You’ve just handed over the keys to your beautiful rental property to a new tenant. Your real estate agent assured you they were the perfect fit. Fast forward six months, and the rent hasn’t been paid in ten weeks, the neighbors are complaining about late-night noise, and you just found out there’s a hole in the living room wall.

The question of whether real estate agents are liable for bad tenants is one of the most debated topics in property investment. According to data from the National Association of Realtors (NAR), nearly 20% of rental transactions involve some form of tenant-related friction. But where does the agent’s job end, and where does your responsibility as a landlord begin?

What Makes a Tenant “Bad”? Common Issues Landlords Face

Before we look at the agent’s role, we need to define what we actually mean by a “bad tenant.” It’s not just someone who forgets to take the trash out once in a while. We are talking about issues that impact your bottom line and your legal standing.

The Financial Drain of Non-Payment

The most common issue, of course, is failure to pay rent. When a tenant stops paying, your mortgage on that property doesn’t stop. You are suddenly bleeding money. According to industry sources like RentPrep, the average cost of an eviction can soar past $4,000 when you factor in court fees, lost rent, and legal representation.

Property Damage and Neglect

There is a big difference between “normal wear and tear” and actual damage. We’re talking about broken windows, stained carpets, or unapproved “renovations.” If an agent didn’t properly vet a tenant’s history, you might end up with someone who has a track record of leaving properties in shambles.

Illegal Activities and Nuisance

This is where things get scary. If a tenant is using your property for illegal business or causing a constant disturbance to the neighborhood, you—as the owner—could face fines or even legal action from the city.

Top 5 Bad Tenant Red Flags Agents Should Catch:

- Inconsistent Employment History: Frequent job hops without explanation.

- Gaps in Rental History: “Missing” years where they can’t provide a landlord reference.

- Low Credit Scores: Specifically, a history of utility collections or previous rent judgments.

- Urgency to Move In: Pushing to move in “tomorrow” with cash in hand can sometimes be a tactic to bypass deep checks.

- Refusal to Provide Documentation: Hesitation to share pay stubs or ID.

Are Real Estate Agents Liable for Bad Tenants? Legal Breakdown

Now, let’s get to the heart of the matter. Can you actually sue your agent if the tenant turns out to be a nightmare? The short answer is: Usually no, but it depends on their level of negligence.

Core Legal Principles: Agency Law

In the real estate industry, agents operate under Agency Law. This means they have a fiduciary duty to act in your best interest. They are expected to use “reasonable care and skill.”

If an agent follows all the standard procedures—they check the credit score, call the references, and verify the income—but the tenant loses their job six months later and stops paying, the agent is not liable. They aren’t psychics; they can only judge based on the information available at the time of the application.

When Negligence Triggers Liability

Liability kicks in when a duty is breached. If an agent told you, “I checked their references, and they are great,” but they actually never called a single person, that is negligence. If they knowingly ignored a previous eviction on a background check to close the deal and get their commission, you may have a legal case against them.

State-Specific Laws (U.S. Focus)

Liability laws vary significantly depending on where your property is located. Here is a breakdown of how different states handle agent responsibility:

State Key Law Agent Liability Trigger

California Civil Code §1940 Negligent Screening: If the agent fails to perform “due diligence” required by the contract.

Texas Property Code §92 Fraud/Misrepresentation: Liability usually only sticks if the agent lied about the applicant.

Florida Ch. 83 Breach of Contract: Depends heavily on the specific language in the Listing Agreement.

New York Real Prop. Law Professional Negligence: High bar for proof; must show the agent ignored industry standards.

Contracts and Disclosures

Most real estate agents use standard contracts that include Exculpatory Clauses. These are basically “get out of jail free” cards that state the agent is not a guarantor of the tenant’s future behavior. You need to read your Listing Agreement or Property Management Agreement very carefully. If it says “Agent shall not be held liable for the conduct of the tenant,” you have a much steeper uphill battle.

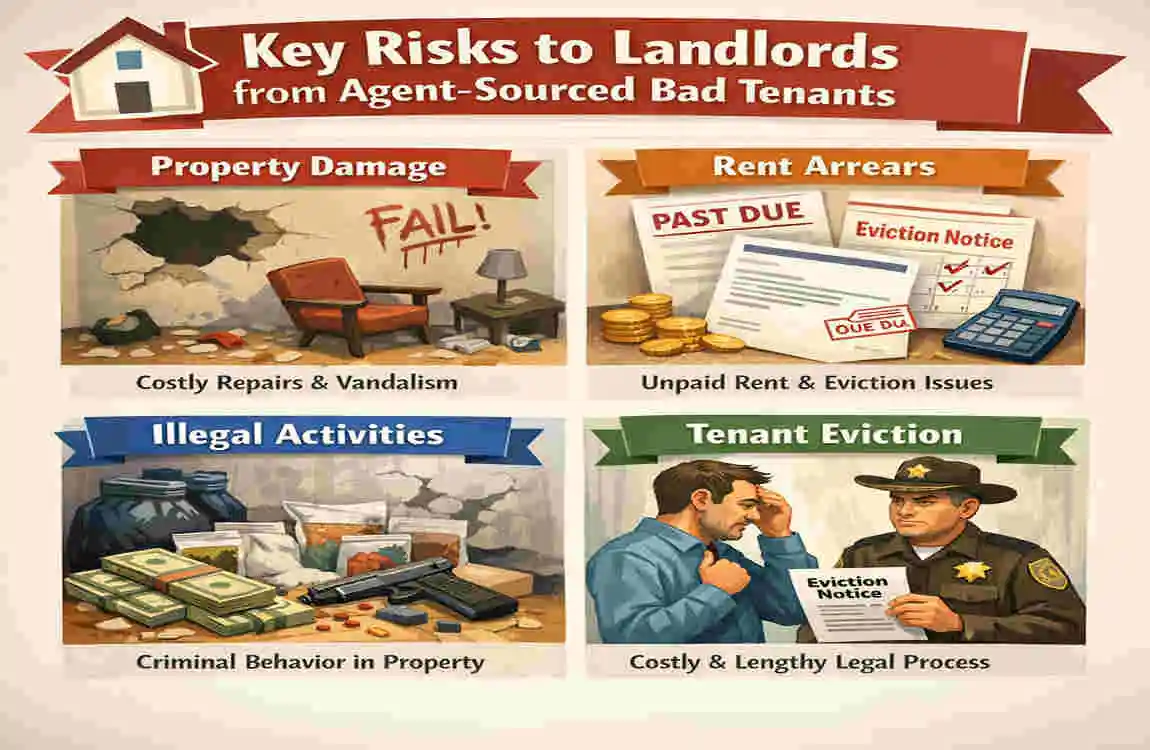

Key Risks to Landlords from Agent-Sourced Bad Tenants

When an agent fails to properly vet a tenant, the “ripple effect” of that failure can be devastating. It’s not just about the one month of missing rent; it’s about the long-term health of your investment.

Massive Financial Hits

The numbers add up quickly. Let’s break it down:

- Lost Rent: Usually 2 to 4 months during the eviction process.

- Repairs: $2,000 to $20,000, depending on the severity of the damage.

- Legal Fees: Hiring an eviction attorney isn’t cheap.

- Re-Leasing Costs: You’ll have to pay another commission to find a new tenant.

Legal Exposure and Lawsuits

If a tenant is injured on the property while doing something illegal, or if they harass a neighbor, those third parties might sue you, the landlord. While the agent made the introduction, the legal “buck” often stops with the property owner. If you can prove the agent knew the tenant was a risk and didn’t tell you, you can pull the agent into the lawsuit, but that’s a long and expensive process.

Reputational Damage

If you own a multi-family building, one bad tenant can drive away all your good tenants. High turnover is an ROI killer. Your property’s reputation in the community matters. If your building becomes known as the “party house” or the “problem building,” your property value could actually take a hit.

When Can You Hold Real Estate Agents Accountable?

How do you prove that your agent is at fault? It’s not enough to be angry; you need evidence.

Proving Professional Negligence

To hold an agent liable, you generally have to prove four things:

- Duty: The agent had a duty to screen the tenant (usually defined in your contract).

- Breach: The agent failed to perform that duty (e.g., they skipped the criminal background check).

- Causation: The specific thing the agent missed is what caused your loss (e.g., the tenant had a history of arson, and they burned your kitchen down).

- Damages: You actually lost money.

Steps to Build a Case

If you suspect your agent was negligent, don’t just call them and yell at them. You need to be methodical:

- Document Everything: Save every email, text, and flyer the agent sent you about the tenant.

- Request the File: Ask for the complete application package that the agent collected. If it’s empty or missing key checks, you have your “smoking gun.”

- Consult an Attorney: Real estate law is complex. You need someone who specializes in Professional Liability (E&O) claims.

The Role of Insurance

Most professional real estate agents carry E&O Insurance. This is designed to cover them if they make a mistake. If you can prove they were negligent, their insurance company is the one paying your settlement. This is why it is vital to only work with insured agents!

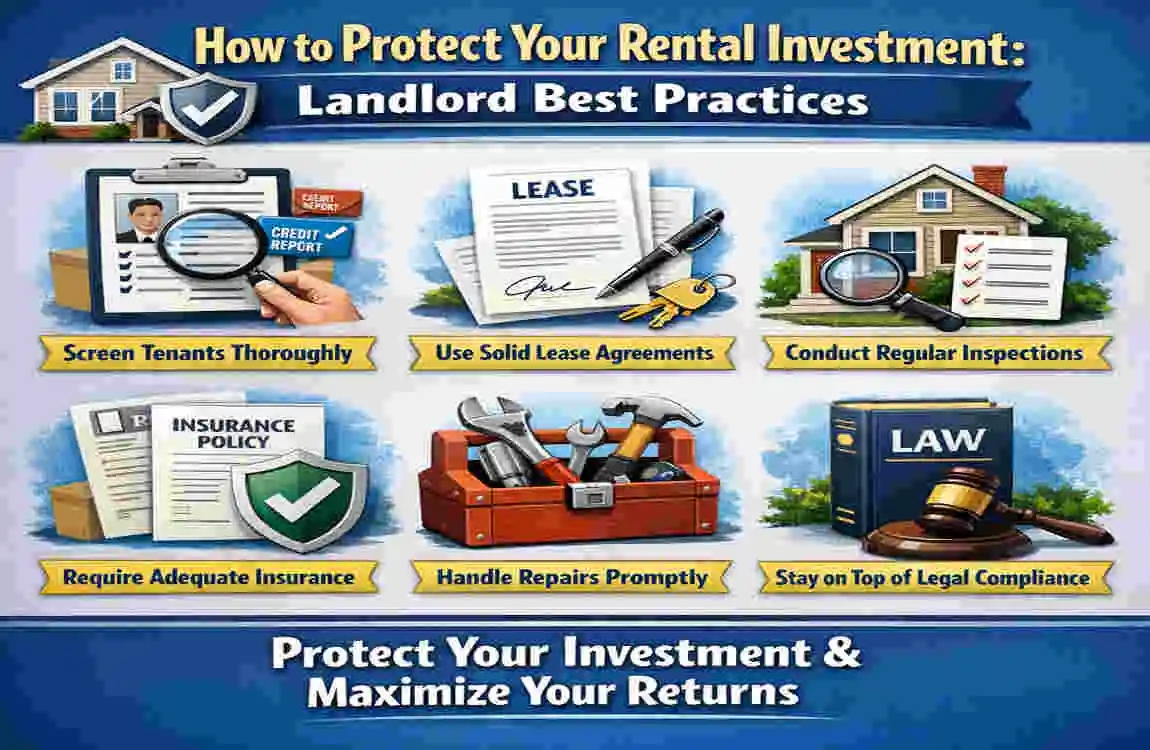

How to Protect Your Rental Investment: Landlord Best Practices

You’ve heard the saying: “An ounce of prevention is worth a pound of cure.” Instead of worrying about whether you can sue your agent later, let’s focus on making sure you never have to.

Vet Your Real Estate Agent Thoroughly

Don’t just hire the first agent who leaves a flyer on your door. You are trusting them with an asset worth hundreds of thousands of dollars.

- Ask for References: Specifically ask for other landlords they’ve worked with.

- Check their Track Record: How many tenants have they placed in the last year? What is the “eviction rate” of those placements?

- Interview Them: Ask, “What is your specific process for verifying income?” If they say, “I just look at a pay stub,” that’s not enough. They should be calling employers.

Implement Robust Tenant Screening

Even if you use an agent, you should have the final say. You should see the screening reports yourself. Use modern tools that provide comprehensive data.

Tenant Screening Checklist for Landlords:

Check: Why It Matters Recommended Tools

A credit score shows financial responsibility, and the debt-to-income ratio does, too. TransUnion SmartMove

Eviction Records: The best predictor of future behavior is past behavior. Experian / CourtRunner

Criminal background checks ensure the safety of the property and the neighborhood. Checkr

Employment Verification confirms they actually have the money they claim to have. Direct Call to HR

A previous landlord reference tells you how they treated the property. Phone Interview

Step 3: Ironclad Lease Agreements & Insurance

Your lease is your shield. Make sure it includes:

- Subletting Prohibitions: To prevent the tenant from moving in “friends” you didn’t screen.

- Maintenance Requirements: Clearly stating what the tenant is responsible for.

- Landlord Insurance: Get a policy that includes explicitly “Loss of Rent“ coverage and “Tenant Damage” riders. This way, if the tenant trashes the place, the insurance company pays you, and they can worry about suing the tenant or the agent.

Real Estate Agent Responsibilities: What They Must (and Mustn’t) Do

It is essential to be fair to agents, too. They have a tough job, and strict ethical and legal guidelines bind them.

The NAR Code of Ethics

If your agent is a Realtor®, they are bound by a strict Code of Ethics. Article 1 states that they must protect and promote their client’s interests. This means they cannot “sugarcoat” a bad application to get the deal done. If they do, they could lose their license.

What Agents CANNOT Do (Fair Housing Laws)

You might want your agent to “find a nice quiet couple,” but the agent legally cannot filter tenants based on race, religion, familial status, or disability. If you pressure an agent to discriminate, you are the one who will end up in legal trouble. An agent’s liability often involves balancing your needs with federal Fair Housing Act requirements.

Tips for Agents (The Professional Standard)

If you are an agent reading this, the best way to avoid liability is transparency.

- Always provide the landlord with the raw screening data.

- Never “recommend” a tenant; instead, “present the facts” and let the landlord make the final decision.

- Keep a paper trail of every verification step you took.

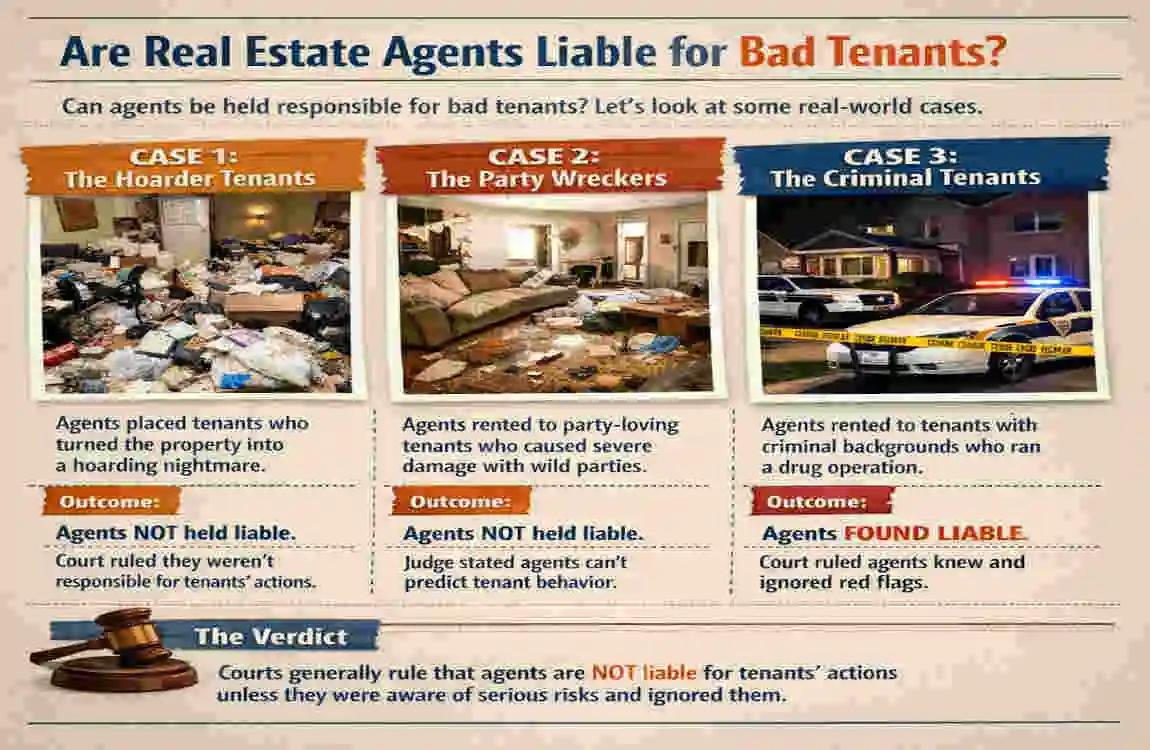

Case Studies: Real-World Lessons from Bad Tenant Disasters

The “Ghost” References (The Failure)

In a well-known case in the Midwest, an agent placed a tenant who claimed to be a high-earning consultant. The agent told the landlord the references “checked out.” Three months later, the tenant was arrested for running a fraud ring out of the house. It turned out the “references” were just the tenant’s friends using burner phones. Because the agent never verified the employer’s business license, the landlord successfully sued the agent for $15,000 in damages and lost rent. Lesson: Trust but verify. Always ask for proof of employment, like a W-2 or tax return, not just a phone number.

The Proactive Agent (The Success)

A landlord in Florida was frustrated that their agent rejected four applicants in a row. The agent insisted that although the applicants had the cash, their rental history was spotty. Eventually, the agent found a tenant with a lower income but a 10-year perfect rental history. Two years later, that tenant is still there, the property is pristine, and the landlord is thrilled. Lesson: A good agent isn’t the one who finds a tenant the fastest; they are the one who finds the right one.

FAQs: Answering Your Top Questions on Agent Liability

Are real estate agents liable for bad tenants in California?

In California, agents are held to a high standard of “Due Diligence.” If they fail to follow the screening protocols outlined in the Bureau of Real Estate (BRE) guidelines, they can be held liable for negligence.

Can I sue my agent for property damage caused by a tenant?

Only if you can prove the agent was grossly negligent. For example, if they knew the tenant had been evicted for trashing a previous home, and they hid that information from you.

How can I avoid bad tenants as a landlord?

The best way is a “Double-Check” system. Let your agent handle the initial legwork, but personally review the credit report and call the last two landlords yourself.

Does landlord insurance cover agent errors?

Standard landlord insurance covers property damage and liability. It usually does not cover the cost of suing your agent. For that, you would need to consult a legal professional.