If you have been scrolling through Zillow or Redfin lately, scratching your head and wondering, “Is this price tag for real?” you are not alone. It is Friday, 20 February 2026, and the real estate landscape in the Lone Star State looks drastically different from what it did just a few years ago.

Here is a stat that might make your jaw drop: In 2026, the median home price in Texas is hovering around $285,000. To put that in perspective, that is roughly 30% below the U.S. national average, which sits at a hefty $412,000 according to recent Zillow data.

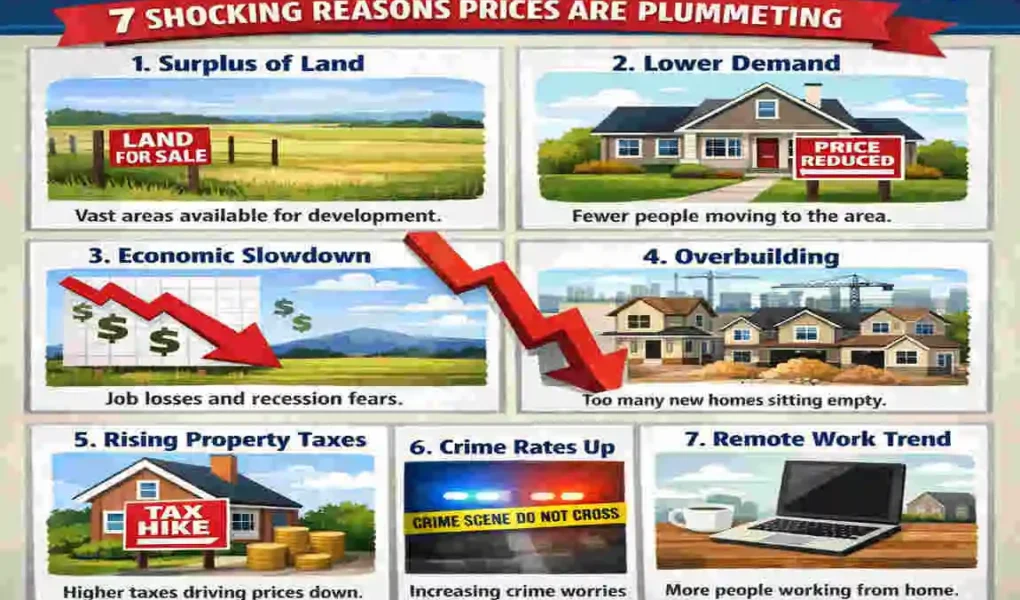

For years, we heard about the booming market, the bidding wars in Austin, and the frantic scramble for land in Dallas. So, why are houses so cheap in Texas when the population is still technically growing? It feels like a paradox, doesn’t it? While the rest of the country struggles with an affordability crisis caused by a lack of inventory, Texas is having a fire sale.

Massive Housing Oversupply

Texas’ Building Boom: Too Many Homes, Not Enough Buyers

If there is one thing Texas has plenty of, it is land. And if there is one thing developers did with that land over the last three years, it is build. They built, and they built, and they kept on building until the market was absolutely saturated.

To understand why houses are so cheap in Texas, you have to look at the sheer volume of construction. In 2025 alone, the Texas Real Estate Research Center reported that the state added over 150,000 new homes. That is a staggering number. While zoning laws and geographic constraints hamstrung other states, Texas developers were given the green light to sprawl.

This created a classic supply-and-demand imbalance. In markets like Dallas-Fort Worth (DFW) and Houston, entire subdivisions popped up seemingly overnight. Now, in early 2026, those homes are sitting empty, waiting for buyers who simply aren’t showing up in the same droves they were in 2022.

The Inventory Overload

Let’s look at the numbers. Real estate health is often measured in “months of inventory”—essentially, how long it would take to sell every house currently on the market if no new houses were listed. A balanced market is usually around 4 months. Look at where Texas cities stand right now:

City New Homes Built (2025)Inventory Months Status

Houston 45,000 6.2 Heavily Oversupplied

Dallas 38,000 5.8 Oversupplied

Austin 25,000 4.9 Buyer’s Market

Why Excess Inventory Crashes Prices

When you have 6.2 months of inventory in a place like Houston, sellers lose their leverage. It becomes a buyer’s playground. If a seller wants to move a property, they can’t just list it and wait for a bidding war. They have to compete with the brand-new build down the street that is offering shiny new appliances and zero repair costs.

This competition forces resale sellers to slash their prices by 10% to 15% just to get noticed.

Consider San Antonio. You can currently find beautiful, family-sized homes with a median price of roughly $240,000. Compare that to a similar setup in California, where you would be lucky to find a shack for $800,000. The abundance of dirt and concrete in Texas is the primary driver of these low sticker prices.

Economic Slowdown and Job Shifts

Oil Slump and Remote Work Exodus: Wallet-Watchers Flee High Costs

For decades, the Texas economy was bulletproof, largely thanks to “Black Gold.” But as we moved into 2025 and now 2026, the energy sector has taken a significant hit. This economic wobble is a massive contributor to why houses are so cheap in Texas today.

According to EIA data, oil prices fell by 20% in 2025. While that might be good news for drivers at the gas pump, it is bad news for the housing market in energy hubs like Houston and Midland-Odessa. When the oil industry sneezes, the Texas housing market catches a cold. Layoffs and hiring freezes mean fewer people are buying homes, and more people are forced to sell, driving prices down.

The Great Tech Exodus

It wasn’t just oil. Remember the “Silicon Hills” boom in Austin? That has cooled off dramatically. Post-2023, the cost of living in Austin skyrocketed, and the infrastructure struggled to keep up.

Redfin reports that 25% of tech workers who moved to Austin during the pandemic boom have since left. They packed up and moved to even cheaper locales in the Midwest or the South, where their remote work salaries stretch even further.

The Impact on Prices

When you combine an energy slump with a tech exodus, you get a significant drop in demand.

- Reduced Demand: With fewer high-paying jobs attracting out-of-state talent, the pool of qualified buyers shrinks.

- Price Correction: This has led to price declines of 8-12% in major economic hubs.

It is a stark contrast to the narrative of five years ago. Migrants from California and New York are still coming, but the data shows they are increasingly renting rather than buying. They are cautious. They are waiting to see if the market bottoms out.

Shocking Fact: “Why are houses so cheap in Texas? Because the people moving here aren’t buying the houses. They are renting the apartments, leaving the single-family homes to sit on the market.”

High Property Taxes and Insurance Costs

Hidden Fees Scare Buyers: Taxes and Hurricanes Hike True Costs

Here is the secret that real estate agents sometimes whisper but rarely shout: Texas has no state income tax, but the government has to get its money from somewhere. That “somewhere” is your property tax bill.

One of the biggest reasons houses are so cheap in Texas, relative to listing price, is that monthly carrying costs are incredibly high.

The Property Tax Trap

The Tax Foundation lists Texas among the states with the highest property tax rates in the U.S., averaging 1.68%. In some recent developments regarding MUD (Municipal Utility District) taxes, the rate can climb closer to 3%.

Let’s do the math on that. On a median-priced home of $285,000, you are looking at roughly $4,800 to $5,000 a year just in taxes. That adds hundreds of dollars to your monthly mortgage payment, reducing the amount of “house” a buyer can actually afford.

The Insurance Crisis

Then, there is the weather. 2025 was a brutal year for hurricanes and severe storms along the Gulf Coast. As a result, the Insurance Information Institute reports that premiums in Texas spiked by a staggering 40%.

The average homeowner in Texas is now paying $3,500 annually for insurance. In coastal areas, it is even higher. When buyers see these hidden costs, they balk. To offset the high monthly tax and insurance payments, sellers have to lower the listing price.

The Cost Comparison

Check out how Texas stacks up against other popular states:

State Avg Property Tax Rate Avg Home Insurance

Texas 1.68% $3,500

Florida 0.89% $4,200

California 0.76% $1,200

Population Growth Mismatch

Booming Population, But Not Where Prices Were Hot

You will often hear the counter-argument: “But Texas is growing! Everyone is moving there!” That is true, but it is where they are moving that explains why houses are so cheap in Texas cities that used to be expensive.

According to the U.S. Census, Texas added about 500,000 residents in 2025. However, the growth patterns have shifted. People are no longer flocking to downtown Austin or the expensive heights of Houston. They are moving to the exurbs, rural areas, and affordable secondary cities.

The Urban Cooldown

Cities that were once red-hot are freezing over. Austin, the poster child for the pandemic boom, has seen prices fall 15% from their 2023 peak (data via HAR.com). The demand evaporated as prices got too high, and now that prices are falling, buyers are catching falling knives.

The Rise of the Secondary city

The growth is happening in places like McAllen, El Paso, and Temple. In these areas, the median home price is often around $180,000.

- McAllen: Booming economy, low cost of living.

- El Paso: Consistently rated one of the safest cities, with very low entry prices.

Because population growth is concentrated in lower-cost areas, it pulls the statewide median price down. The “Texas Housing Market” isn’t one big blob; it’s a collection of micro-markets, and right now, the expensive ones are losing steam while the cheap ones are soaking up the population.

Builder Price Wars

Developers Slash Prices to Move Inventory Fast

We discussed oversupply earlier, but the builders’ behavior deserves its own section. The competition among homebuilders in Texas right now is fierce, and frankly, it’s a race to the bottom.

In the Dallas-Fort Worth area alone, there are over 200 active builders. When you have that many companies fighting for a shrinking pool of buyers, things get desperate.

The Incentives Game

According to the 2026 New Home Trends report, builders are doing everything they can to avoid lowering the “sticker price” too much, but the effective price is plummeting. They are offering:

- Rate Buydowns: Buying your interest rate down from 6.5% to 4.5% for the first year.

- Free Upgrades: Granite, smart home tech, and Premium flooring included at no cost.

- Closing Costs: Covering $10,000 to $15,000 in closing fees.

Dragging Resales Down

When a builder like Lennar or Taylor Morrison lists a brand new home at $220 per square foot (compared to the national average of $180), and then throws in $20,000 worth of incentives, a neighbor trying to sell their 10-year-old house is in trouble.

Interest Rates and Affordability Crunch

Mortgage Rates Bite: Buyers Can’t Afford Even Low Prices

You cannot talk about real estate in 2026 without talking about the Federal Reserve. Even though prices are dropping, interest rates remain the elephant in the room.

As of February 2026, mortgage rates are hovering around 6.5%. While this is better than the peaks of previous years, it is still high enough to lock out a huge portion of the population. The National Association of Realtors (NAR) estimates that rates at this level exclude nearly 30% of millennial buyers from the market.

The Texas Specific Crunch

You might ask, “If rates are high everywhere, why is Texas special?” It comes back to the Affordability Index. ATTOM Data rates Texas at a 145 on their affordability index (where higher is worse), compared to a national average of 110.

Why? Because wages in Texas, while decent, haven’t kept pace with the insurance and property tax hikes we mentioned earlier.

- High Rates + High Taxes = Unaffordable Monthly Payments.

Even if a house is “cheap” at $285,000, a 6.5% interest rate combined with a 2% tax rate makes the monthly payment feel like a $450,000 mortgage.

This affordability crunch kills demand. Sellers realize that nobody can afford their asking price at these rates, so they lower it. This has led to 12% Year-Over-Year price drops in many counties.

Investor Pullback and Foreclosures

Wall Street Exits: Flippers Flood Market with Bargains

For a long time, Texas was Wall Street’s darling. Institutional investors and “iBuyers” (companies like Opendoor and Zillow) were buying up thousands of homes to turn into rentals.

But the party is over.

The Big Sell-Off

According to the Wall Street Journal, institutional investors have sold off nearly 40% of their Texas holdings since the start of 2024. They realized that, with property taxes skyrocketing and rent growth stalling, the numbers no longer worked.

When these massive companies decide to liquidate, they don’t do it slowly. They dump inventory. This floods the market with homes that are priced to sell now, undercutting mom-and-pop sellers.

The Return of Foreclosures

Sadly, we are also seeing a rise in distressed properties. ATTOM Data reports that foreclosure filings in Texas are up 25% in Q1 2026, the highest level since 2010.

- Homeowners who bought at the peak in 2022/2023 are finding themselves “underwater” (owing more than their homes are worth).

- If they lose a job or face a medical emergency, they can’t sell their way out of trouble because prices have dropped.

Result: We are seeing distressed sales hitting the market at 15-20% discounts. In Houston, homes are selling for an average of $200,000 at foreclosure auctions.

Warning/Buyer’s Edge: If you are wondering why houses are so cheap in Texas, it is partly because a foreclosure goldmine is opening up. If you have cash and patience, you can pick up incredible assets for pennies on the dollar.

FAQ

Why are houses so cheap in Texas right now? The main drivers are a massive oversupply of new construction, high property taxes and insurance costs that limit buyer power, and a cooling economy in the tech and energy sectors.

What are the cheapest cities in Texas in 2026? If you are looking for value, check out San Antonio, El Paso, and McAllen. These cities consistently offer median home prices under $250,000.

Will Texas house prices rebound? Likely, yes. Real estate is cyclical. As interest rates eventually decline and a growing population absorbs surplus inventory, prices should begin to rise again, likely stabilizing in 2027.