Are you staring at a tuition bill and a lease agreement at the same time, wondering how on earth you’re going to pay for both? You are not alone. One of the most frantic questions we hear from students every semester is: “Does FAFSA cover housing for college students struggling with rent or dorm costs?”

Navigating financial aid can feel like learning a new language, especially when you are just trying to keep a roof over your head. Whether you are planning to live in a bustling on-campus dormitory or eyeing a quiet off-campus apartment, understanding how the Free Application for Federal Student Aid (FAFSA) interacts with your living expenses is crucial.

What Is FAFSA and Housing Coverage?

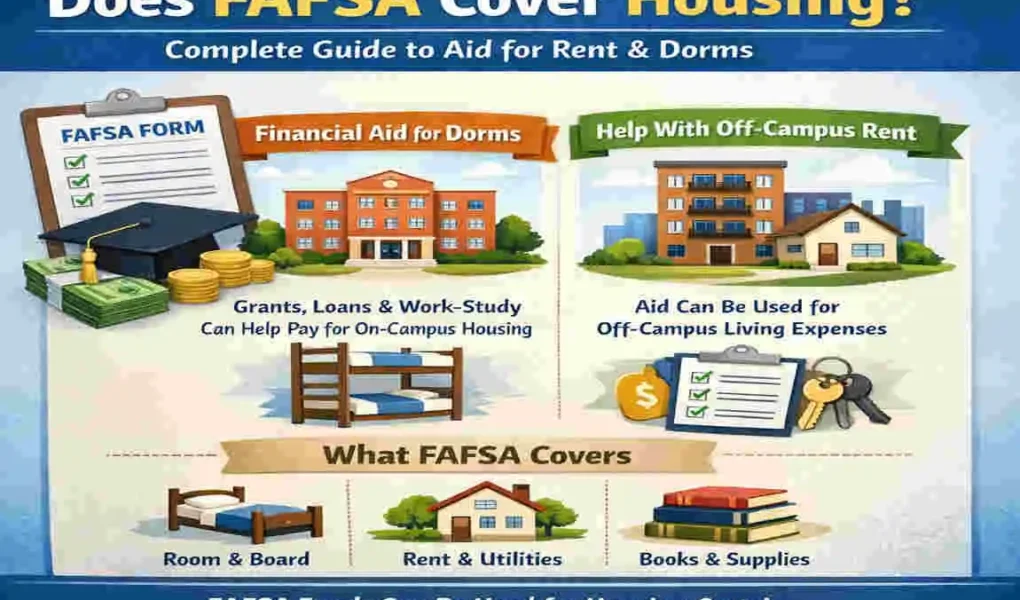

To understand how your housing gets paid, you first need to understand the machinery behind financial aid. The FAFSA is simply the application—the key that unlocks the door to federal, state, and institutional money. But the number that really matters here is your school’s Cost of Attendance (COA).

The Role of Cost of Attendance (COA)

Every college has a sticker price, but it includes more than just classes. The COA is a comprehensive estimate of what one year at that school will cost you. By law, this number must include:

- Tuition and Fees (The direct cost of classes)

- Room and Board (Housing and food)

- Books and Supplies

- Transportation

- Personal Expenses

Here is the secret: Financial aid packages are designed to cover the entire COA, not just tuition. This means that if your financial aid package (grants, loans, scholarships) exceeds your tuition bill, the excess funds are intended to cover your living expenses, including housing.

Direct vs. Indirect Coverage

So, does FAFSA cover housing? Yes, indirectly via aid eligibility.

When you fill out the FAFSA, you aren’t applying for a “housing voucher.” You are applying for a lump-sum payment. The school uses that money to pay your tuition and fees first. If there is money left over—often called a “credit balance”—that money is yours to use for housing.

- On-Campus Students: The process is seamless. The school bills you for the dorm, applies your aid to the total bill, and you pay the difference (if any).

- Off-Campus Students: This is where students get confused. If you live off-campus, the school cannot pay your landlord directly. Instead, they refund the extra aid money to you, and you are responsible for paying your rent.

Understanding this distinction is vital because it affects your cash flow. You need to know when that money hits your account so you don’t miss a rent payment.

Types of Aid Covering Housing

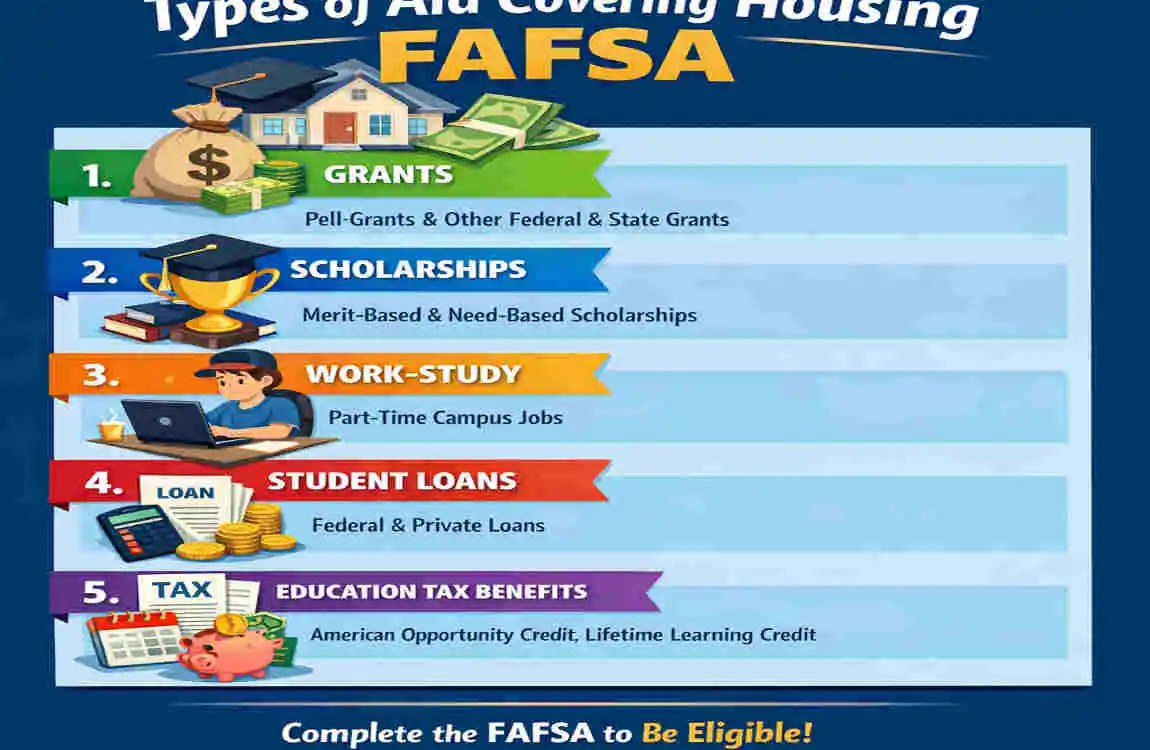

Not all financial aid is created equal. Some of it is free money you never pay back, and some of it is debt that will follow you after graduation. However, almost all types of federal aid can be used to pay for room and board.

Here is a breakdown of how different aid types apply to your living situation:

Aid Type Covers Housing? Details

Pell Grants: Yes. This is the gold standard of aid. It is need-based and does not need to be repaid. In the 2026-2027 award year, the maximum Federal Pell Grant is $7,395. If your tuition is covered by other means, this entire amount can go toward rent or dorms.

Federal Loans: Yes, both Subsidized (interest-free while in school) and Unsubsidized Direct Loans can be used for housing. While nobody likes debt, these loans offer flexible repayment terms and are often necessary to bridge the gap between grants and rent costs.

Work-Study Partial Federal Work-Study provides you with a part-time job. Unlike grants or loans, which are disbursed in a lump sum, work-study funds are disbursed in paychecks based on hours worked. You can use this income for monthly rent, but you can’t rely on it for a large upfront deposit.

Scholarships vary. Private and institutional scholarships usually specify what they cover. While many are “tuition-only,” some general merit scholarships can be applied to the full Cost of Attendance, including room and board.

The Pros and Cons of Using Loans for Rent

While using Pell Grants for housing is a no-brainer, using student loans requires caution.

- The Pro: It provides immediate stability. You can pay your semester’s rent and focus on studying.

- The Con: You will pay interest on that burger you ate, or on that month’s rent, for 10 to 20 years. Always calculate exactly how much you need for rent and only borrow that amount. Never max out your loans just because you can.

On-Campus Dorms vs. Off-Campus Rent

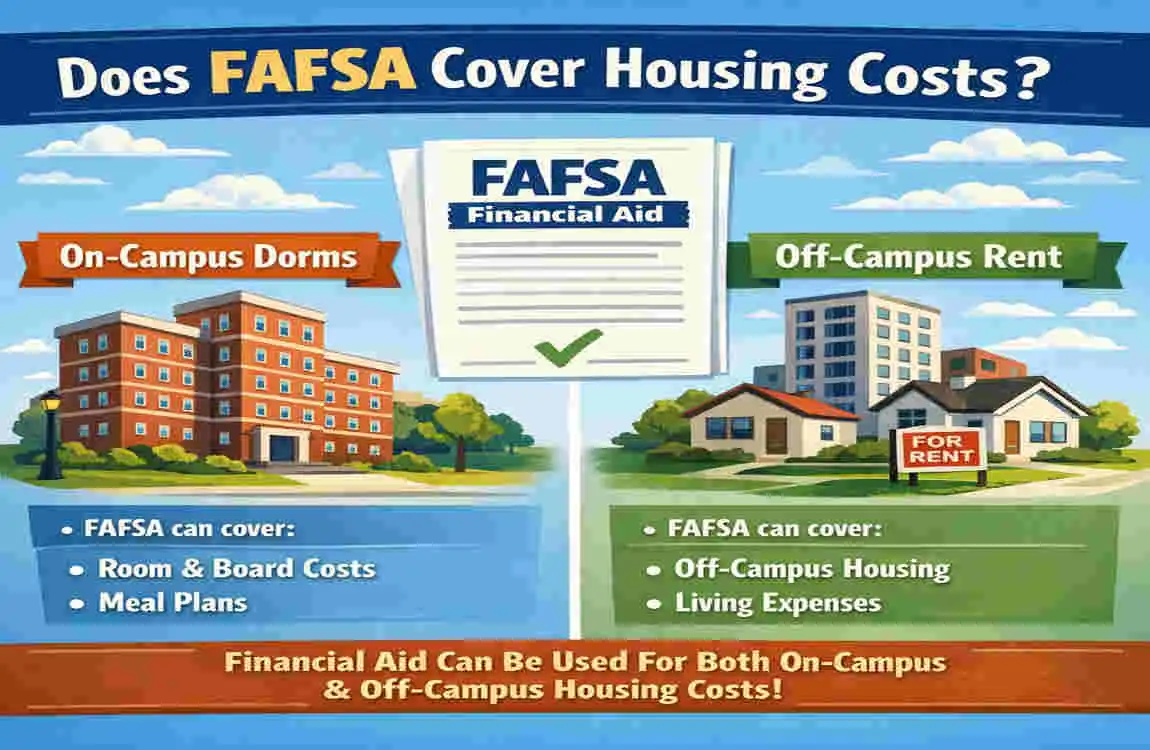

Where you choose to live significantly affects how your FAFSA funds cover your housing costs. This is one of the biggest decision points for students entering the 2026 school year.

Living On-Campus (Dorms)

Living in a dorm is the “autopilot” option for financial aid.

- The Bill: Your university creates a master bill that includes Tuition + Fees + Dorm Room + Meal plan.

- The Payment: Your financial aid (Loans, Grants, Scholarships) is sent directly to the school.

- The Result: The school subtracts the total aid from the total bill.

- If aid > bill: You get a small refund for books/supplies.

- If bill > aid: You pay the remaining balance to the school.

Why choose this? It is less hassle. You don’t have to worry about monthly rent checks, utility bills, or chasing down roommates for their share of the internet bill. The FAFSA funds cover the roof over your head before you even see the money.

Living Off-Campus (Apartments)

This option requires more financial discipline but offers more freedom.

- The Bill: Your university bills you only for Tuition + Fees.

- The Payment: Your financial aid is sent to the school.

- The Refund: Because your bill is lower (no dorm charge), there is likely a larger aid balance left over. The school issues this “credit balance” to you via direct deposit or a paper check.

- Your Responsibility: You take that refund money and pay your landlord, utility company, and grocery store.

The Risk Factor: You must budget wisely. If you get a $4,000 refund at the start of the semester in September, that money has to last you until January. If you spend it all in October, you will not have rent money for November and December.

Pro Tip: Your financial aid package might be adjusted based on where you live. Schools often have different Cost of Attendance calculations for “On-Campus,” “Off-Campus,” and “Living with Parents.” Always report your housing plans accurately on the FAFSA to ensure you get the correct amount of aid.

Example Calculation

Let’s look at a hypothetical student, Alex, to see how this works in the real world:

- Tuition: $10,000

- Total Financial Aid Awarded: $15,000

- Scenario: Alex lives off-campus.

The school takes the $15,000 aid, keeps $10,000 for tuition, and sends Alex a $5,000 refund check. Alex uses this $5,000 to pay rent for the 5-month semester ($1,000/month). In this case, FAFSA covered 100% of Alex’s housing costs.

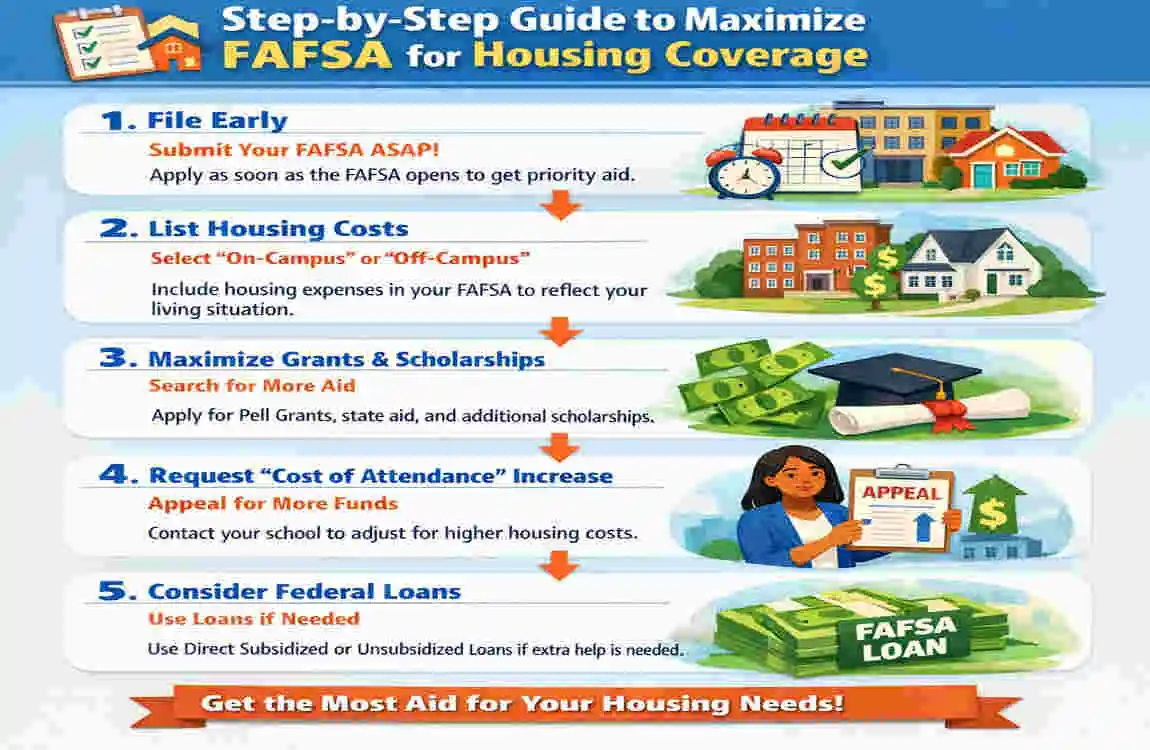

Step-by-Step: How to Maximize FAFSA for Housing

Securing housing aid isn’t passive; you have to manage the process actively. Follow these steps to ensure you don’t leave money on the table.

File FAFSA Early (Opens 1 October)

The early bird gets the worm—and the grant money. Some state-based housing grants are “first-come, first-served.” File your FAFSA as close to 1 October as possible for the following academic year.

Indicate Your Housing Intent Correctly

On the FAFSA form, you will be asked about your housing plans for each school you list (On Campus, Off Campus, or With Parent). Do not guess. If you select “With Parent,” the school will lower your Cost of Attendance estimate, which reduces the total aid you can receive. If you plan to rent an apartment, make sure you select “Off Campus” to maximize your budget eligibility.

Review Your Award Letter

When you receive your financial aid offer, look at the COA breakdown. Ensure they have allocated a realistic amount for Room and Board. If you live in an expensive city and the estimate is too low, you can sometimes file a “Cost of Attendance Adjustment” appeal with the financial aid office to potentially increase your loan eligibility.

Accept Your Aid and Watch for Refunds

Accept the grants and loans you need. Then, set up Direct Deposit with your school’s bursar office immediately.

- Paper checks can take weeks to arrive in the mail.

- Direct deposit usually hits your bank account within 2-4 days of disbursement.

- Disbursement Timeline: Most schools release funds 10 days before classes start or during the first week of the semester.

Budget Your Refund Wisely

Once that refund hits your account, move your rent money into a separate savings account immediately. Do not keep it in your checking account, where it might accidentally get spent on late-night pizza or online shopping. Treat that account as “Rent Only.”

2026 Updates and Eligibility Rules

The financial aid landscape has shifted slightly for the 2026-2027 academic year. The “Better FAFSA” initiatives that began a few years ago are now fully standard, making the form easier to complete.

Simplified Form and Income Protection

The 2026 FAFSA continues to use the Student Aid Index (SAI) instead of the old EFC. The formulas for income protection allowances have been adjusted for inflation, which may help more families qualify for Pell Grants. If you didn’t qualify for aid in 2024 or 2025, apply again. The thresholds change every year.

Who Qualifies?

To use FAFSA funds for housing, you generally must:

- Be a U.S. citizen or eligible non-citizen.

- Have a valid Social security Number.

- Be enrolled at least half-time (usually 6 credits). Note: If you drop below half-time, you may lose your eligibility for housing immediately.

- Maintain Satisfactory Academic Progress (SAP)—usually a 2.0 GPA.

Special Circumstances

- Homeless Youth: If you are an unaccompanied youth who is homeless or at risk of being homeless, the 2026 FAFSA has specific questions that allow you to file as an “independent student” without parent info. This significantly increases your eligibility for housing aid.

- Online Students: Yes, online students have housing costs too! Even if you never step foot on campus, your COA includes a room and board allowance, meaning you can get a refund check to pay rent while studying remotely.

FAQs: Common Questions About FAFSA and Rent

Q: Does FAFSA cover housing completely? A: It depends on your financial needs. For some low-income students, a combination of full Pell Grants and state aid might cover all housing. For others, FAFSA aid may only cover a fraction, requiring you to work or take out private loans to make up the difference.

Q: Can I use FAFSA loans for an off-campus apartment deposit? A: Yes, but the timing is tricky. Aid is usually disbursed after the semester starts. Most landlords require a security deposit months before you move in. You may need to save up for the deposit out of pocket and reimburse yourself once your refund check arrives.

Q: Does FAFSA pay for food, too? A: Yes! The “Board” in “Room and Board” refers to food. If you live on campus, this pays for your meal plan. If you live off-campus, your refund money is intended to help cover your groceries.

Q: What if my rent is higher than the school’s estimate? A: Schools use an average cost for the area. If you choose a luxury apartment that costs $2,000/month but the school estimates $1,000, you are responsible for the difference. FAFSA will not increase your aid just because you chose a more expensive place to live.

Q: Will I get in trouble if I use my refund for something else? A: Technically, federal aid is for “educational expenses,” which include housing, food, and transport. While nobody is auditing your grocery receipts, using student loan money to buy a car or go on vacation is a violation of the loan agreement (and a terrible financial decision).