Owning a home is a significant milestone and a substantial financial investment. As a homeowner or prospective buyer, understanding the intricacies of house taxes is essential for budgeting, financial planning, and making informed decisions. However, the terminology surrounding house taxes can be perplexing, particularly when distinguishing between “real estate taxes” and “property taxes.”

What Are Real Estate Taxes?

Real estate taxes, in simple terms, are taxes levied on the value of real estate property. These taxes are typically imposed by local governments and are based on the assessed value of the land, as well as any buildings or improvements on it. The funds generated from real estate taxes often support vital local services, such as schools, infrastructure maintenance, and public safety.

When we talk about real estate taxes, we usually refer to taxes on physical property that cannot be moved, such as:

- Land

- Houses

- Commercial buildings

- Permanent structures attached to the land

The amount of real estate taxes you pay depends on the assessed value of your property, which local tax assessors determine. They consider factors like the size of the land, the square footage of the building, the property’s age and condition, and recent sales of similar properties in the area.

It’s important to note that the property owner typically pays real estate taxes. If you have a mortgage, your lender may collect these taxes as part of your monthly mortgage payment and hold them in an escrow account until they are due to the local government.

What Are Property Taxes?

Property taxes, on the other hand, encompass a broader category that includes taxes on various types of property, not just real estate. While property taxes often include real estate taxes, they may also apply to personal property such as vehicles, boats, or even business equipment.

The assessment methods and frequency of property taxes can vary widely depending on the jurisdiction. Some local governments assess property taxes annually, while others evaluate them less frequently. The tax rates and calculations may also differ based on the type of property being taxed.

Here are a few examples of how property taxes can vary:

- In some states, vehicle property taxes are based on the car’s value and are paid annually during the registration renewal process.

- Boat owners may need to pay personal property taxes based on the vessel’s assessed value.

- Businesses often pay property taxes on equipment, furniture, and other tangible assets.

It’s crucial to understand that property tax systems can differ significantly from one county or municipality to another. Some jurisdictions may have separate tax rates for real estate and personal property, while others may combine them into a single property tax bill.

Are Real Estate Taxes and Property Taxes the Same?

Now, let’s address the burning question: “Are real estate taxes and property taxes the same?” The answer is both yes and no. In many cases, the terms “real estate taxes” and “property taxes” are used interchangeably when referring to taxes on real estate. However, as we’ve discussed earlier, property taxes can be a more inclusive term that encompasses taxes on both real estate and personal property.

To clarify further:

- Real estate taxes specifically refer to taxes on immovable property, such as land and buildings.

- Property taxes can include real estate taxes, but may also apply to movable assets, such as vehicles or equipment.

It’s worth noting that the usage of these terms can vary depending on the region or context. In some states or localities, “property tax” is used exclusively to refer to real estate taxes, while in others, it may include both real estate and personal property taxes.

To summarize the key points:

- Real estate taxes are a subset of property taxes, focusing on immovable property.

- Property taxes can encompass both real estate taxes and taxes on personal property.

- The terminology usage may vary based on local customs and legal definitions.

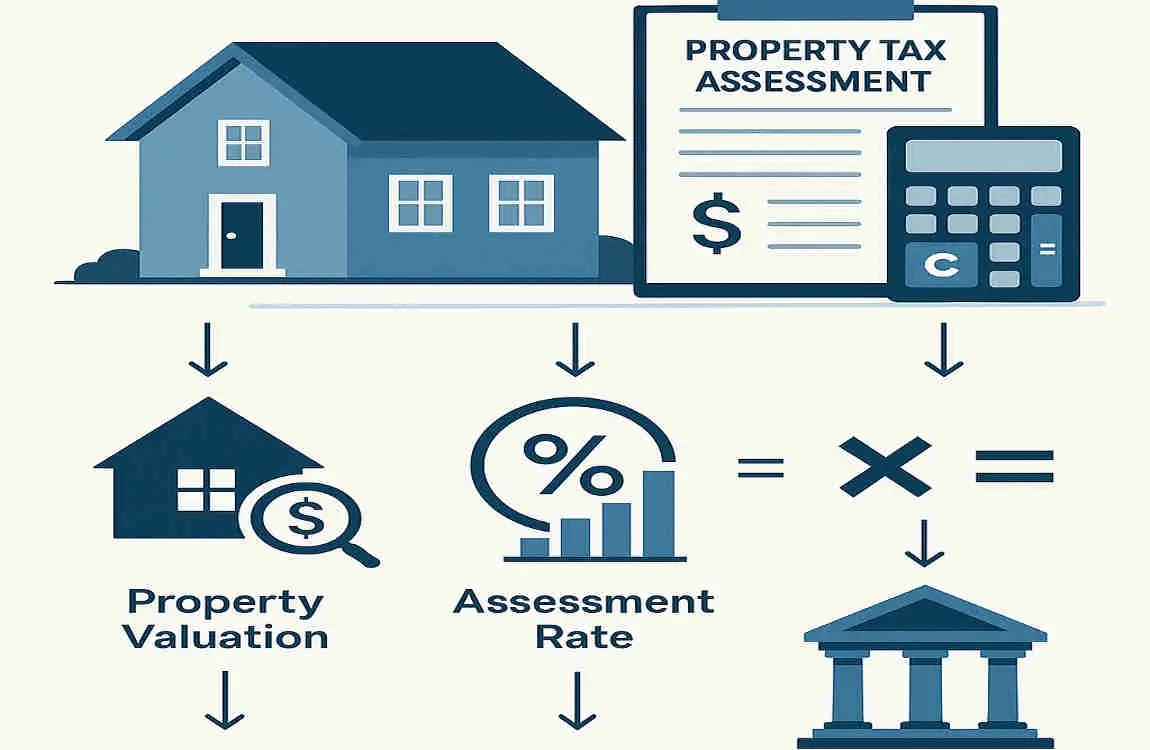

How Real Estate and Property Taxes Are Calculated

Understanding how real estate and property taxes are calculated is essential for homeowners and buyers. While the specific formulas and assessment methods may vary by jurisdiction, there are some common elements to be aware of.

The tax assessment process typically involves three key values:

- Market Value: This is the estimated price at which your property would sell on the open market.

- Assessed Value: Local tax assessors determine this value based on the market value and any applicable assessment ratios.

- Taxable Value: This is the value on which your taxes are calculated after applying any exemptions or deductions.

Once the taxable value is determined, it is multiplied by the local tax rate, often expressed as a mill rate. A mill is equal to one-tenth of a cent, and the tax rate is typically described as the number of mills per $1,000 of taxable value.

For example, if your home has a taxable value of $200,000 and the local tax rate is 10 mills, your annual real estate house tax would be:

($200,000 / $1,000) * 10 = $2,000

It’s important to note that various exemptions, deductions, and caps can affect the final tax bill. Some common examples include:

- Homestead exemptions for primary residences

- Senior citizen or veteran exemptions

- Limits on annual tax increases

Consulting with local tax authorities or a tax professional can help you understand the specific calculations and exemptions applicable to your situation.

Impacts of Real Estate and Property Taxes on Homeowners and Buyers

Real estate and property taxes can have significant impacts on homeowners and buyers. As a recurring cost, these taxes play a crucial role in budgeting and financial planning.

For homebuyers, understanding the tax implications is essential when assessing affordability. In addition to the mortgage payment, property taxes can significantly increase the monthly housing expenses. Buyers should factor in the estimated taxes when determining their budget and evaluating potential homes.

Homeowners need to plan for property taxes as an ongoing expense. Creating a budget that accounts for tax payments can help ensure financial stability and security. Escrow accounts, often established by mortgage lenders, can help manage tax payments by spreading the cost over the course of the year.

Property taxes also influence home equity and refinancing considerations. As home values increase, so can the assessed value and corresponding taxes. Homeowners should regularly monitor their tax assessments and consider appealing if they believe the value is overstated.

It’s worth noting that property taxes can impact various types of properties differently. Mobile homes, commercial properties, and investment properties may have distinct tax rules and rates compared to traditional single-family homes.

Tips for Managing and Reducing Your House Taxes

While property taxes are a necessary part of homeownership, there are strategies to manage and reduce your tax burden. Here are some tips to consider:

- Appeal Tax Assessments: If you believe your property’s assessed value is too high, you can file an appeal with the local tax authority. Gather evidence, such as recent sales of similar properties, to support your case.

- Explore Exemptions and Tax Relief Programs: Many jurisdictions offer exemptions or tax relief to specific groups, including seniors, veterans, and individuals with disabilities. Research the available programs and see if you qualify.

- Plan with Tax Professionals: Consulting with a tax professional or financial advisor can help you develop a tax planning strategy tailored to your situation. They can guide you on timing home improvements, claiming deductions, and optimizing your overall tax position.

- Stay Informed and Keep Records: Regularly review your tax statements and assessments for accuracy. Keep detailed records of your property, including improvements, repairs, and relevant documentation. This information can be valuable if you need to appeal an assessment or claim deductions.