Have you ever wondered if you are leaving money on the table when selling your home? It is a common fear. Pricing a property is often seen as a mix of art and science, but recently, the “science” part has received a massive upgrade. Artificial Intelligence (AI) is changing the game. Recent data shows that AI-driven valuations can improve accuracy by a staggering 96% over traditional methods. This level of precision is not just for show; it helps sellers price their homes 3% to 7% higher on average because they no longer have to guess the “sweet spot” of the market what is AVM in real estate? At its core, an Automated Valuation Model (AVM) is a sophisticated algorithm. It processes mountains of data—including public records, MLS listings, and local economic trends—to give you an instant estimate of what a property is worth Instead of waiting days for a human to walk through your door, you get a data-backed number in seconds.

What Does AVM Stand For in Real Estate?

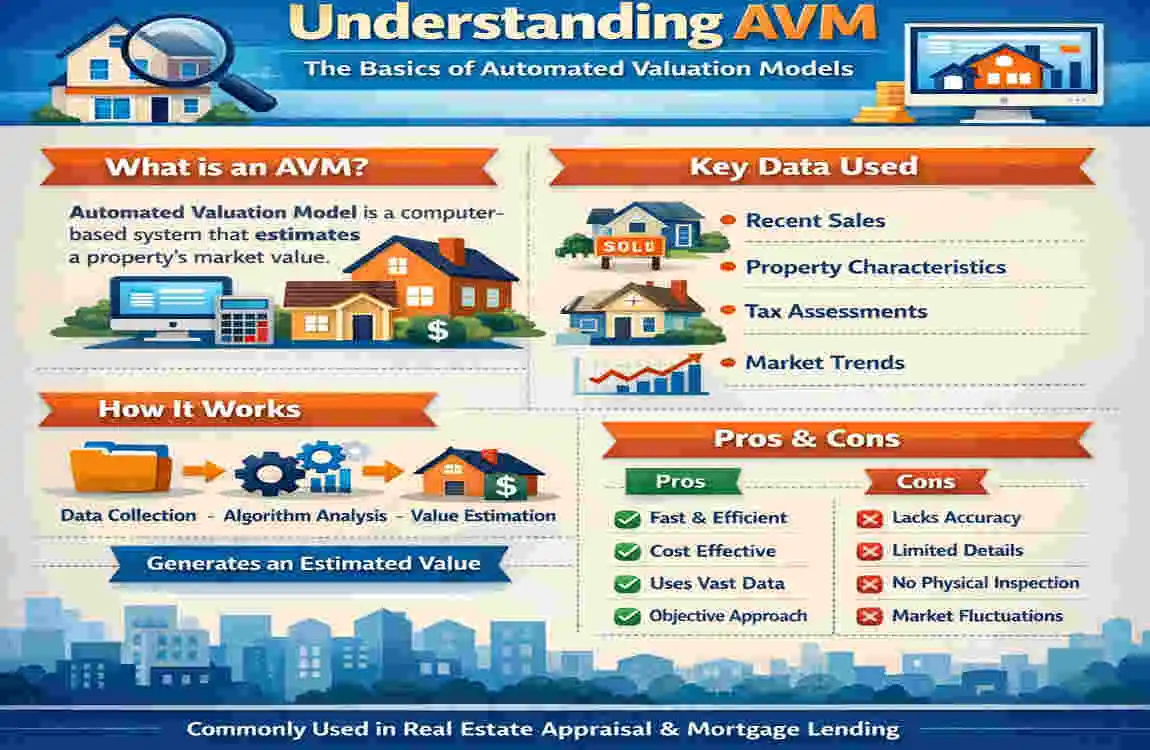

AVM stands for Automated Valuation Model. It is a software-based service that uses mathematical modeling combined with machine learning and massive databases to estimate the value of a property

Think of it as a digital appraiser that never sleeps. While traditional appraisals rely on a human’s experience and a few “comps” (comparable sales), an AVM considers the entire neighborhood, the city’s economy, and even the quality of local schools. These systems have come a long way. They started in the 1990s as basic statistical tools, but today they are powered by advanced AI that can learn from new data in real time. How Does an AVM Work in Real Estate?

You might be asking, “How can a computer know what my house is worth without seeing it?” The answer lies in Big Data. An AVM follows a specific process to arrive at a number:

- Data Collection: The model pulls information from various sources. This includes MLS listings, sales history, and public records like property taxes and building permits Algorithm Processing: The system uses complex math, such as regression analysis and neural networks, to compare your home to thousands of others Contextual Analysis: It doesn’t just look at the house; it looks at the world around it. It considers macro factors like local crime rates, school rankings, and even how close the nearest coffee shop is Confidence Score: Finally, the AVM provides a value along with a “confidence score.” This tells you how specific the AI is about the price based on the amount of data available Data Sources for AVMs:**

- MLS Data: Current listings and recently sold prices.

- Public Records: Tax assessments and historical deeds.

- Geographic Trends: Neighborhood demand and local amenities The Role of AI in House Valuations

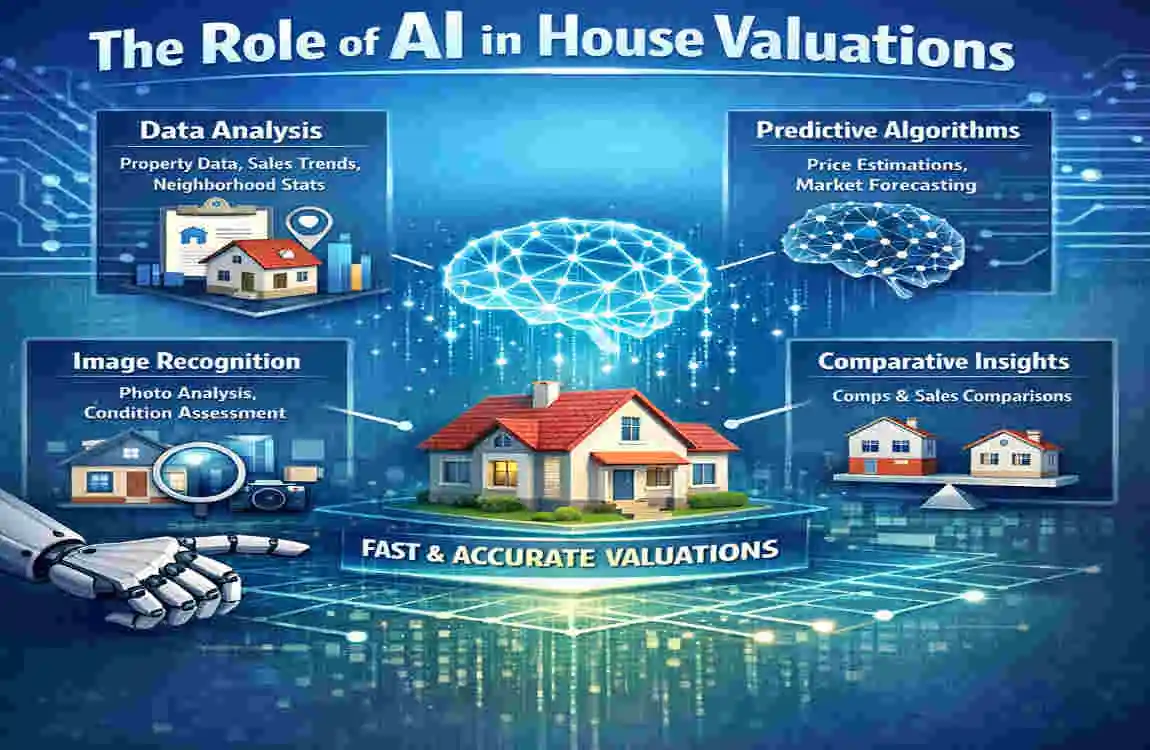

The shift from human-led appraisals to AI house valuations is one of the most significant shifts in real estate history. It is like moving from a paper map to a GPS with live traffic updates.

From Traditional Appraisals to AI-Driven AVMs

Traditional appraisals are still critical, especially for getting a mortgage, but they have limitations. They are slow, expensive, and can sometimes be influenced by human bias. AI-driven AVMs, on the other hand, are built for speed and objectivity.

Aspect Traditional Appraisal AI AVM

Time 3–7 days Seconds

Cost $300–$500 Free or very low-cost

Accuracy 70–85% (Subjective) Up to 96% (Data-driven)

Factors Limited to 3–5 comps Millions of data points

Bias Possible human error Objective algorithm

AI Technologies Powering AVMs

Modern AVMs are not just calculators; they are “smart.” They use several layers of technology to get the price right:

- Machine Learning (ML): This enables the model to learn and improve. If a house sells for more than predicted, the AI analyzes why and adjusts its future valuations Computer Vision: Some advanced AVMs can now “look” at photos of your home. They use AI to identify high-end finishes like granite countertops or hardwood floors, which adds value that a basic algorithm might miss Natural Language Processing (NLP): AI reads the descriptions in listing notes. It can pick up on keywords like “recently renovated” or “new roof” to adjust the price accordingly *Predictive Forecasting: This is the “crystal ball” feature. AI can look at economic trends to predict what your home might be worth in six months, helping you decide the best time to sell How AI House Valuations Boost Home Selling Prices

This is the part you really care about: the money. How does a digital tool actually put more cash in your pocket? It comes down to confidence and timing.

Pricing Right: Evidence Sellers Price Higher

One of the biggest mistakes sellers make is underpricing . They are afraid the house won’t sell or that it’s overpriced because they are emotionally attached. Both cost you money.

Accurate AVMs reduce the risk of underpricing by about 5% When you have a data-backed number, you can stand firm during negotiations. Tools like Zillow’s Zestimate have shown that when sellers have access to high-quality AI valuations, their confidence increases, often leading to a 3% to 10% uplift in the final sale price You aren’t just guessing; you are presenting a price that the market data supports.

Real-World Examples and Stats

The impact of AI is being felt globally. For instance, researchers at the University of Manchester developed an AI system that reached 96% accuracy in property valuations This technology allows for much smoother negotiations because both the buyer and the seller are looking at the same objective data.

Investors also use AVMs to “buy low and sell high.” By using AI to spot undervalued homes in up-and-coming neighborhoods, they can flip properties at the peak of the market, maximizing their returns Mechanisms for Price Boosts

How does the AI actually find that extra value?

- Dynamic Updates: If a new subway station or a popular grocery store opens nearby, the AVM updates your home’s value instantly A human appraiser might not visit your area for months.

- Confidence Intervals: AVMs give you a range. If the “confidence” is high, you can safely list at the higher end of that range Market Trend Predictions: AI can tell you if the market is heating up. If prices are expected to rise by 2% next month, you might wait a few weeks to list, netting you thousands more Pros and Cons of Using AVM in Real Estate

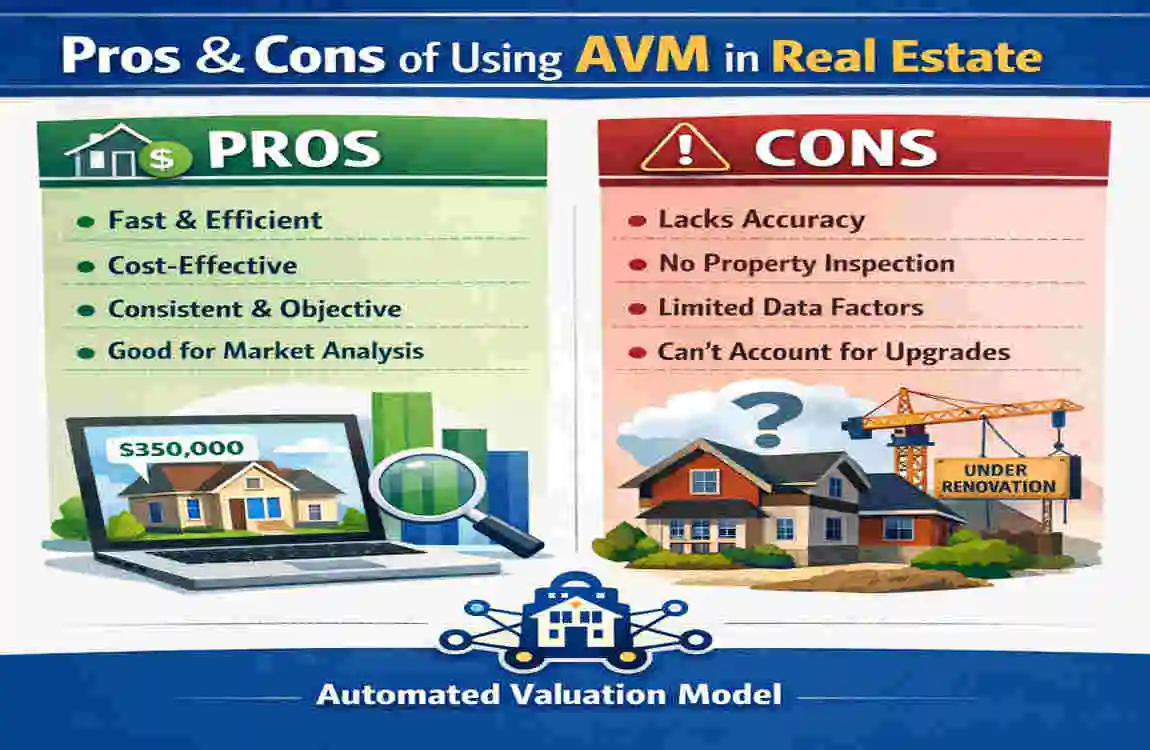

While AVMs are incredibly powerful, they are not magic. It is essential to know when to rely on them and when to call in a human expert.

Key Advantages

- Speed and Efficiency: You get an answer in the time it takes to click a button Cost Savings: You can run dozens of valuations for free instead of paying hundreds for each one Scalability: For real estate investors with large portfolios, AVMs allow them to track the value of hundreds of properties simultaneously Bias Reduction: Algorithms don’t care about the color of your front door or your personal style; they only care about the data Limitations and When to Avoid AVMs

Top AVM Tools for Real Estate in 2026

As we move through 2026, the tools available to homeowners have become incredibly sophisticated. Here are the top players you should know:

- Zillow Zestimate: The most famous AVM, now updated with advanced neural networks for better local accuracy HouseCanary: A favorite for investors, offering deep “pro” level data and predictive analytics CoreLogic: Often used by banks and lenders, this tool is known for its massive database of public records Realtors Valuation Model (RVM): Available through real estate agents, this combines AVM speed with actual MLS “sold” data for higher accuracy Redfin Estimate: Known for being highly accurate in markets where Redfin has a strong brokerage presence.

To get the most accurate “AI house valuation,” try to use a tool that integrates computer vision. These tools allow you to upload photos of your recent kitchen remodel, and the AI will automatically adjust your home’s value upward. How to Use AVMs to Maximize Your Home Sale.

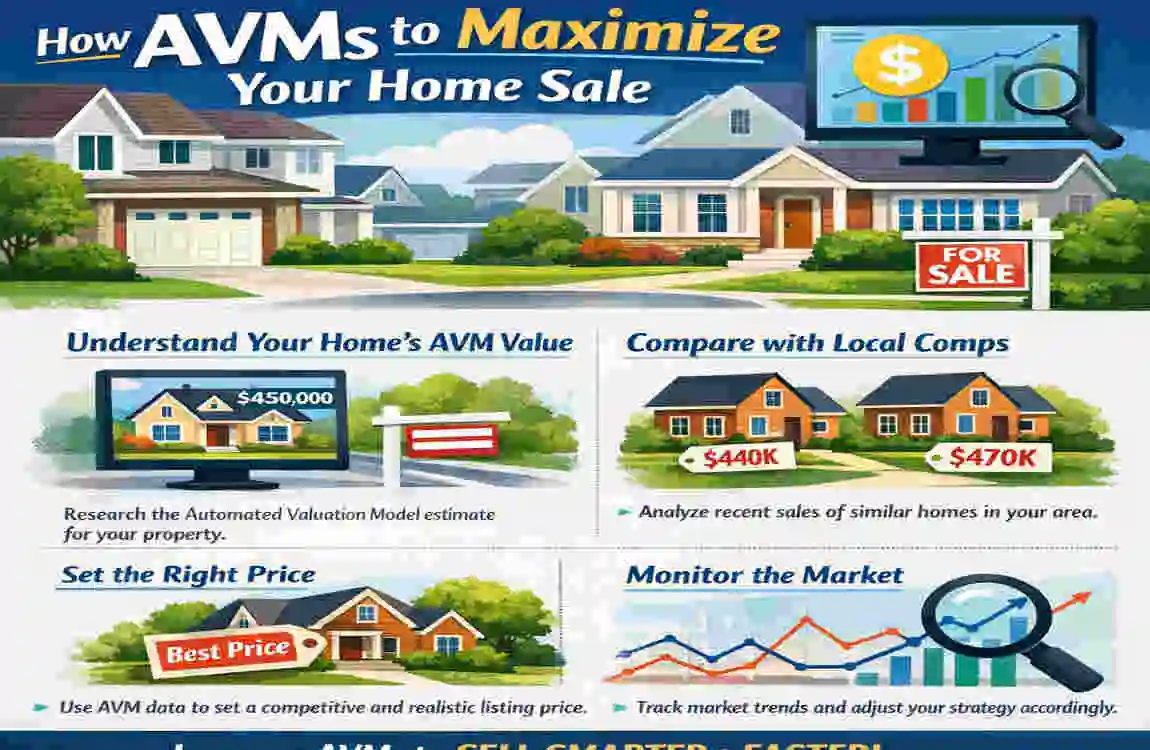

Ready to sell? Don’t just look at one number and call it a day. Follow these steps to use AI to your advantage:

- Get Multiple Estimates: Check at least three different AVM tools. If they all agree, you have an excellent price point. If they vary wildly, your home might be “unique,” and you need a human appraiser.

- Cross-Check with Comps: Look at the “comparable sales” the AI used. Are they actually like your house? If the AI used a house across a busy highway, you might need to adjust for Recent Upgrades manually: If you just spent $20,000 on a new deck, add that to the AVM’s base price. Most AVMs lag slightly behind recent renovations. List Strategically: Use the AI’s “market trend” data. If the AI shows that inventory is low in your specific zip code, you can afford to be more aggressive with your asking price. Conclusion and Next Steps.

FAQ Section

1. What is AVM in real estate?

An AVM, or Automated Valuation Model, is a digital tool that uses AI and machine learning to estimate a property’s value by analyzing millions of data points like sales history and local trends

2. Do AI house valuations really increase selling prices?

Yes! By providing more accurate, data-backed pricing, AVMs help sellers avoid underpricing. Studies show this can lead to a 3% to 10% increase in the final sale price.

3. Are AVMs more accurate than human appraisers?

In many cases, yes. Modern AI AVMs can reach up to 96% accuracy because they analyze far more data than a human can However, for very unique or damaged homes, a human appraiser is still recommended 4. What is the best AVM for sellers to use? Popular and reliable tools include Zillow Zestimate, HouseCanary, and the Realtors Valuation Model (RVM). It is best to use multiple tools to find a consensus 5. What is the difference between an AVM and a human appraiser? An AVM is instant, low-cost, and data-driven, but it doesn’t “see” the home’s interior. A human appraiser is slower and more expensive but can account for specific physical conditions and unique features.