It is a humid Tuesday afternoon in Florida. You have just come home to find a puddle forming under your kitchen sink. Panic sets in, you frantically call a local plumber, and they arrive just in time to save your cabinetry. You breathe a sigh of relief—until you get the invoice.

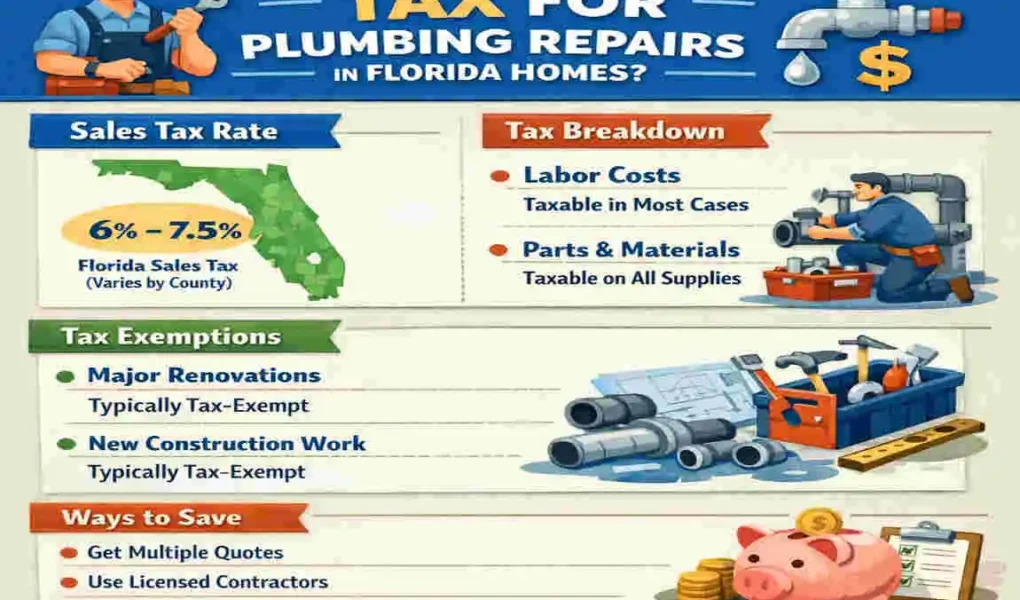

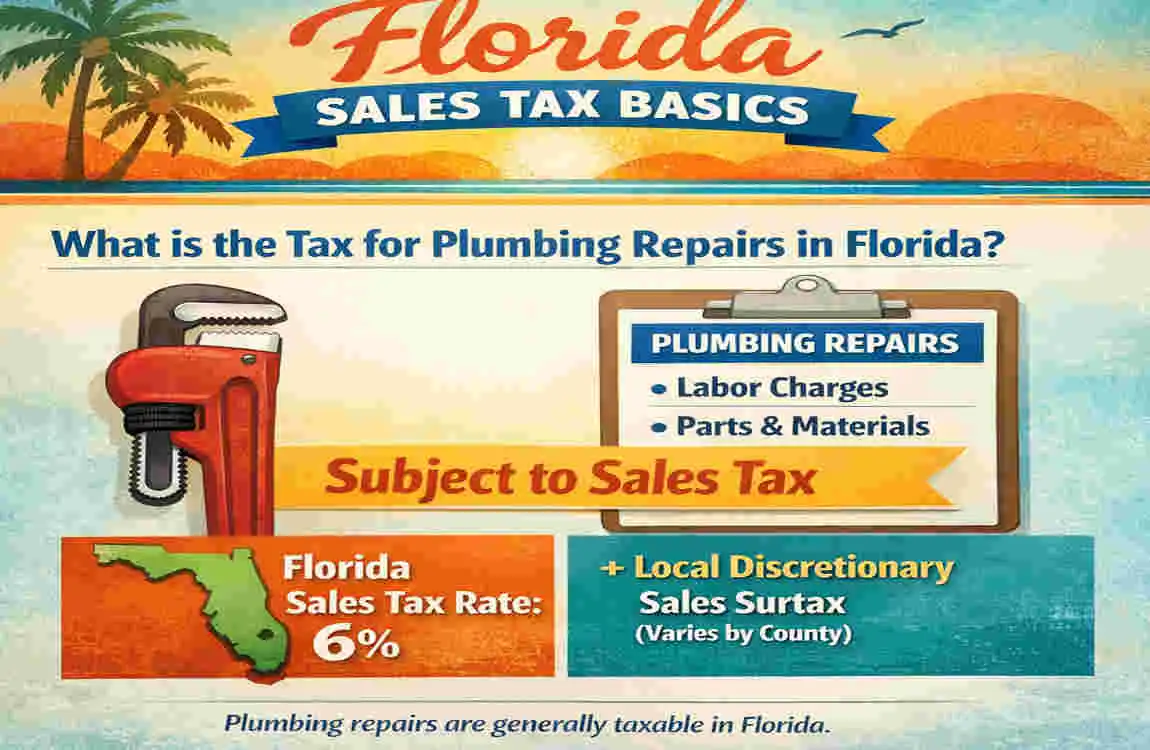

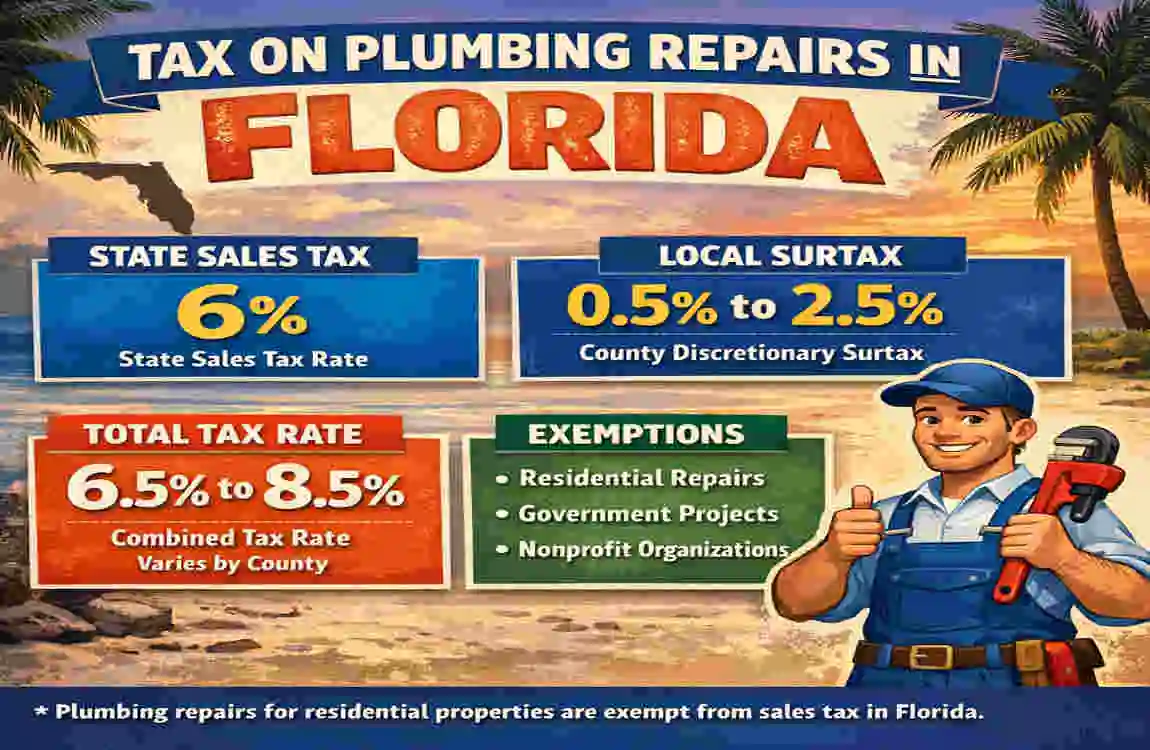

Unlike many other states, where services are often tax-exempt, Florida has specific laws that encompass repair services. Generally speaking, Florida imposes a base 6% state sales tax on most plumbing repair services. This applies to the total cost, which often includes both the materials used and the labor provided to install them. But that is not all—depending on where you live, local county surtaxes can push that rate up to 7%, 7.5%, or even 8%.

Navigating tax codes can feel about as fun as dealing with a clogged drain. However, understanding where your money is going is the first step to being a savvy homeowner. In this guide, we are going to break down exactly how plumbing taxes work in Florida, explore the specific rates in your county, and uncover hidden exemptions and deductions that could save you money—especially if you own rental properties.

Florida Sales Tax Basics: Understanding the 6% Rule

To truly understand your plumbing bill, we first need to look at how Florida structures its sales tax. It is a common misconception that sales tax only applies to “things” you can hold, like a new faucet or a length of pipe. In many states, that is true. But Florida operates a little differently when it comes to repairs.

The “Total Invoice” Rule

In Florida, the Department of Revenue views a plumbing repair as a bundled transaction involving “tangible personal property.” When a plumber comes to your house to fix a leak, they are usually providing new parts (tangible property) and the service to install them (labor).

Here is the kicker: Under Florida law, the entire repair charge is subject to sales tax. This includes:

- Materials: Pipes, valves, wax rings, faucets.

- Labor: The hourly rate the plumber charges to do the work.

- Overhead fees: Trip charges or service call fees.

The state’s base sales tax rate is 6%. If your bill is $100, the state takes $6 right off the top. But as many Floridians know, the math rarely stops there.

The Discretionary Sales Surtax

Beyond the state’s 6%, individual counties have the authority to add their own “Discretionary Sales Surtax.” This is a local tax used to fund county services, such as schools, transportation, and infrastructure.

This surtax usually ranges from 0.5% to 1.5%, though some counties have capped it at a different rate. This means your total tax rate is not just 6%; it is the combination of the state rate plus your county’s rate.

- Miami-Dade County: 6% State + 1% County = 7% Total

- Hillsborough County: 6% State + 1.5% County = 7.5% Total

- Leon County: 6% State + 1.5% County = 7.5% Total

It is vital to check your specific county’s current surtax rate, as these can change via local referendums.

Tax Rates by County Example

To help you visualize what this looks like on a real bill, let’s look at a hypothetical $500 plumbing repair across different major Florida counties.

County, State Base Tax, Local Surtax, Total Tax Rate, Tax RateTax Amount on $500 Repair

Miami-Dade 6% 1% 7% $35.00

Broward 6% 1% 7% $35.00

Orange 6% 0.5% 6.5% $32.50

Duval 6% 1.5% 7.5% $37.50

Hillsborough 6% 1.5% 7.5% $37.50

Palm Beach 6% 1% 7% $35.00

As you can see, the location of your home can swing the final cost of your repair by several dollars. While a few dollars might not seem like much on a small repair, imagine the impact on a $15,000 whole-home re-piping job. That 1% difference suddenly becomes $150.

When Is Plumbing Taxable? The Fine Print

Not every interaction with a plumber is taxed the same way. The nuance lies in the type of work being performed. Are you fixing something that is broken, or are you building something new? In the eyes of the tax man, these are two very different activities.

Routine Repairs: Fully Taxable

This is the category most homeowners encounter. A “repair” is defined as restoring an existing structure or fixture to its working condition.

- Examples: Fixing a burst pipe, unclogging a toilet, replacing a broken garbage disposal, or swapping out a leaking water heater.

- Tax Rule: As mentioned earlier, the total invoice is taxable. The plumber charges you tax on the parts and the labor, collects it from you, and remits it to the state.

Why is the labor taxed? The logic is that the labor is “incidental” to the sale of the parts required to do the fix. Even if the plumber separates the parts and labor on the invoice, the state usually requires tax on the total if the transaction involves furnishing tangible personal property.

New Construction: Different Rules Often Apply

New construction contracts are often treated as “Real Property Contracts.” This gets a bit technical, but stick with me.

When a plumber is hired to install the plumbing system in a brand-new house or a completely new addition (like adding a new bathroom where one didn’t exist), they are improving real property.

- Tax Rule: In many cases, the plumber pays sales tax on the materials when they purchase them from the supplier. They do not charge the homeowner sales tax on the final bill. Instead, the tax is built into the contract price.

- Why this matters: If you are building a custom home, you likely won’t see a specific line item for “sales tax” on your plumbing draw, but rest assured, the tax was paid at the supply house.

Capital Improvements vs. Repairs

This is a common area of confusion. A Capital Improvement adds to the value of the property, prolongs its life, or adapts it to new uses.

- Examples: Installing a water filtration system where none existed, or repiping an entire house with PEX.

- The Grey Area: While new construction is often exempt from direct sales tax on the invoice, retrofits and improvements in existing homes often still fall under the taxable umbrella in Florida if the contractor itemizes materials and labor.

However, if a contractor offers a “Lump Sum” contract for a capital improvement, they may pay the tax on the materials themselves and not charge you for labor tax. It depends heavily on how the contract is written and the specific nature of the job.

Tax Deductions & Exemptions: Can You Write It Off?

Now for the million-dollar question: Can I claim these plumbing costs on my taxes?

The answer depends entirely on who you are: a primary homeowner, a landlord, or someone with specific medical needs.

For the Average Homeowner

If you live in the house as your primary residence, the news is generally not great.

- Standard Repairs: You cannot deduct the cost of fixing a leaky faucet or a running toilet from your federal or state income taxes. These are considered personal living expenses.

- Sales Tax Deduction: You can technically deduct state and local sales taxes on your federal return if you itemize deductions (Schedule A). However, most people opt for the standard deduction. If you do itemize, you can save your receipts for big projects (like that $15,000 re-pipe) to add to your total sales tax paid for the year.

The “Medical Necessity” Exception

There is a rare exception for homeowners. If a plumbing upgrade is medically necessary, you can deduct it as a medical expense.

- Example: Installing a walk-in bathtub or accessible shower for a resident with mobility issues.

- The Catch: You can only deduct the portion of the cost that exceeds the increase in the home’s value, and only if your total medical expenses exceed a certain percentage of your adjusted gross income.

For Rental Property Owners: The Gold Mine

If you are a landlord, plumbing repairs are treated very differently. This is strictly business.

- Repairs: Costs to keep your rental property in good operating condition (like unclogging drains or fixing leaks) are fully deductible as operating expenses in the year they occur. This lowers your taxable rental income.

- Improvements: If you replace a water heater or re-pipe the building, these are usually considered capital improvements. You cannot deduct the full cost immediately; instead, you must depreciate it over several years (usually 27.5 years for residential rental property).

Note: While this doesn’t exempt you from paying the sales tax at the register, it does allow you to recoup a significant portion of the cost through income tax savings later.

For Home Office Users

Do you work from home? You might have a small loophole.

- If you have a dedicated home office and you incur a plumbing repair that affects the entire house (like a main line fix), you can deduct a percentage of that cost equal to the square footage percentage of your office.

- Always consult a CPA before claiming this, as home office deductions are highly scrutinized.

Savings Tips: How to Lower Your Plumbing Bill

Just because taxes are inevitable doesn’t mean you have to overpay for the service itself. Here are several strategic ways to keep more money in your pocket when dealing with plumbing issues in Florida.

Bundle Your Repairs

Plumbers often charge a “trip fee” or a minimum service hour to show up at your door. This fee is taxable!

- Strategy: Don’t call a plumber for a single dripping faucet. Make a list. Wait until you have a few non-urgent issues (a running toilet, a slow drain, and a drip).

- The Saving: You pay the trip fee (and the tax on it) only once, rather than three separate times.

Preventive Maintenance

Emergency plumbing calls are the enemy of your wallet. Not only are emergency hourly rates significantly higher, but you pay sales tax on that higher rate.

- Strategy: Schedule an annual plumbing inspection during standard business hours.

- The Saving: Catching a small leak before it bursts saves you the Premium emergency labor costs, which in turn lowers the total tax you pay.

DIY the Small Stuff (Legally)

If you are handy, you can legally perform minor plumbing repairs on your own home (changing a flapper, tightening a p-trap).

- The Tax Hack: When you buy parts at a hardware store, you pay 6-7% sales tax on the materials only. Since you are doing the work yourself, there is zero labor cost and therefore zero labor tax.

- Warning: Know your limits. Unlicensed plumbing work on major systems can void insurance policies and violate local codes.

Look for Energy Credits

While not a sales tax exemption, federal tax credits can offset the cost of upgrades.

- The Tip: The Inflation Reduction Act offers credits for installing high-efficiency electric heat pump water heaters.

- The Math: If you get a $2,000 credit on your income taxes, it effectively wipes out the sales tax you paid on the installation—and then some.

Summary of Savings Potential

Tip Potential Savings Best For

Annual Inspection 20-30% on major repairs , Preventing emergencies

Bundling Repairs $50-$100+ (Trip Fees) Multiple small issues

DIY Minor Fixes 100% of Labor Tax Handy homeowners

Rental Deductions Reduce Taxable Income for Landlords / Investors

Energy Fixtures Up to $600-$2000 Credit Water heater upgrades

FAQs

To wrap things up, let’s address the most frequent questions Florida homeowners ask about plumbing taxes.

Do I have to pay tax on plumbing labor if I supply the parts?

Yes. Even if you buy the faucet yourself and hire a plumber to install it, Florida law generally requires the plumber to charge sales tax on their labor services for the repair/installation of tangible personal property.

Are senior citizens exempt from plumbing sales tax in Florida?

No. Unfortunately, there is no specific sales tax exemption for plumbing services based on age. Seniors pay the same 6% + surtax rate as everyone else.

Is emergency plumbing service taxed at a higher rate?

The tax rate percentage (e.g., 7%) remains the same. However, because emergency services have a higher base cost (often double the hourly rate), the amount of tax you pay in dollars will be higher.

How do I know if my plumber is charging the right tax rate?

You can verify your local discretionary sales surtax rate on the Florida Department of Revenue website. If you live in a county with a 1% surtax (total 7%) and the plumber charges you 8%, you have the right to question the discrepancy.

Can I deduct plumbing repairs if I work from home?

Only partially, and only if the repair serves the home office. A direct repair to a bathroom in your main bedroom likely won’t qualify, but a whole-house repipe might be deductible based on the percentage of your office’s square footage.

What is the tax for plumbing repairs in Florida for rental properties?

You still pay the sales tax at the time of service. However, the total cost (including the tax) is deductible as a business expense on your Schedule E tax form.