You are sitting at your kitchen table, scrolling through real estate apps. You see a house that looks “okay,” but it needs a new kitchen, the backyard is tiny, and the price tag makes your eyes water. Then, you look at an empty plot of land nearby and think, “Could I just build exactly what I want for less money?”

It is the age-old question that every aspiring homeowner faces, especially as we navigate the unique housing market of 2026. With interest rates fluctuating and material costs changing by the week, you need to know the truth. Is it cheaper to build or buy a house right now?

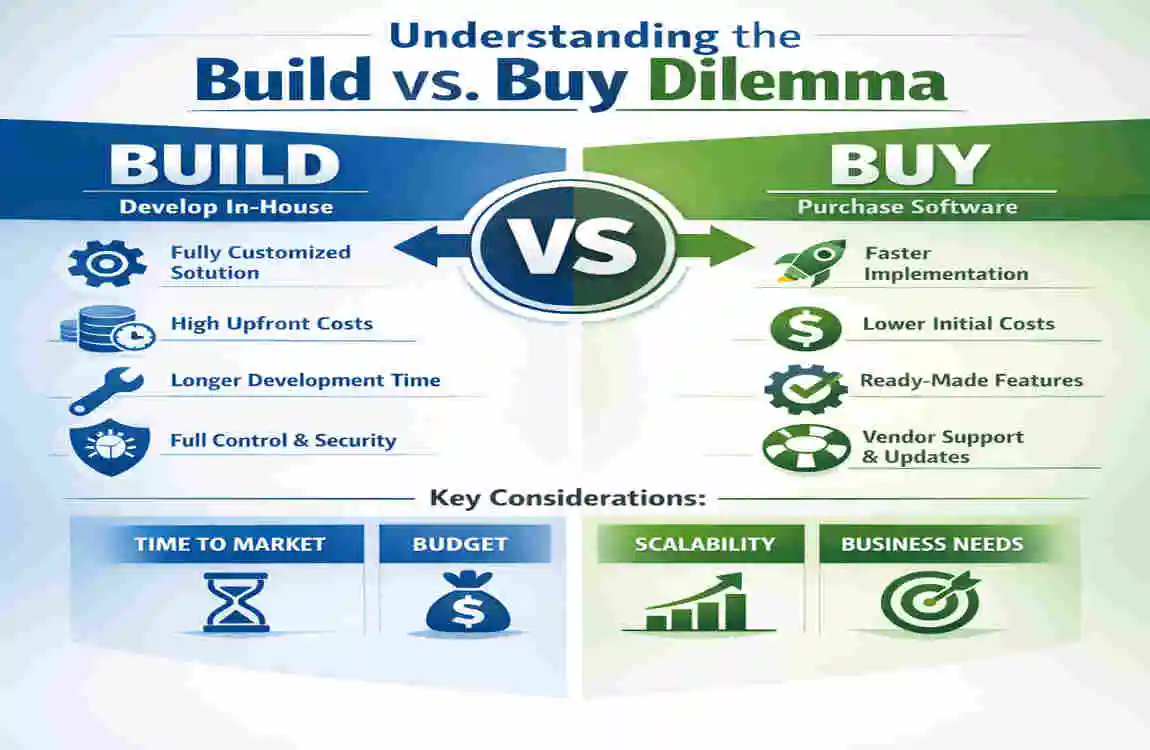

Understanding the Build vs. Buy Dilemma

Before we crunch the numbers, let’s talk about why this is such a difficult choice in 2026. The world has changed. A few years ago, buying an existing home was almost always the cheaper route. Today, the “inventory” (the number of houses actually for sale) is at an all-time low in many regions, from the suburbs of Lahore to the outskirts of Texas.

When there are fewer houses to buy, the prices of existing homes skyrocket. This makes the cost to build vs buy a much closer race than it used to be.

Who Are You in This Market?

Your personal situation dictates the “cheaper” option. Are you an urban millennial looking for a short commute? Buying an existing condo or townhouse might be your only realistic choice. Are you a growing family looking for space in the suburbs or rural areas? Building might actually save you money on a “price per square foot” basis, since land is more affordable farther out.

The 2026 Market Trends

As of early 2026, we are seeing interest rates settle between 5% and 7%. While this is better than the peaks of previous years, it still means your monthly mortgage payment is a big deal. Additionally, home construction costs have stabilized after the chaotic supply chain issues of the early 2020s, but labor is still expensive.

If you choose to buy, you are competing with other buyers in “bidding wars.” If you decide to build, you are competing with the clock and potential weather delays. Both have their own “price.”

Actual Costs of Buying a House

When people ask, “Is it cheaper to build or buy a house?” they often only think about the mortgage. But buying a house is like buying a used car—the sticker price is just the beginning.

Upfront Costs: The “Handshake” Fees

When you find a house you love, you need a lot of cash ready to go.

- The Down Payment: Usually, you need between 3% and 20% of the home’s value. On a $400,000 (or roughly 11 crore PKR) home, that’s a significant chunk of change.

- Closing Costs: These are the “hidden” fees you pay to lawyers, banks, and the government to finalize the sale. Expect to pay 2% to 5% of the purchase price.

- Inspections and Appraisals: You must pay experts to make sure the house isn’t falling down and that it’s actually worth what you’re paying. This can easily cost $500 to $1,000.

Ongoing Costs: The Monthly Reality

Once you have the keys, the spending doesn’t stop.

- The Mortgage: At a 6.5% interest rate, your monthly payment will be much higher than it was five years ago.

- Property Taxes: These are unavoidable and usually rise every year.

- Insurance and HOA Fees: If you live in a planned community, those Homeowners Association (HOA) fees can add $200 to $500 to your monthly budget.

Hidden Expenses: The “Oops” Factor

This is where buying an existing home can get expensive. HomeAdvisor suggests that homeowners should set aside 1% to 4% of their home’s value every year for maintenance.

- Repairs: That 15-year-old HVAC system might quit the day you move in.

- Renovations: Most people spend at least $20,000 in the first two years “making the house their own” by painting, updating floors, or fixing the kitchen.

- Resale Costs: Remember, when you eventually sell this house, you’ll likely pay 5-6% in agent commissions.

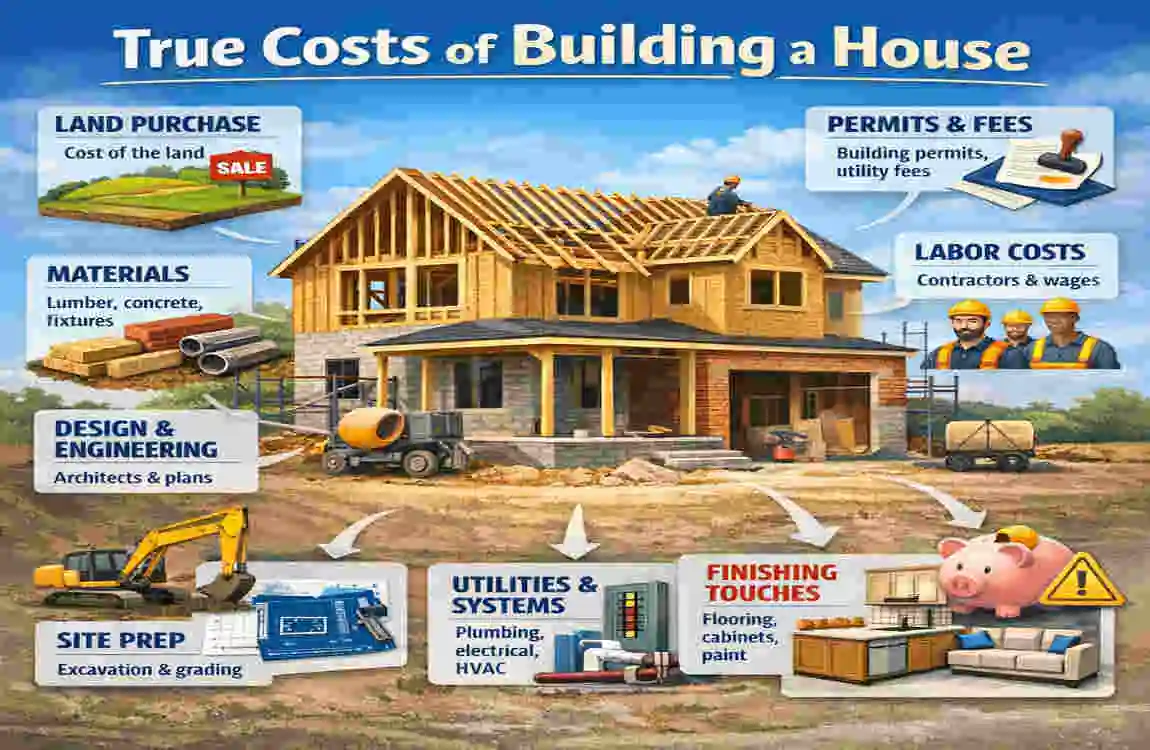

Actual Costs of Building a House

Building a home is a marathon, not a sprint. It is often more expensive upfront, but you are paying for perfection and efficiency.

Land Acquisition: Finding Your Canvas

The first step in home construction costs is the land.

- Location Matters: A plot in a developed urban area like Lahore’s Phase 6 or a trendy US suburb could cost as much as a small house. In contrast, rural land is cheap but comes with a catch.

- Site Preparation: This is the “boring” money. You have to clear trees, level the ground, and—most importantly—bring in utilities like water, electricity, and sewage. This can add $10,000 to $50,000 before you even lay the first brick.

Construction Breakdown: The Meat and Potatoes

According to 2025/2026 data from the National Association of Home Builders (NAHB), the average cost to build a standard 2,500 sq ft home is roughly $428,000, excluding land.

- Materials and Labor: You can expect to pay between $150 and $300 per square foot. High-end finishes (marble vs. laminate) will swing this number wildly.

- Permits and Design: You need an architect and a pile of government permits. This usually costs between $20,000 and $50,000.

- The “Delay Tax”: Almost no house is finished on time. A three-month delay means three more months of paying rent elsewhere while also paying interest on your construction loan.

Financing and Ongoing Costs

Building isn’t financed like buying.

- Construction Loans: These are short-term loans with higher interest rates (7-9%). Once the house is finished, you “convert” this into a standard mortgage.

- The Benefit: Since everything is brand new, your maintenance costs for the first 10 years will be nearly zero. Plus, modern homes are built with better insulation, saving you a fortune on electricity and heating bills.

Head-to-Head Cost Comparison

To answer the question of whether it’s cheaper to build or buy a house in 2026, we need to look at the numbers side by side. Let’s compare a standard $400,000 existing home with a $450,000 custom build.

Short-Term vs. Long-Term Analysis

Cost Category: Buying an Existing House ($400K), Building a New Home ($450K), The Winner

Upfront Cash Needed ~$80,000 (Down payment + Closing) ~$120,000 (Land + Deposit) Buy

Monthly Payment Moderate (Standard Mortgage) Higher (Initial Construction Loan) Buy

Immediate Repairs High (Average $15k-$30k) Zero (Everything is new) Build

Energy Efficiency Lower (Older tech/insulation) High (Modern standards) Build

5-Year Total Cost $250,000 $280,000 Buy

Regional Factors: Where You Live Matters

In high-demand areas like Lahore, Karachi, or Austin, Texas, building is a more brilliant financial move. Why? Because land values appreciate so quickly. If you build a house for $500k in a growing area, it might be worth $650k by the time you move in. In these cases, the “equity” you gain makes building “cheaper” in the long run.

The ROI Formula

To find your own answer, use this simple logic: Total Cost = (Upfront Cash) + (Annual Expenses × Years Lived) – (Home Appreciation). Often, the “buy” option looks cheaper for the first 3 years, but the “build” option becomes cheaper after year 10 due to lower maintenance and a higher resale value.

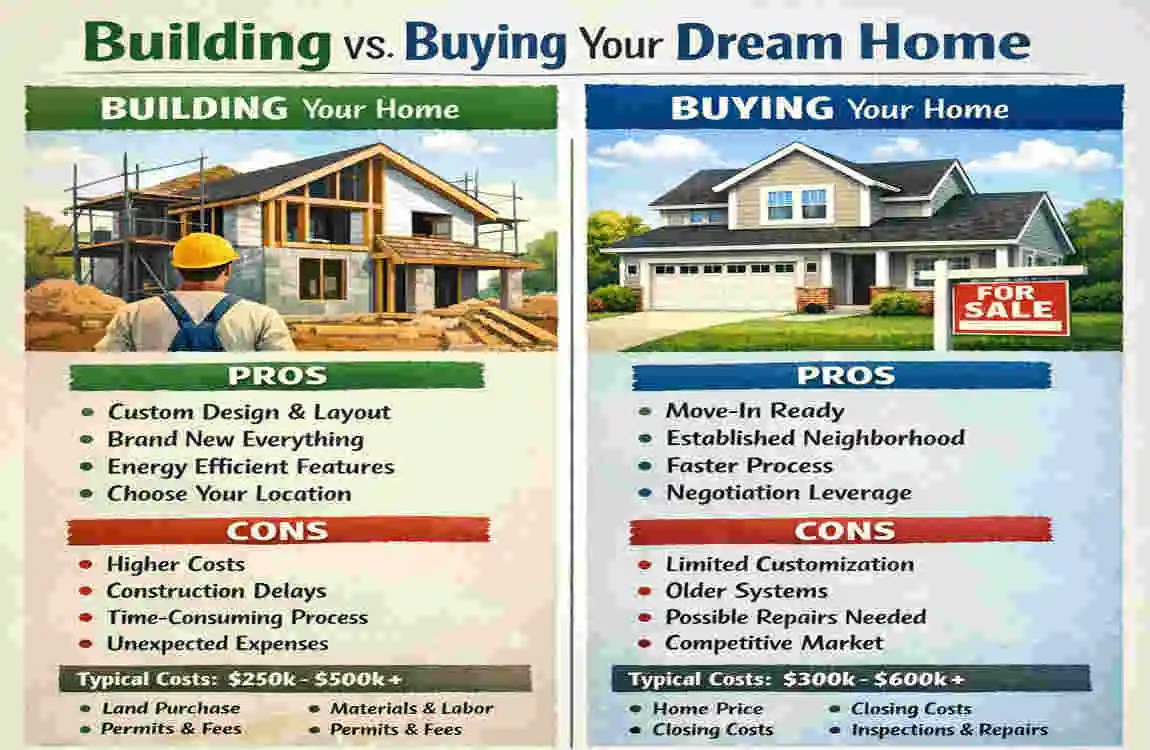

Pros and Cons: Build vs. Buy

Still undecided? Let’s break down the lifestyle impact of each choice.

Buying an Existing Home

The Pros:

- Speed: You can move in within 30 to 60 days.

- Predictability: You know exactly what the neighborhood looks like and who your neighbors are.

- Established Landscaping: You get mature trees and a lawn that doesn’t look like a dirt pit.

The Cons:

- Compromise: You will likely hate the bathroom tiles or the kitchen layout.

- Competition: You might lose your dream home to a higher bidder.

- Hidden Gremlins: Mold, old wiring, or a leaky roof can stay hidden until after you move in.

Building a Custom Home

The Pros:

- Total Control: Want a home office with soundproof walls? You got it.

- Health and Safety: No lead paint, no asbestos, and better air filtration systems.

- Warranty: Most builders offer a 1-year “everything” warranty and a 10-year structural warranty.

The Cons:

- Stress: You will have to make 1,000 decisions, from doorknobs to outlet placements.

- The Wait: It takes 9 to 18 months, on average, to build a house.

- Budget Creep: 80% of construction projects go over budget due to “while we’re at it” upgrades.

Factors That Tip the Scales in 2026

When is it actually cheaper to build or buy a house? Look at these three factors:

- Your Debt-to-Income Ratio: Banks are stricter with construction loans. If your credit isn’t perfect, buying is your only path.

- The “Fixer-Upper” Trap: In 2026, the cost of labor for renovations is so high that buying a “cheap” house to fix it up often costs more than just building new.

- Remote Work: If you work from home, building a house with a dedicated, high-speed wired office is a massive lifestyle win that an old house can’t easily replicate.

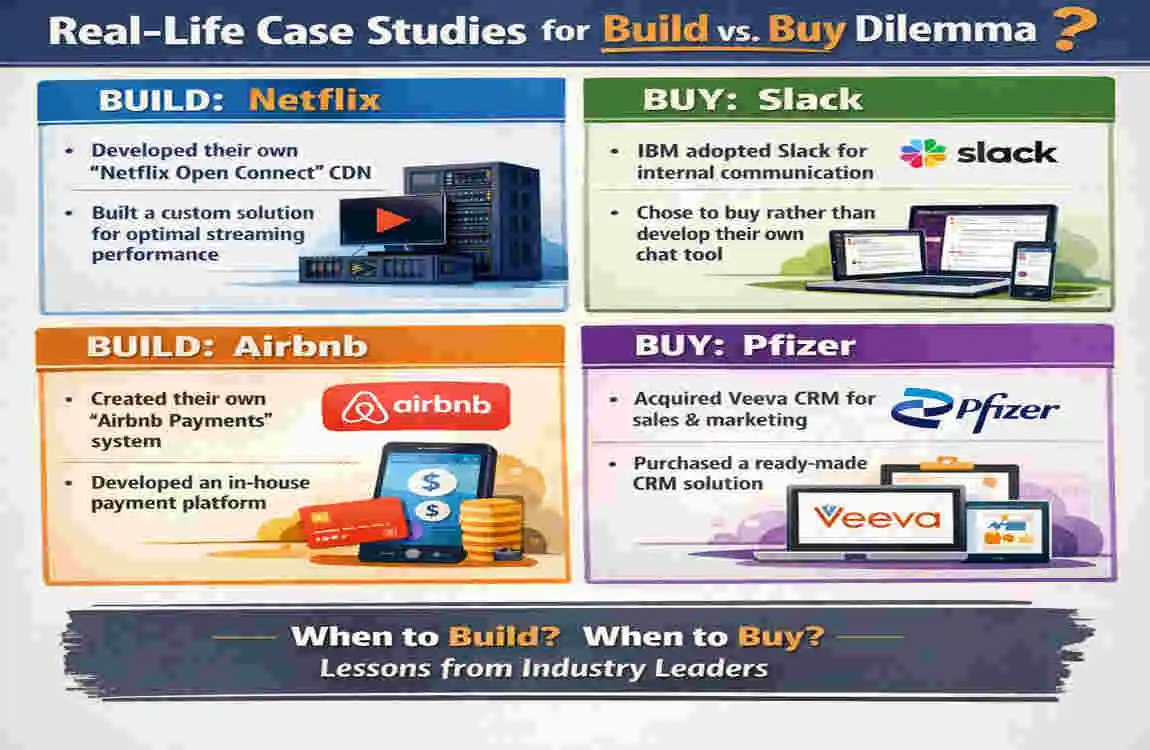

Real-Life Case Studies

The Renovation Nightmare

The Ahmad family bought a charming 1990s house in a Lahore suburb for $150,000 (approx 4.2 Crore PKR). They thought they’d save money. However, they found termites and outdated plumbing. They spent $40,000 on renovations in the first year. In the end, they spent as much as a new build, but still had old windows and high electricity bills.

The Patient Builder

Sarah and John decided to build in a developing area. They bought land for $60,000 and spent $300,000 on construction. It took 14 months and was incredibly stressful. However, by the time they moved in, a developer had built a shopping mall nearby. Their $360,000 investment was appraised at $475,000. They “made” $115,000 just by waiting.

Here’s a short, clear, and helpful FAQ on “Is it cheaper to build or buy a house?”, with citations based on the search results you provided.

FAQ: Is It Cheaper to Build or Buy a House?

Is it generally cheaper to buy or build a house?

Most of the time, buying an existing home is cheaper than building a new one, especially when looking at overall costs and fewer surprises.

Why is buying usually cheaper?

Buying avoids the unexpected expenses that commonly show up during construction projects—like delays, price increases in materials, and labor shortages . It also reduces the chance of unanticipated costs compared to building.

Can building a house ever be cheaper?

Yes. Building can be cheaper upfront when you’re only looking at base construction costs, though this depends heavily on labor prices, material choices, and the home’s size and finishes.

What factors make building more expensive?

Construction comes with risks like cost overruns, rising lumber prices, and delays caused by labor shortages—all of which can push the total price higher than expected.

What factors make buying more expensive?

Buying may require compromises on design, layout, or energy efficiency. Older homes can have higher utility bills and more maintenance due to outdated insulation or HVAC systems.

When should I consider building instead of buying?

Build if customization, new materials, and long-term energy savings matter more to you than short‑term costs. It’s also ideal if you have flexible timelines and want everything brand new.

What’s the bottom-line answer?

It depends on your priorities and budget, but buying is usually cheaper, while building offers more control and long‑term benefits.