Sold your house? Congratulations! But before you move on to your next adventure, there’s something important you shouldn’t overlook—your homeowners’ insurance refund when selling a real estate house. Many homeowners leave money on the table simply because they don’t know a refund is possible. Don’t let that be you!

What Is a Homeowners Insurance Refund?

If you’re unfamiliar with the term, let’s break it down. A homeowner’s insurance refund refers to the money you can claim back from your insurance provider when you cancel your policy after selling your house. Insurance policies are typically billed annually or semi-annually, so if you sell your home before the end of the policy term, you’ve essentially prepaid for coverage you no longer need. That’s where your refund comes in!

Why Does This Refund Happen?

When you sell your house, your homeowners’ insurance policy no longer applies since you’re no longer the owner. Here’s why insurers issue refunds:

- Annual Billing Structure: Most homeowners’ insurance policies are billed annually. If you sell your home mid-year, you’ve already paid for coverage you won’t use.

- Pro-Rated Refunds: Insurers calculate the amount you’re owed based on the days left in your policy term after the closing date.

- Additional Endorsements: If you’ve added endorsements like flood insurance, those premiums may also be eligible for a refund.

Types of Refunds You Can Expect

There are two main types of refunds:

- Unused Premium Refund: The standard refund for the remaining term of your policy.

- Endorsement Refunds: If you’ve purchased add-ons like earthquake or flood insurance, those may be refunded separately.

Do You Qualify for a Homeowners Insurance Refund When Selling?

Not everyone qualifies for a refund, so it’s essential to know the criteria. Let’s go through a simple checklist to see if you’re eligible.

Eligibility Checklist:

- Policy Active on Closing Date: Your homeowners’ insurance policy must still be active on the day you close the sale.

- No Claims Pending: If you’ve filed a recent insurance claim, it may impact your eligibility for a refund.

- Sale Completed: The house must be officially sold, with the title transferred to the buyer.

Exceptions to Keep in Mind

Some situations may prevent you from receiving a refund:

- Liens or Escrow Holds: If there are outstanding liens or issues with the escrow account, your refund might be delayed or ineligible.

- Multi-Policy Bundles: If your homeowners insurance is bundled with other policies (e.g., auto insurance), the refund calculation may get more complicated. Check with your insurer.

Buyer vs. Seller Responsibility

It’s important to note that the seller (you) is responsible for canceling the policy and requesting the refund. The buyer will need to purchase their own insurance policy for the home.

Regional Variations

Refund rules can vary by state. For example:

- In California, refunds are strictly prorated with specific time limits for cancellation.

- In Florida, hurricane clauses may affect refunds. Always check your state’s regulations or consult with your insurance provider for details.

Step-by-Step Guide: How to Claim Your Homeowners Insurance Refund Fast

Claiming your refund doesn’t have to be complicated. Follow these steps to ensure a smooth process.

Notify Your Insurer Immediately

Once your house is sold and the closing is complete, notify your insurance provider as soon as possible. Ideally, this should happen within 48 hours of closing. Most insurance companies offer multiple ways to cancel your policy:

- Online portals

- Phone calls

- Physical cancellation forms

Gather the Necessary Documents

You’ll need to provide specific documents to support your refund request. These typically include:

- Closing Statement: This document (e.g., HUD-1 or ALTA) confirms the sale’s completion and the closing date.

- Policy Number: Your unique policy number for verification.

- Proof of Sale Date: Include the exact date when ownership transferred.

Submit a Cancellation Request

Once you’ve gathered your documents, submit a formal cancellation request to your insurer. Depending on your provider, you may need to complete a cancellation form or send an email. Be sure to include:

- Your name and contact information

- Policy number

- Date of sale

- Request for refund calculation

Calculate Your Prorated Refund

Wondering how much you’ll get back? Here’s a simple formula to calculate your refund:

Refund = (Days Left / 365) × Annual Premium

Example: If your annual premium is $1,200 and you have 180 days left in your policy:

Refund = (180 / 365) × $1,200 = $591.78

Follow Up and Track Your Refund

Once you’ve submitted your request, track its progress through your insurer’s app or customer service. Refunds typically take 2 to 4 weeks, but delays can happen. Follow up after 7-10 business days if you haven’t received an update.

Timeline for Receiving Your Refund After Selling Your House

Here’s a general timeline for receiving your homeowners’ insurance refund:

Day Action

Day 0 Closing completed; notify insurer.

Week 1: Submit cancellation request.

Week 2: Insurer processes the request and calculates the refund.

Week 3 Refund issued via mail or direct deposit.

Factors That Can Delay Refunds

- Holidays: Refunds requested during holidays may take longer.

- Outstanding Claims: Pending claims on your policy can delay processing.

- Incomplete Documents: Missing information can lead to delays; double-check your submission.

Tips to Speed Up the Process

- Submit your request digitally for faster processing.

- Contact your insurer directly for updates.

- Confirm your refund preferences (e.g., direct deposit).

Common Mistakes to Avoid When Claiming a Homeowners Insurance Refund

Avoid these pitfalls to ensure you get your refund without hassle:

- Forgetting to Cancel: If you fail to cancel your policy, you risk losing your unused premium.

- Ignoring Endorsements: Additional coverage, such as flood insurance, may require separate cancellation.

- Missing Deadlines: Some insurers have a 30-60 day window for refund requests.

- Incorrect Prorating: Ensure the refund amount is calculated accurately.

Here’s a case study to illustrate:

- Before: A seller forgot to cancel their homeowners insurance policy, resulting in a $400 loss of unused premium.

- After: By following the steps in this guide, they successfully claimed their refund.

How Much Can You Expect? Refund Calculator Example

To give you a clearer idea of how much you can expect, here’s a quick table based on typical scenarios:

Home Value Annual Premium Refund (6 Months Left)

$250,000 $1,200 $600

$500,000 $2,000 $1,000

$750,000 $3,000 $1,500

Keep in mind that factors like deductibles, location, and endorsements can affect your refund.

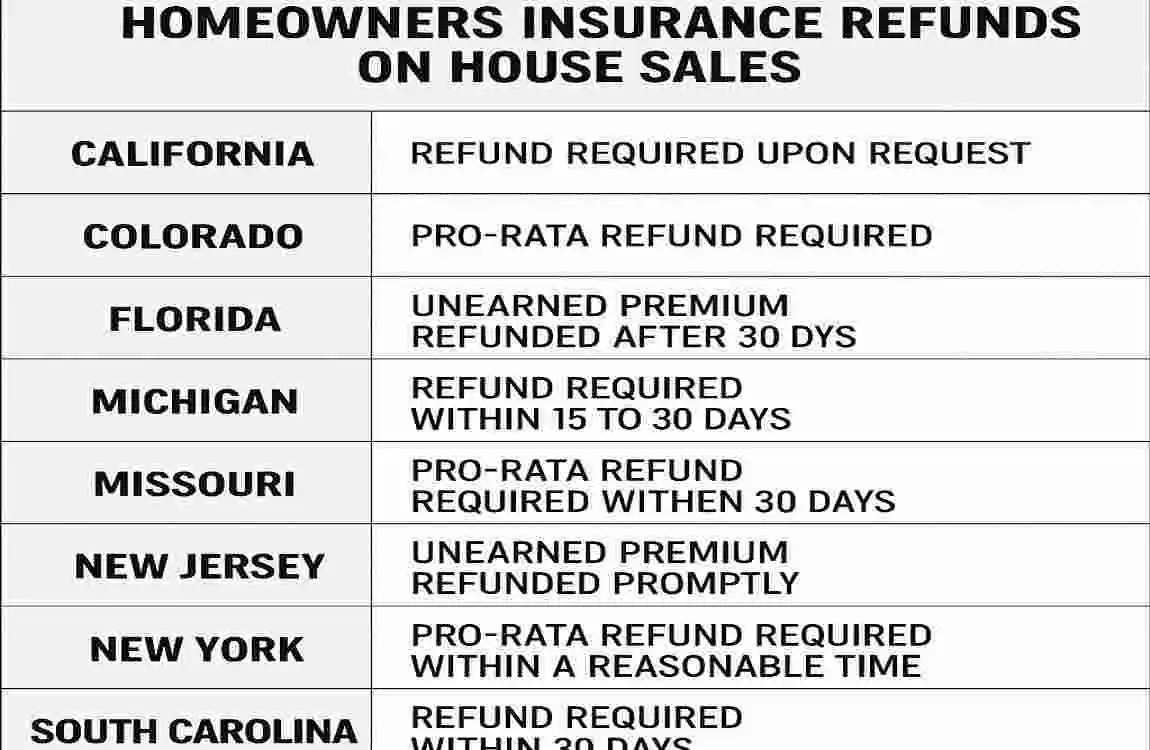

State-Specific Rules for Homeowners Insurance Refunds on House Sales

Refund rules vary by state. Here’s a quick overview:

State Refund Window Key Notes

California has 30-day strict prorating rules.

Texas: 45 days. Escrow often handles refunds.

Florida varies. Hurricane clauses may apply.

Always check with your state’s Department of Insurance for the latest regulations.

Tax Implications of Your Insurance Refund When Selling Real Estate

Good news! In most cases, your homeowners’ insurance refund is not taxable because it’s a return of premium, not income. However:

- If the refund is tied to capital gains or other taxable events, consult a tax professional to ensure compliance.

Alternatives If No Refund: What to Do Next

If you’re not eligible for a refund, don’t worry—you still have options:

- Negotiate with the Buyer: Work out a deal for the buyer to take over the policy.

- Bundle with New Policy: Transfer your remaining premium to a new homeowners insurance policy for your next house.