Buying property is one of the most significant financial decisions you’ll ever make. But have you ever wondered if you could buy a second home through a limited company rather than personally? Many people, especially investors, are exploring this route for its potential tax advantages, liability protection, and investment opportunities.

What Is a Limited Company and How Does It Relate to Property Buying?

What Is a Limited Company?

A limited company is a legal business entity that operates separately from its owners. It can own assets, generate income, and take on liabilities in its own name. Owners, also known as shareholders, have limited liability, meaning their personal assets are protected in case of financial difficulties.

What Does Corporate Property Ownership Mean?

When a property is purchased through a limited company, the company becomes the legal owner of the asset. This differs from personal ownership, where the property is registered in your name.

Buying Personally vs. Through a Limited Company

Here’s a quick comparison:

Aspect Personal Ownership Limited Company Ownership

Ownership Type Held in individual’s name Held in company’s name

Taxation Income tax on rental profits Corporation tax on rental profits

Liability Personal liability for debts and risks Limited liability protection

Mortgage Interest Relief Restricted Fully deductible as a business expense

Owning a property through a company can offer significant benefits, especially for those looking to expand their portfolio or reduce their personal tax burden. But it’s not without its challenges, as we’ll explore further below.

Benefits of Buying a Second Home Through a Limited Company

Tax Advantages

One of the most appealing aspects of buying property through a limited company is the tax efficiency.

- Corporation Tax Rates: Rental income from a property owned by a company is taxed at the corporation tax rate (currently 19% in the UK). This is often lower than the higher income tax rates individuals may pay (40%-45%).

- Mortgage Interest Relief: Companies can deduct mortgage interest payments as a business expense, reducing taxable profits. In contrast, individuals face restrictions on mortgage interest relief.

Limited Liability Protection

When you purchase a property under a corporation, the company assumes the risk. This means your personal assets are protected from claims or debts related to the property.

Flexible Ownership Structures

A limited company allows for flexible ownership arrangements, such as:

- Adding multiple shareholders (e.g., family members or business partners).

- Easy transfer of ownership by selling shares instead of the property itself.

Access to Commercial Mortgages

Mortgage lenders often provide buy-to-let or commercial mortgages tailored for limited companies. Although these mortgages may have higher interest rates, they allow companies to scale their property investments more easily.

Considerations and Drawbacks When Buying Property Through a Limited Company

While there are plenty of benefits, it’s essential to weigh the challenges and limitations of this approach.

Initial and Ongoing Costs

Setting up and maintaining a limited company involves additional costs:

- Company registration fees: You’ll need to register with Companies House in the UK.

- Accounting and administrative fees: You’ll need to file annual accounts, tax returns, and manage bookkeeping.

Stamp Duty Land Tax (SDLT)

Properties purchased through a company are subject to higher SDLT rates. For example, in the UK, there’s a 3% surcharge on second homes or investment properties owned by companies.

Restricted Personal Use

If you purchase a property through a company, using it for personal purposes can complicate tax calculations. You may need to declare the benefit as income and pay additional taxes.

Capital Gains Tax (CGT)

When selling a property owned by a company, any profit (capital gain) is subject to Corporation Tax. This could be at lower-than-personal CGT rates, but requires careful planning to avoid higher overall costs.

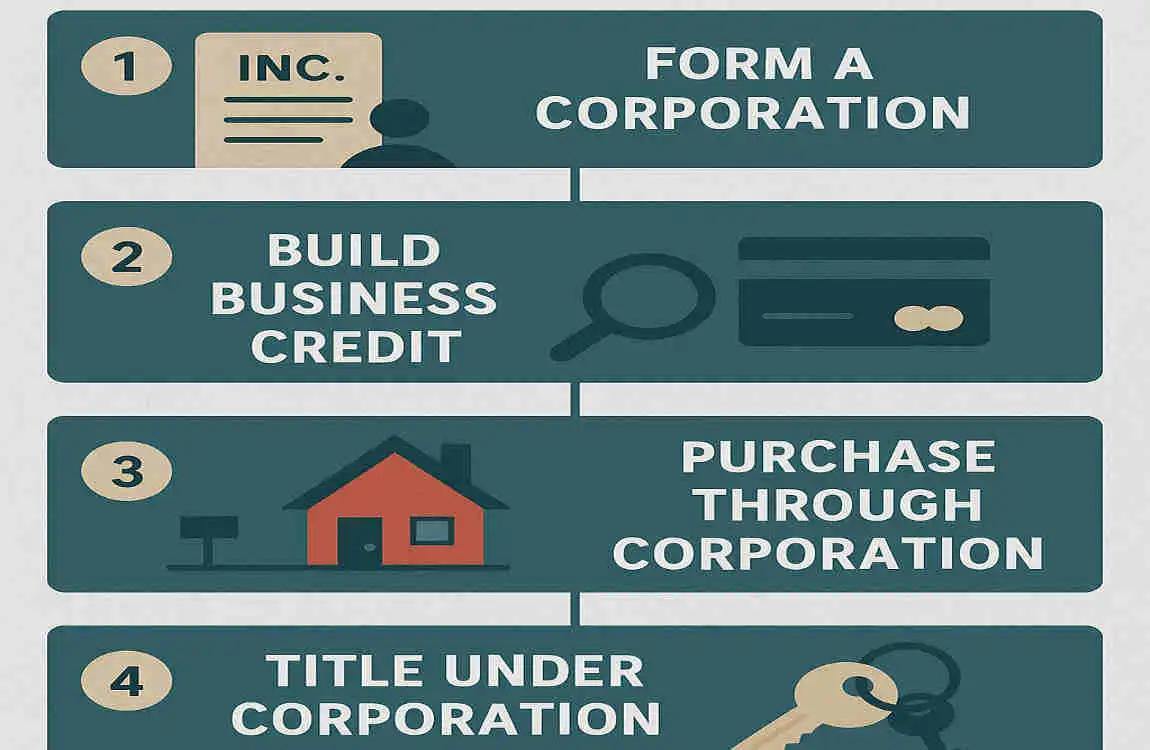

How to Buy a House Under a Corporation: Step-by-Step Guide

If you’ve decided that buying a house under a limited company is the right move, here’s a simple step-by-step guide:

Set Up a Limited Company

- Register your company with Companies House (in the UK) or the equivalent in your country.

- Choose a name, appoint directors, and issue shares.

- Open a business bank account to manage company finances.

Arrange Financing

- Apply for a buy-to-let mortgage or commercial loan in the company’s name.

- Many lenders require a strong business case and may charge higher interest rates.

Conduct Property Search

- Look for properties that align with your investment goals.

- Perform due diligence, including property inspections and legal checks.

Complete the Purchase

- Hire a solicitor experienced in corporate property transactions.

- Finalize the purchase under the company’s name.

Manage the Property

- Keep detailed financial records for the company.

- Use a property management service or handle lettings yourself.

Tax Implications of Buying Property Through a Limited Company

Understanding the tax implications is crucial when buying property under a corporation.

Corporation Tax on Rental Income

Companies pay Corporation Tax (currently 19% in the UK) on rental profits after deducting expenses such as:

- Maintenance costs

- Mortgage interest

- Property management fees

Stamp Duty Considerations

As mentioned earlier, higher SDLT rates apply to company-owned properties, especially second homes.

Capital Gains Tax

When selling the property, profits are taxed as part of the company’s income at the corporation tax rate. However, withdrawing these profits as dividends could incur additional personal tax.

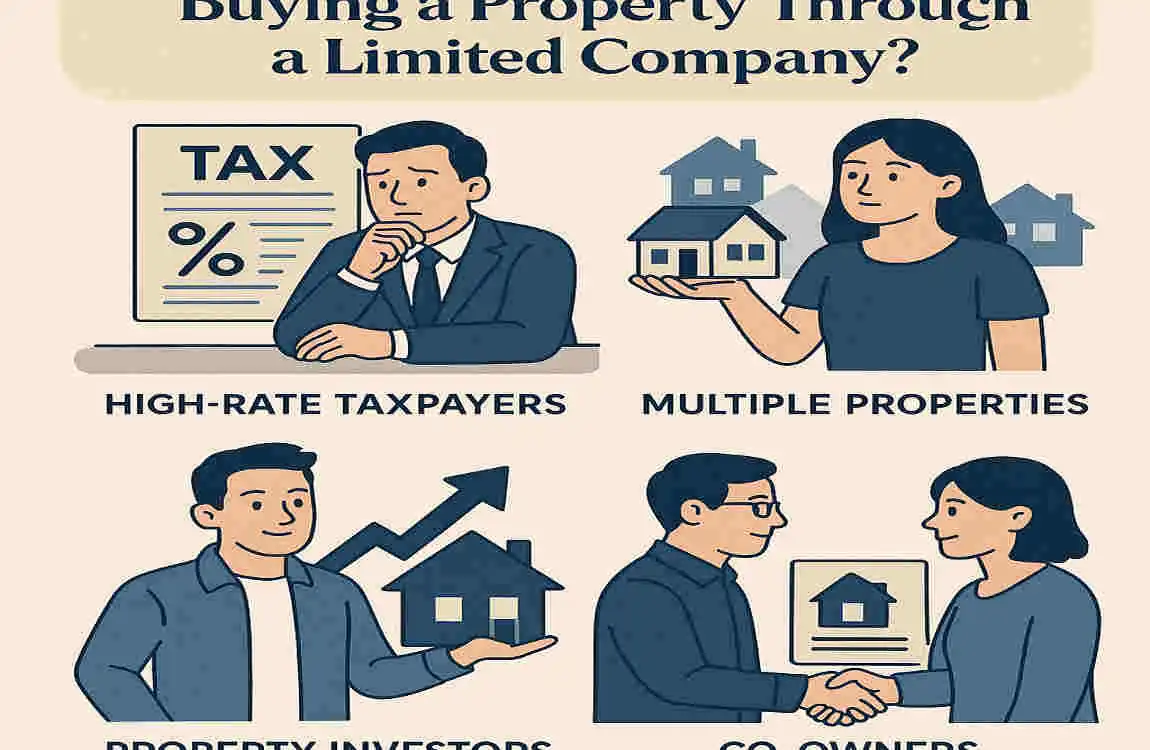

Who Should Consider Buying a Property Through a Limited Company?

This approach isn’t for everyone. Here’s who it’s best suited for:

- Property Investors and Landlords: Those with multiple rental properties can benefit from tax efficiencies and liability protection.

- Buyers Seeking Limited Liability: If you want to protect your personal assets, this structure is ideal.

- Those Planning Multiple Purchases: A company structure makes it easier to manage a portfolio of properties.

FAQs

Can You Live in a Property Owned by a Limited Company?

Yes, but it can be complicated. You’d need to pay market rent to the company, and it could trigger additional tax liabilities.

Does Buying Through a Company Avoid Personal Taxes?

No. While a company can reduce some taxes, personal taxes may still apply when withdrawing profits.

How Does It Impact Mortgage Eligibility?

Limited company mortgages are different from personal ones. Lenders typically assess a company’s financials rather than its owners’ income.