Buying a new home is one of the most exciting milestones you will ever experience. You’ve picked out the perfect floor plan, selected the modern finishes, and watched the walls go up day by day. But then, a thought creeps in: What if something goes wrong? What if the foundation cracks three years from now, or the roof starts leaking after the first big storm?

This is where home builders’ warranty insurance steps in to save the day. It is your ultimate safety net. However, as you balance your budget for closing costs and moving vans, you’re likely asking the big question: How much is home builders‘ warranty insurance really costing you?

What Is Home Builders Warranty Insurance?

Before we dive into the dollars and cents, let’s get clear on what we are actually talking about. Many people confuse home builders’ warranty insurance with a standard home insurance policy or a simple appliance warranty. They are not the same thing.

A standard home insurance policy protects you against “sudden and accidental” events like fires, theft, or a tree falling on your roof. A home builder’s warranty, often called a structural warranty or latent defects insurance, is specifically designed for newly constructed homes. It covers the “bones” of the house—the things the builder did (or didn’t do) correctly during construction.

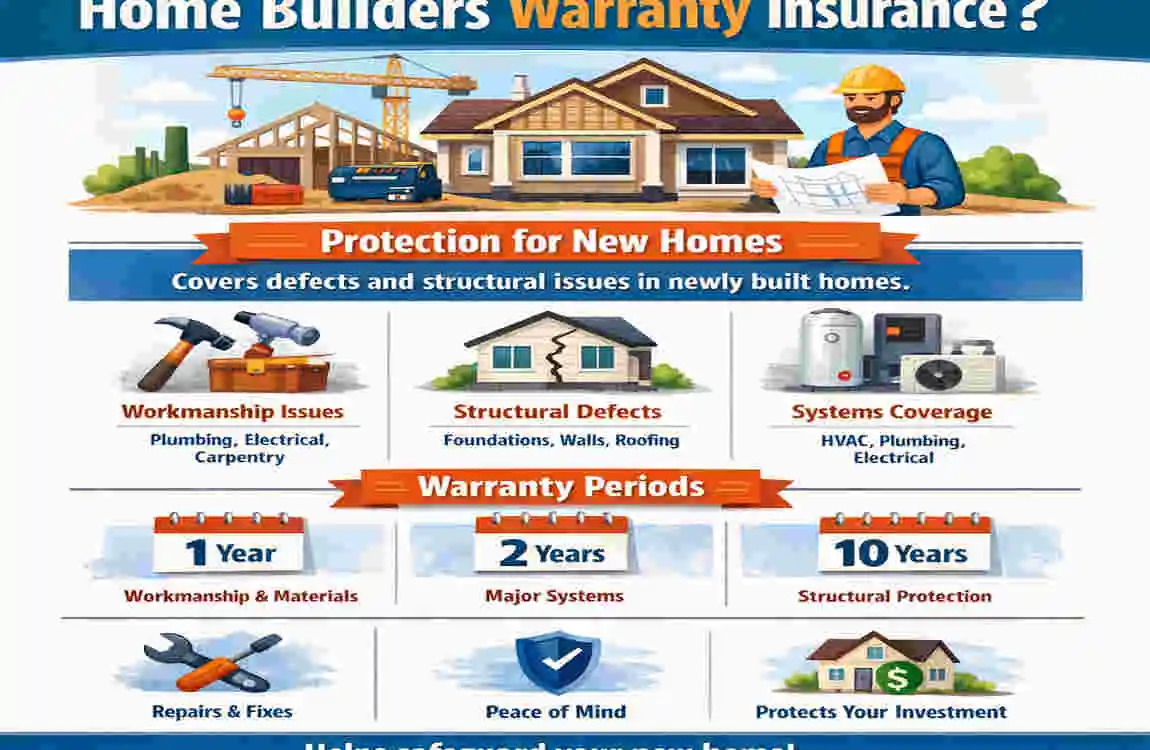

The Core Protections

When you pay for this insurance, you are buying a promise that the structural integrity of your home is guaranteed for a set period, usually 10 years.

- Artistry and Materials: Usually covered for the first 1 to 2 years. This includes items such as siding, trim, and minor plumbing or electrical issues.

- Major Structural Defects: This is the big one, usually covered for years 3 through 10. We’re talking about foundation failures, roof framing collapses, or load-bearing wall issues that make the home unsafe.

Why Is It Mandatory?

In many parts of the world, including the UK, Australia, and several US states, you cannot even get a mortgage without this insurance. Lenders want to know that their investment (your house) won’t crumble. Even if it isn’t legally required in your specific area, skipping it is a massive risk. Imagine paying off a 30-year mortgage on a house that needs $100,000 in structural repairs because the builder cut corners.

Types and Providers

There are generally two ways you’ll encounter this:

- Structural Warranty: The long-term 10-year protection.

- Latent Defects Policy: Often used in commercial or high-end residential projects to cover hidden flaws.

Common providers include NHBC, LABC, and Premier Guarantee in the UK, or 2-10 Home Buyers Warranty in the US.

Factors Influencing Home Builders’ Warranty Insurance Cost

You might find that your neighbor paid $800 for their warranty while yours is quoting $1,500. Why the gap? Insurance companies don’t just pull numbers out of a hat; they use a complex set of variables to determine your risk level.

The Size and Value of Your Home

This is the most obvious factor. A 5,000-square-foot mansion has more “surface area” for things to go wrong than a 1,200-square-foot bungalow. Generally, the cost is calculated as a percentage of the total build cost. If your home costs more to build, it costs more to insure.

Your Location and Geography

Where you build matters immensely; are you in a high-seismic-risk area in California? Your premiums will be higher. Are you building on “heaving” clay soil that is prone to shifting? The insurance company will view that as a higher risk for foundation claims. Even local labor rates affect the cost because if a repair is needed, the insurance company has to pay those local rates to fix it.

The Builder’s Track Record

Believe it or not, your builder’s reputation affects your wallet. Insurance providers keep “risk profiles” on builders. If a builder has a history of high-quality work with zero claims over 20 years, the insurance company will offer lower premiums. If you are working with a brand-new builder or one with a history of structural issues, expect to pay a “risk premium” of 10% to 25% more.

Key Cost Factors at a Glance

Factor Impact on Cost Real-World Example

Home Size/Value High (+20-50%) A $500k home costs significantly more to cover than a $200k home.

Location Moderate (+15%) Building in a flood zone or earthquake-prone area increases the rate.

Builder Risk Profile High (+10-25%) Established builders with clean records get “preferred” pricing.

Build Type Moderate (+30%) Custom homes with non-standard materials (eco-materials) are pricier.

Coverage Level Variable Basic structural coverage vs. “all-inclusive” artistry riders.

Inflation and 2026 Trends

As we move through 2026, we are seeing a trend where premiums are rising by about 5-8% annually. This is mainly due to the “cost of repair.” If a structural beam fails today, it costs the insurance company more to buy the steel and hire the labor than it did five years ago. Consequently, they pass those costs onto the homeowner or builder.

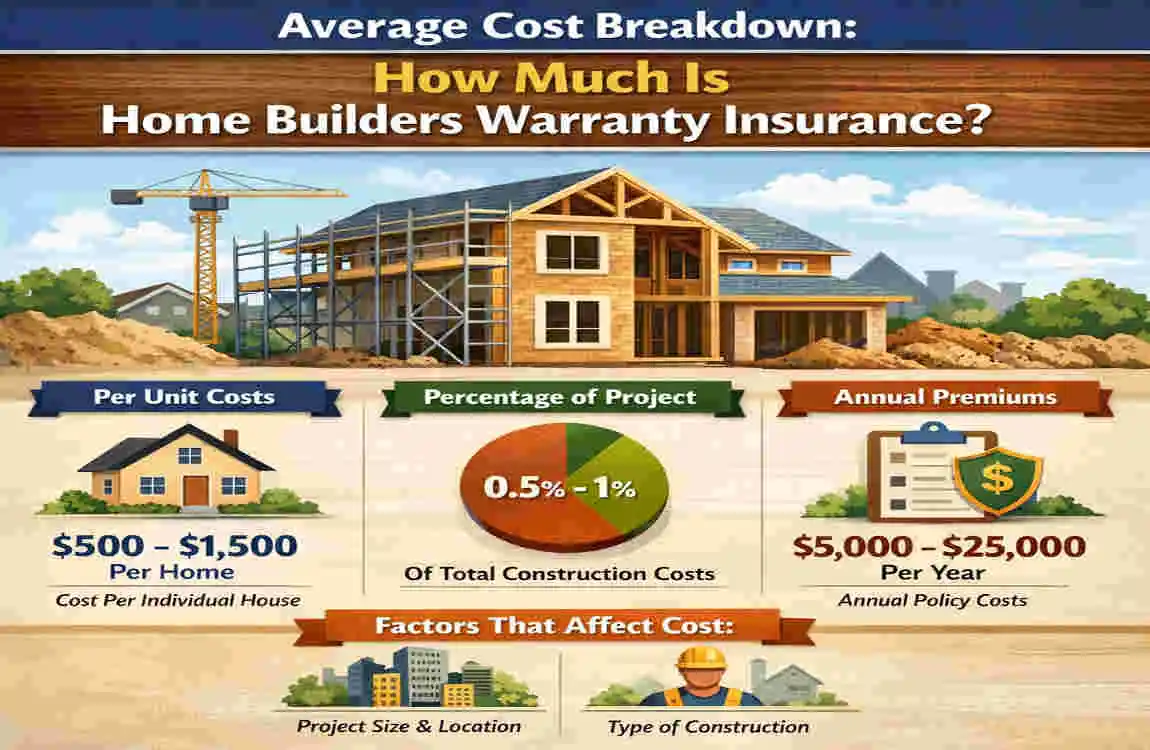

Average Cost Breakdown: How Much Is Home Builders Warranty Insurance?

Now, let’s get into the complex numbers. While every project is unique, we can look at national averages to give you a ballpark figure. Generally, you should pay between 0.5% and 1.5% of the total construction value.

The United States Market

In the US, the cost is often bundled into the home’s purchase price, but if you are a custom builder, you’ll see it as a line item.

- Average Range: $800 to $2,500 per year (or as a one-time 10-year premium).

- State Variations: In Texas, where land is plentiful, but soil can be tricky, you might see averages around $900. In California, due to seismic requirements, thethe average jumps to $1,200-$1,500.

The United Kingdom Market

The UK has a very mature market for these warranties, dominated by a few big players.

- Average Range: £400 to £1,200.

- Benchmark: The NHBC (National House Building Council) sets the standard here. For a standard semi-detached home, you are likely looking at the lower end of that scale, whereas a large detached custom build will hit the £1,000+ mark.

The Australian Market

Australia has strict “Home Building Compensation” (HBC) schemes that vary by state (like NSW or VIC).

- Average Range: AUD 1,000 to AUD 3,000.

- Note: Costs here have been particularly volatile due to recent changes in government-backed insurance funds.

Per Square Foot Pricing

If you want a quick “back of the napkin” calculation, many experts suggest budgeting $0.50 to $1.00 per square foot. For a 2,500-square-foot home, that puts you right in the $1,250 to $2,500 range for a comprehensive 10-year policy.

A Real-World Scenario

Let’s say you are building a lovely 3-bedroom home valued at $400,000.

- If you get a “Standard” policy at 0.8%, your cost is $3,200 for the full 10 years of coverage.

- When you break that down, it’s only $320 per year to protect your $400,000 investment. When you look at it that way, it’s one of the cheapest forms of peace of mind you can buy!

Hidden Costs and Fees to Watch Out For

The “premium” isn’t the only number you need to worry about. Like any financial product, home builders’ warranty insurance comes with a few “gotchas” that can inflate the total cost of ownership.

Excess and Deductibles

Just like your car insurance, if you make a claim, you usually have to pay an excess (UK/AUS) or a deductible (US). This is the amount you pay out of pocket before the insurance kicks in.

- Standard deductibles range from $250 to $1,000 per claim.

- Pro Tip: Choosing a higher deductible can lower your initial premium, but make sure you have that cash sitting in a savings account just in case.

Inspection Fees

Before an insurance company will issue a policy, they want to make sure the house is actually built well. They will send out inspectors at key stages: foundations, framing, and completion.

- These fees are often separate from the premium and can cost between $200 and $500 per visit.

- Some providers bundle these, but always ask if “Technical Audit Fees” are included in your quote.

Renewal Hikes and Inflation Clauses

If your policy is set up as an annual renewal rather than a one-time 10-year payment, be prepared for the “creep.” Many homeowners see yearly premium increases of 5-10%. If you have the option, a pre-paid 10-year structural warranty is almost always the better financial move because it locks in today’s rates.

The Total Ownership Formula

To truly understand what you are paying, use this simple formula:

Total Cost = Premium + (Inspection Fees) + (Potential Deductibles x Estimated Claims)

Most people forget the inspection fees, which can add an extra $1,000 to the project over the course of a year.

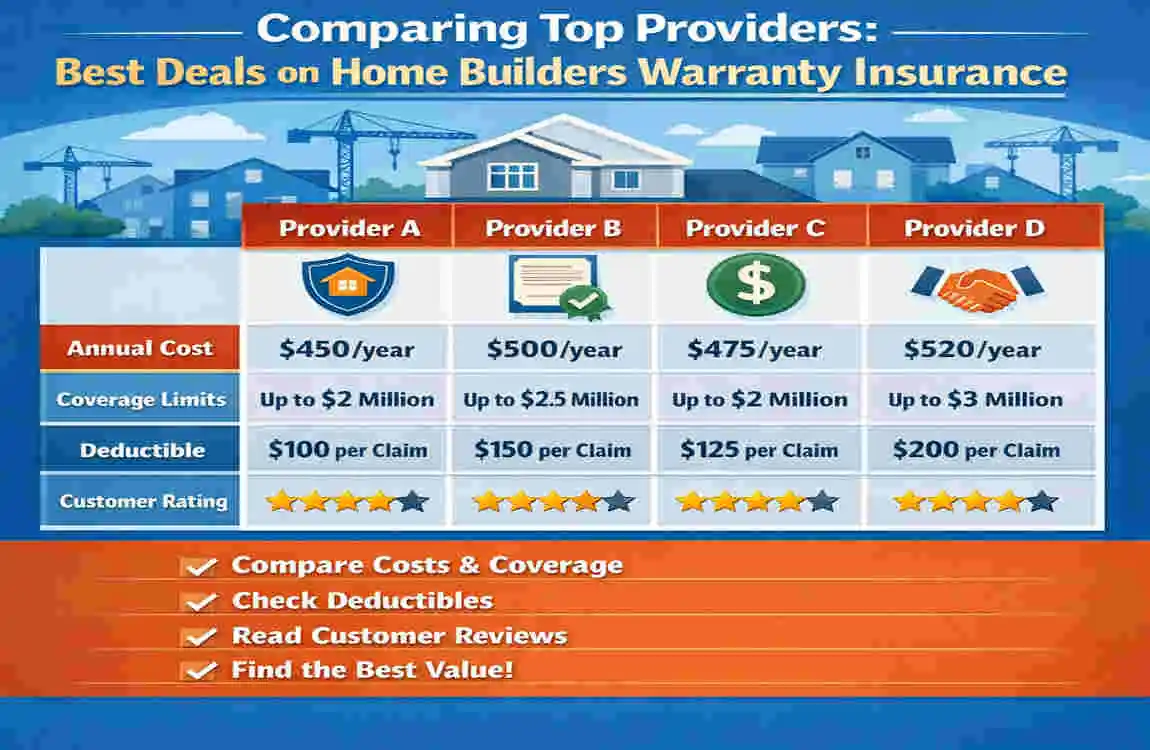

Comparing Top Providers: Best Deals on Home Builders Warranty Insurance

Not all insurance companies are created equal. Some offer rock-bottom prices but make the claims process a nightmare. Others are expensive but have a “no-quibble” reputation. In 2026, here is how the top players stack up.

Provider Comparison Table

Provider Avg Annual/Policy Cost Coverage Highlights Best For Rating (2026)

NHBC (UK) £600 – £1,200 Industry gold standard; 10-yr structural. Standard residential 4.8/5

2-10 Home Buyers (US) $900 – $2,000 Extensive structural coverage; easy transfers. High-value homes 4.9/5

Premier Guarantee £500 – £1,000 Flexible terms for high-risk or unique builds. Custom/Eco homes 4.7/5

LABC Warranty £450 – £900. Works closely with local authorities. Fast approvals 4.6/5

Who Offers the Best Deals?

If you are looking for the absolute cheapest home builders’ warranty insurance deals, you often have to look toward newer market entrants or “volume” providers.

- Volume Discounts: If you are a builder doing 10+ homes a year, providers like 2-10 Home Buyers offer massive discounts—sometimes up to 20% off—because they are insuring a portfolio of risk rather than a single house.

- The “Switching” Strategy: If you are a builder, switching providers every 3 years can often trigger “new customer” discounts. We’ve seen builders save 15% just by moving from a legacy provider to a more tech-forward one like BuildZone.

User Story: How One Builder Saved 15%

Take the case of “Modern Craftsman Homes,” a small firm in Oregon. They had been with the same provider for six years. By simply spending one afternoon gathering three competing quotes and presenting their clean 6-year claims history, they negotiated their premium down by 15%. Insurance companies hate losing “low-risk” clients—use that to your advantage!

How to Get the Best Home Builders Warranty Insurance Deals

You don’t have to accept the first quote you get. There is plenty of room for negotiation and “smart shopping.” Here is your step-by-step guide to driving that price down.

Get at Least 3 Quotes

This sounds basic, but you would be surprised how many people go with the builder’s “preferred” partner. Use online comparison tools. Even if you love one provider, having a lower quote from another gives you leverage to ask for a price match.

Leverage Your Builder’s Experience

If your builder has been in business for 30 years and has a pristine record, scream it from the rooftops. Make sure the insurance company knows this. A veteran builder is a low risk, and that should be reflected in a lower premium for you.

Time Your Purchase

Did you know there are “off-peak” times for insurance? Many companies have end-of-quarter targets. Getting a quote in late March, June, September, or December can sometimes result in slightly more aggressive pricing as sales agents try to hit their bonuses.

Bundle Your Policies

If you are already getting “Builder’s Risk Insurance” (which covers the house during construction from fire/theft), ask for a bundle deal that includes the 10-year structural warranty. Companies like Liberty Mutual or State Farm often offer “multi-line” discounts.

Review the Claims History

A “deal” isn’t a deal if the company never pays out. Check 2026 reviews on Trustpilot or specialized construction forums. A slightly more expensive policy from a company with a 95% claim approval rate is worth much more than a cheap policy from a company that fights every claim.

FAQs: How Much Is Home Builders Warranty Insurance?

Q: Is home builders’ warranty insurance worth the cost? A: Absolutely. For about 1% of your home’s value, you are protected against structural failures that could cost $50,000 to $200,000. It is one of the most cost-effective ways to manage the risk of homeownership.

Q: Does the insurance cover my appliances?A: Usually, no. That is a “Home Service Contract.” Builder’s warranty insurance focuses on the structure (walls, roof, foundation) and the systems (plumbing/electrical inside the walls).

Q: Can I transfer the warranty if I sell the house? A: Yes! This is a huge selling point. Most structural warranties stay with the house, not the owner. This adds significant resale value to your home.

Q: How much should I budget for a $500,000 new build?A: You should budget roughly $4,000 to $6,000 for a comprehensive 10-year policy, including inspection fees.

Q: Does it cover “wear and tear”?A: No. If your carpet wears out or your paint chips after five years, that is considered routine maintenance and is not covered by a structural warranty.