderate Low (10-30% discount)

Initial Cost Lower Higher

Tile and Slate: Durable but Costly

Clay and concrete tiles are common in fire-prone areas because they offer excellent fire resistance. Slate, on the other hand, is known for its longevity, sometimes lasting over 100 years.

Pros:

- High durability

- Good fire resistance

Cons:

- High installation and material costs

- Moderate insurance savings compared to metal

Wood Shakes: Avoid for Insurance

While wood shakes look beautiful and add rustic charm, they pose a high fire risk. Insurance companies often charge surcharges or refuse coverage altogether for wood-shake roofs.

Emerging: Synthetic Composites

Synthetic roofing materials mimic wood or slate but come with enhanced fire ratings and better insurance profiles. These products are gaining traction as fire-safe alternatives that maintain aesthetic appeal.

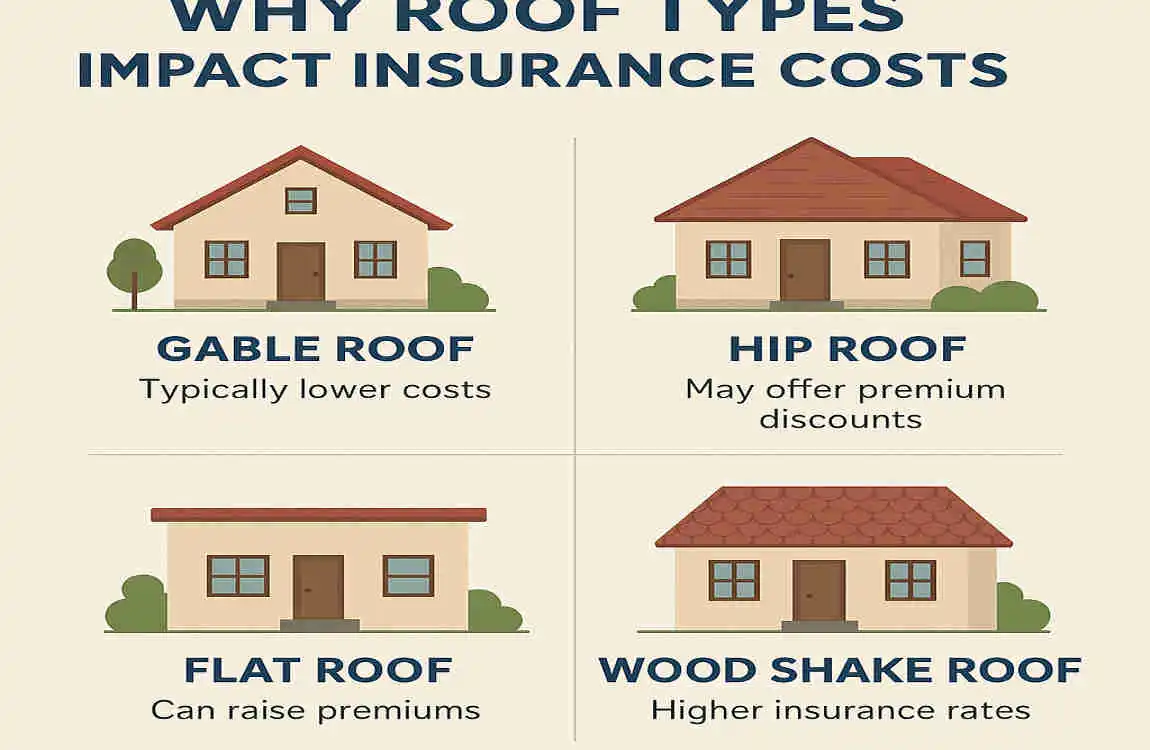

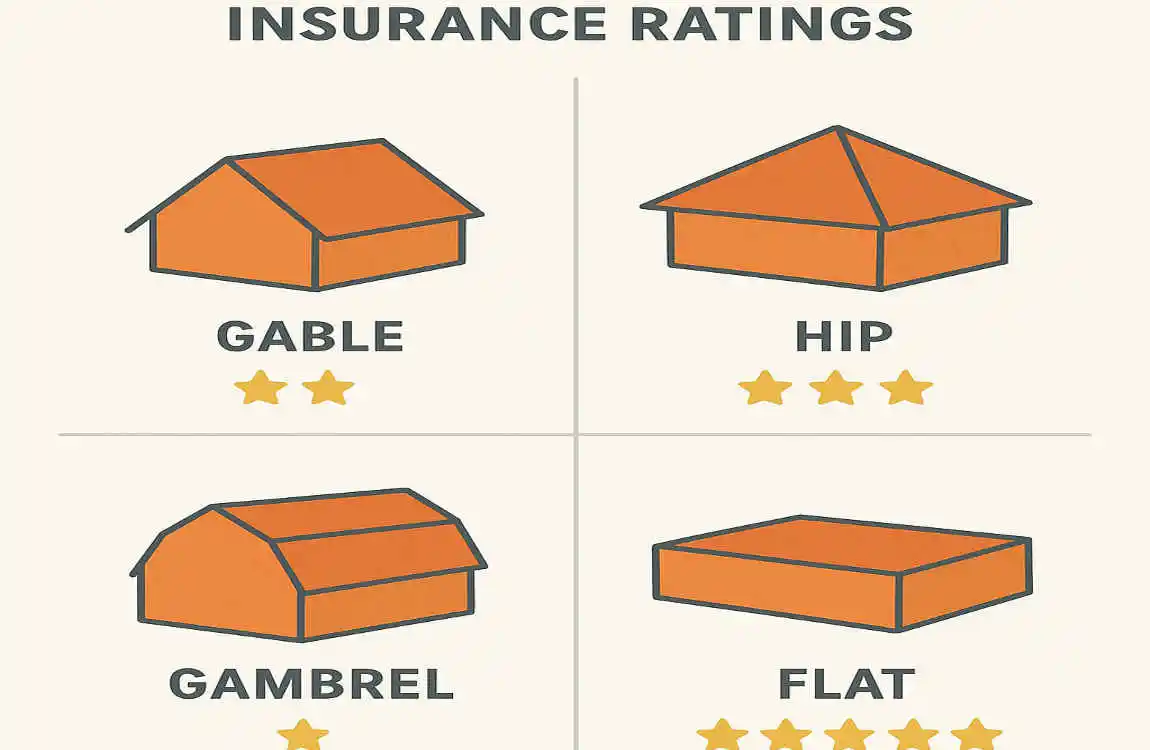

Roof Shapes and Insurance Ratings

Did you know your roof’s shape influences your insurance premiums? The design affects how well your roof withstands wind and water, which impacts insurer risk assessments.

Common Roof Shapes and Their Impact

- Hip Roofs: All sides slope downwards, making them more wind-resistant. This shape often earns insurance discounts.

- Gable Roofs: The traditional triangular shape. Considered moderate risk but easier to maintain.

- Gambrel and Mansard Roofs: Complex shapes with multiple slopes. These are more vulnerable to wind damage and can lead to higher premiums.

- Flat Roofs: Prone to leaks and water pooling, often resulting in premium hikes.

Why Shape Matters

Sloped roofs shed water and debris better, reducing wear and damage. Flat or complex roofs can trap moisture or poorly withstand wind, increasing claim risk.

If you live in a hurricane or heavy rain zone, choosing a hip roof could help lower your premiums.

2026 Roofing Trends for Lower Premiums

The roofing industry is evolving fast, and 2026 is no exception. New materials and technologies promise safer, greener, and cheaper roofs.

Sustainable and Cool Roofs

- Solar-integrated metal roofs: These roofs generate energy and qualify for green discounts on insurance.

- Cool roofs: Reflect sunlight, reduce cooling costs, and may earn discounts for energy efficiency.

- Recycled shingles: Eco-friendly and sometimes eligible for rebates.

Impact-Resistant Everything

Insurance companies are pushing for Class 4 or higher impact resistance in hail-prone areas. Many new roofing materials come with 50-year warranties, signaling durability and lowering insurance risk.

AI-Inspected Roofs

Some insurers now use AI to remotely inspect roofs, identifying potential damage risks early and adjusting premiums accordingly. This tech-savvy approach helps reward homeowners with safer roofs.

How to Choose and Claim Discounts

Buying a new roof? Here’s a step-by-step guide to maximize your savings:

- Assess Your Location’s Risks: Look at common weather threats like hail, wind, or fire.

- Request Quotes for Class 4 or Metal Roofs: These qualify for the best discounts.

- Provide Installer Certification: Certified installers help prove your roof meets insurance standards.

- Shop Around: Different insurers offer varying discounts (e.g., State Farm often provides good rates).

Cost-Benefit Calculator Example

Consider the upfront cost versus years of savings. A metal roof may cost more initially, but could pay off in 5-7 years through lower premiums and fewer repairs.