Imagine this: You’ve been scrolling through real estate apps for weeks, filtering by zip code, price, and that specific “must-have” open-concept kitchen. Finally, you see it—the perfect home. But as you click on the listing, your heart sinks. Right there, in bold letters, it says “Under Agreement.“

If you are navigating the real estate market in 2026, you know how fast things move. Understanding the jargon is half the battle. When a house is under agreement, it’s in a bit of a “limbo” state. It’s not quite sold, but it’s definitely off the market for most people.

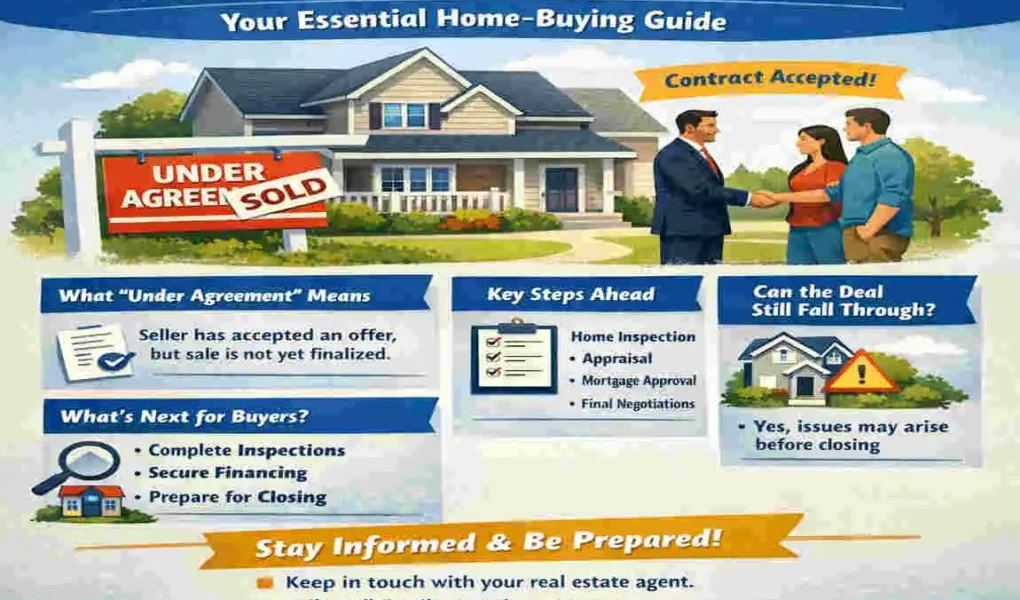

What Does “House Under Agreement” Actually Mean?

At its simplest, a house under agreement means the seller has officially accepted a buyer’s offer. Both parties have signed a Purchase and Sale Agreement (P&S).

Think of it like a marriage proposal. The “Yes” has been said, the ring is on the finger, and the date is set. However, the couple isn’t legally married until they sign the papers at the altar. In real estate, being under agreement is that “engagement” period. The deal is moving forward, but the keys haven’t been handed over, and the money hasn’t been fully transferred yet.

Legal Definition and Real Estate Lingo

In the world of real estate, words matter. You might see different terms depending on which website you are using or which part of the world you are in.

- Under Contract: This is essentially the same as “under agreement.” It means a contract exists, but the closing hasn’t happened.

- Pending: A home typically moves from “under agreement” to “pending” once all the significantmajor hurdles (such as inspections) are cleared.

- Contingent: This means the deal is active but depends on certain conditions—like the buyer selling their old house first.

While these terms are often used interchangeably by the public, real estate agents use them to signal how close a deal is to the finish line. In international markets, such as the Pakistan real estate market (Lahore or Islamabad), this stage is often referred to as the “token” or “bayana” stage, where a formal commitment is made before the final transfer of the allotment letter or deed.

The Purchase Agreement Document

The Purchase Agreement is the heart of the deal. This isn’t just a handshake; it’s a massive legal document that outlines every single detail of the transaction. If it isn’t in this document, it basically doesn’t exist in the eyes of the law.

Key components typically include:

- The Final Sale Price: The exact amount the buyer is paying.

- Earnest Money Deposit: The “good faith” cash the buyer puts down upfront.

- The Closing Date: The day everyone meets to swap money for keys.

- Inclusions and Exclusions: Does the expensive Swarovski chandelier stay, or is the seller taking it? This document decides.

Pro Tip: Always read the “fine print” regarding deadlines. Missing a deadline by even an hour can put you in breach of contract, which is a headache no one wants.

The Step-by-Step Home-Buying Process When a House Is Under Agreement

When a house enters the “under agreement” phase, a precise clock starts ticking. It’s a period of high activity, paperwork, and—let’s be honest—a little bit of stress. Here is how the timeline usually unfolds.

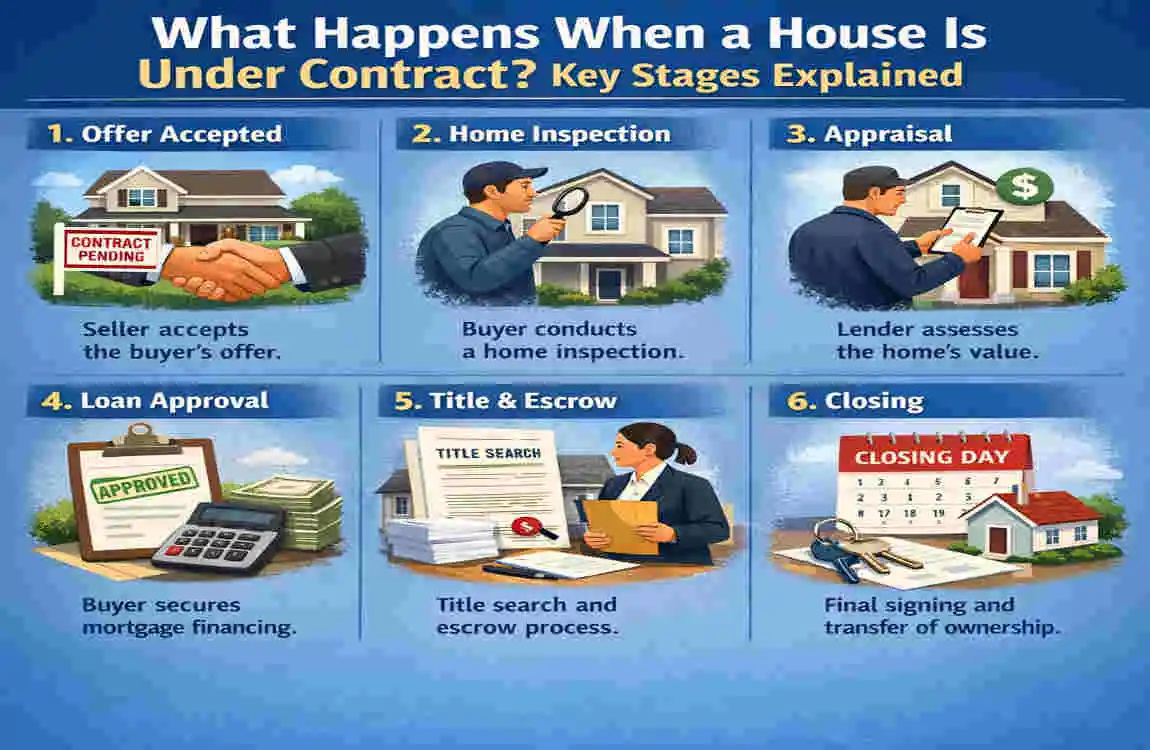

Offer Acceptance (Day 1)

This is the moment of celebration. The seller reviews all offers—sometimes dozens in a hot market—and picks one. Once both parties sign the offer, the house status changes on the Multiple Listing Service (MLS).

In a competitive market, sellers might still accept backup offers. This means if the first deal falls apart, the seller has a “Plan B” ready to go immediately. If you really love a house that is under agreement, don’t be afraid to ask your agent to submit a backup offer.

Earnest Money and Escrow

Within a few days of agreeing, the buyer must hand over the earnest money. This is usually 1% to 3% of the purchase price.

This money hasn’t been paid to the seller yet. Instead, it sits in an escrow account—a neutral third-party “bucket.” If the buyer backs out for no good reason, the seller might be able to keep this money as compensation for the wasted time. If the deal goes through, this money counts toward the buyer’s down payment.

Inspections, Appraisals, and Contingencies

This is the most critical part of the “under agreement” phase. Most contracts have contingencies, which are essentially “get out of jail free” cards for the buyer.

- Home Inspection: A professional checks the roof, the pipes, and the foundation. If they find a termite colony or a cracked foundation, the buyer can renegotiate the price or walk away with their earnest money intact.

- The Appraisal: The bank wants to make sure the house is actually worth what you’re paying. If you agreed to pay $500,000 but the bank says it’s only worth $480,000, there is an “appraisal gap” that needs to be settled.

- Financing: The deal is only “done” when the bank officially says, “Yes, we are giving you the loan.”

What Happens When a House Is Under Contract? Key Stages Explained

Once the initial excitement wears off, the “under contract” period becomes a game of logistics. You are moving from the “emotional” phase of buying a home into the “administrative” phase.

During the Contingency Period

During this time, the buyer has the upper hand. They are poking, prodding, and investigating the house. As a buyer, you must be diligent. This is your chance to make sure the house isn’t a “money pit.”

Sellers, on the other hand, often feel a bit anxious here. They are waiting for the buyer to finish their inspections. Some sellers include a “Kick-out Clause.” This allows the seller to keep showing the house and “kick out” the current buyer if a better, non-contingent offer comes along (though the first buyer usually gets a chance to match it).

From Under Agreement to Closing

After the contingencies are cleared, the house moves toward “Clear to Close.” This is when the title company conducts a title search to ensure no one else has a legal claim to the property (such as an ex-spouse or an unpaid contractor).

The average timeline from signing the agreement to moving in is typically 30 to 60 days. In 2026, we are seeing some digital-first lenders close deals in as little as 21 days, but don’t count on it—government and bank paperwork still moves at its own pace!

Post-Agreement: Pending vs. Active Under Contract

You might notice a change in the listing status from “Under Agreement” to “Pending.”

- Active Under Contract: The seller is still looking for backup offers because they aren’t 100% sure the deal will close.

- Pending: The deal is almost sure to close. The inspections are done, the money is lined up, and they are just waiting for the lawyers to finish the paperwork.

Implications for Buyers: Can You Still Buy a House Under Agreement?

If you see your dream home is under agreement, don’t delete the tab just yet. While it’s unlikely you’ll get the house, it’s not impossible. Deals fall through more often than you might think—sometimes as usually as 10-15% of the time depending on the market conditions.

Strategies for Backup Offers

A backup offer is your way of saying, “If their deal fails, I’m standing right here with my checkbook.”

- Be Clean: Your backup offer should have as few contingencies as possible to make it attractive.

- Be Fast: Have your pre-approval letter ready.

- Show Sincerity: Sometimes a short, professional note explaining why you love the home can keep you top of mind with the seller.

Risks and Red Flags: When to Walk Away

If you have a house under agreement, you need to know when to run. Don’t let “sunk cost fallacy” trap you in a bad deal.

5 Signs You Should Walk Away During the Agreement Phase:

- Major Structural Issues: Foundation cracks or massive roof leaks that the seller refuses to fix.

- Title Clouds: If the seller doesn’t have the clear right to sell the house,

- Appraisal Gap is Too Wide: If the bank won’t lend you the money and you don’t have the cash to cover the difference.

- Unresolved Liens: Unpaid taxes or contractor bills attached to the house.

- Bad “Vibes” During Final Walkthrough: If you show up the day before closing and the basement is flooded, that’s a sign!

Tips for Competing in a Seller’s Market

In 2026, the market remains tight. To get your own “Under Agreement” status, you need to be aggressive. Get pre-approved, not just pre-qualified. Consider an escalation clause, which automatically increases your offer if someone else bids higher. Most importantly, work with an agent who has a reputation for closing deals quickly.

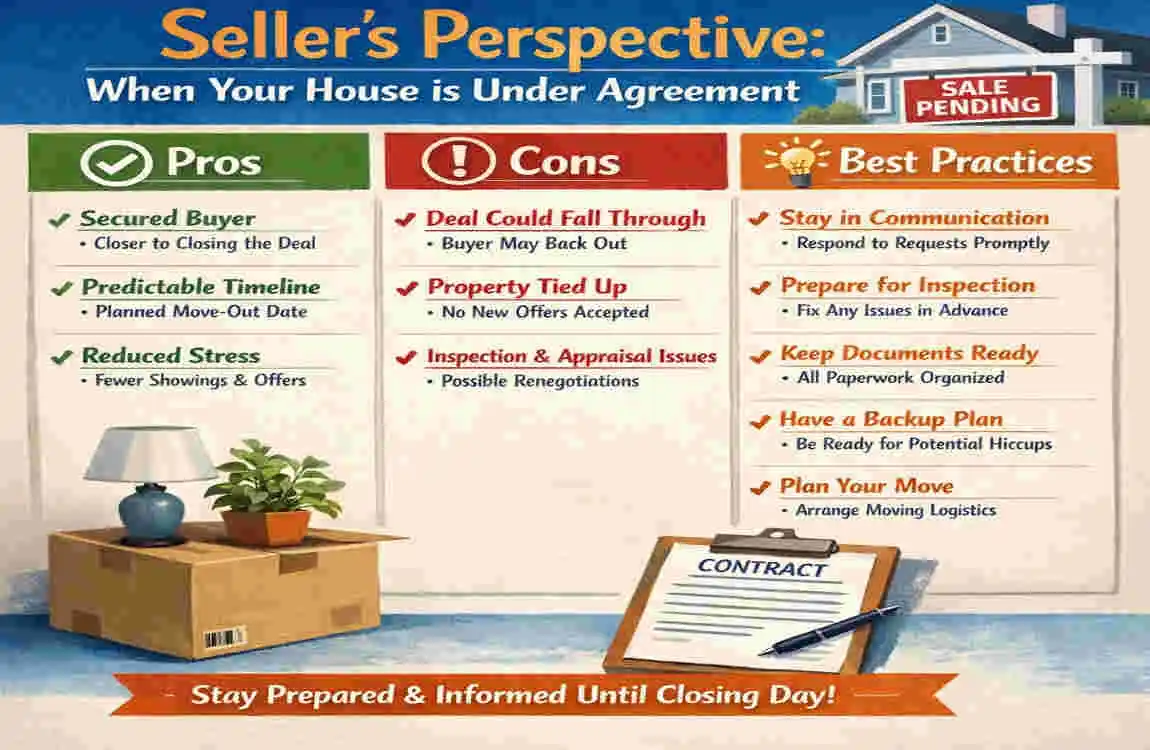

Seller’s Perspective: Pros, Cons, and Best Practices

Selling a house is an emotional rollercoaster. When you finally get that “Under Agreement” status, you might feel like you can finally breathe—but the work isn’t over.

The Pros:

- Price Security: You have a locked-in price.

- Clear Timeline: You can start packing and planning your move to your next home.

The Cons:

- Market Stagnation: Your house is effectively off the market. If the deal falls through after three weeks, your listing will look “stale” to new buyers.

- Repair Demands: Buyers might use the inspection report to nickel-and-dime you on the price.

Buyer vs. Seller Responsibilities (The Agreement Phase)

Responsibility Who is Responsible? Why it Matters

Home Inspection Fee Buyer The buyer pays to ensure the house is safe.

Keeping Utilities On Seller The inspector needs power and water to test systems.

Title Insurance Negotiable Protects against future legal claims on the home.

Earnest Money Buyer Shows the buyer is serious and has “skin in the game.”

Home Repairs Seller (usually) Negotiated after the inspection report is released.

Final Walkthrough Buyer Ensures the house is in the same condition as when agreed.

Common Scenarios and Real-Life Examples

To really understand what “under agreement” looks like, let’s look at two common scenarios we see in the current market.

The Appraisal Gap Heartbreak

In 2026, a buyer in Lahore, Pakistan, agreed to buy a luxury villa for 10 Crore. However, the bank’s appraiser valued the property at only 9 Crore. Because the house was under agreement with a financing contingency, the buyer couldn’t secure the full loan amount. The seller refused to drop the price, and the buyer didn’t have the extra 1 Crore in cash. The deal “fell through,” and the house went back to “Active” status the next day.

The Victorious Backup Offer

A small family found a home “under agreement” in a quiet suburb. They submitted a backup offer anyway. Two weeks later, the original buyer’s financing failed when they unexpectedly lost their job. Because the family had a backup offer already signed, they bypassed the “bidding war” and went straight into the “under agreement” phase themselves. They closed 30 days later.

Frequently Asked Questions (FAQs)

What does it mean when a house is under agreement but still shows as available?

This usually means the seller is nervous! They have an accepted offer, but they are worried it might fall through (perhaps due to a weak buyer profile or a risky contingency). They are continuing to show the house to collect backup offers.

Can the seller accept other offers while under agreement?

Yes and no. They can accept backup offers, but they cannot legally break the first contract just because a better one came along (unless there is a specific “kick-out clause”). They are legally bound to the first buyer as long as that buyer meets their deadlines.

Contingent vs. under agreement: What’s the difference?

“Contingent” is a type of “under agreement” status. It specifically means the deal is waiting on a specific event (like a home inspection or the buyer selling their current home). “Under agreement” is the broader term for the whole process.

How long does the “under agreement” status last?

Typically 30 to 60 days. However, in cash sales, it can be as short as 7 to 10 days. If there are major repair issues or title problems, it can stretch to 90 days or more.

Can I buy a house that is already under agreement?

You can’t buy it immediately, but you can put yourself next in line. By submitting a backup offer, you ensure that if the first deal fails, you are the very next person the seller talks to.

Final Tips and Next Steps for Home Buyers

Navigating a home purchase is one of the most significant financial moves you will ever make. When you see a house is under agreement, remember that it is a sign of progress, not necessarily the end of the road.

Your Actionable Checklist:

- Don’t Panic: If your dream home is under agreement, ask your agent for the “inside scoop” on why. Is the buyer solid?

- Stay Pre-Approved: Keep your financial paperwork up to date so you can move instantly if a house comes back on the market.

- Watch the MLS: Set up alerts for “Status Changes.” You want to be the first to know if a house moves from “Under Agreement” back to “Active.”

- Hire a Pro: A great buyer’s agent is worth their weight in gold. They can often find out if a deal is “shaky” before it even hits the public news.