Have you ever looked at your monthly security bill or the receipt for those high-tech outdoor cameras and wondered, “Can I get a break on this?” You aren’t alone. With crime rates fluctuating and home security becoming a top priority for families and entrepreneurs alike, the costs can add up quickly. In fact, recent data suggests that nearly 40% of small businesses experienced a break-in or theft last year. This makes security not just a luxury but a vital necessity.

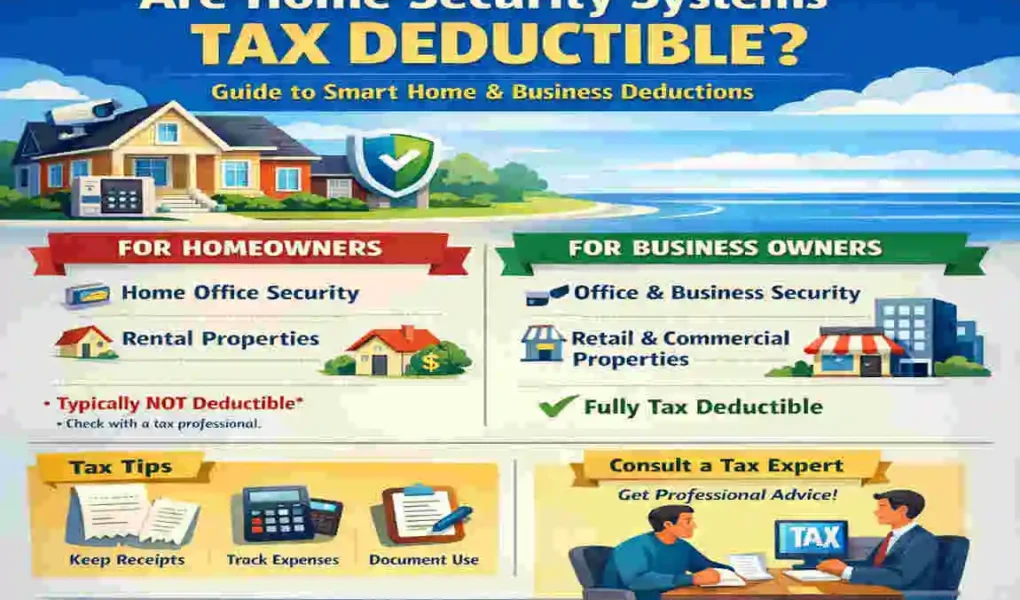

The short answer is: it depends. If you are using the system purely to protect your family and your personal television, the IRS usually says “no.” However, if you run a business, work from a dedicated home office, or manage rental properties, you might be sitting on a significant tax windfall.

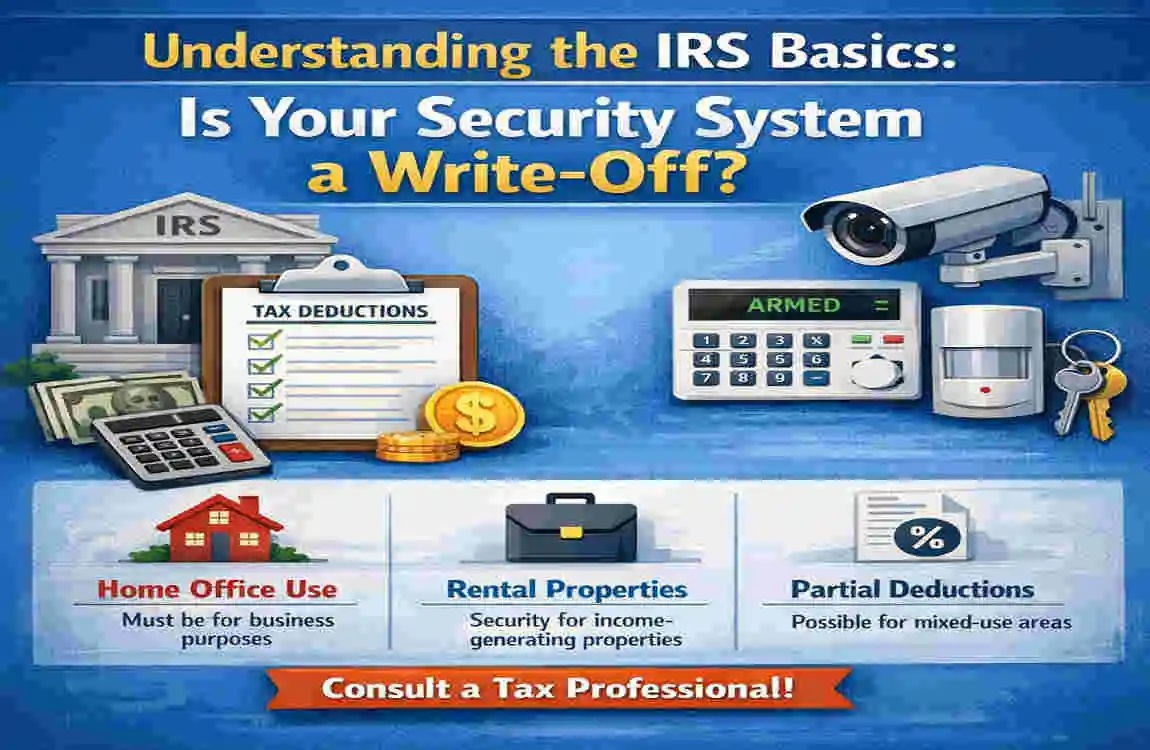

Understanding the IRS Basics: Is Your Security System a Write-Off?

Before we dive into the nitty-gritty details, we need to establish the foundation. Tax laws can feel like a maze, but they generally boil down to how you use the property being protected. The IRS classifies expenses into two main categories: personal and business.

Personal vs. Business Use: The Great Divide

If you are a homeowner who wants to keep an eye on your packages and ensure your kids get home safely, your security system is considered a personal expense. According to IRS Publication 529, individual, living, or family expenses are not deductible. Think of it like your grocery bill or your Netflix subscription—the IRS views this as a cost of living, not a cost of earning money.

However, the game changes entirely when income generation is introduced. If that security system protects a place where you make money, it suddenly becomes a potential tax deduction.

What Does “Ordinary and Necessary” Actually Mean?

To qualify for a business deduction under IRS Publication 535, an expense must be both ordinary and necessary.

- Ordinary: This means the expense is common and accepted in your trade or business.

- Necessary: This means the expense is helpful and appropriate for your business.

In 2026, having a security system for a business is almost always considered “ordinary and necessary.” In an age of porch pirates and digital physical threats, protecting your business assets is a no-brainer.

The 2026 Tax Landscape

As we navigate the 2026 tax year, many of the reforms from previous years remain in place, but limits have shifted. Specifically, Section 179 allows business owners to deduct the full purchase price of qualifying equipment (such as security cameras) in the year they are purchased, rather than depreciating them over several years.

To help you visualize where you stand, take a look at this quick reference table:

Scenario: Is it Deductible? Key IRS Requirement

Purely Personal Home No N/A (Personal Expense)

Home Office Partial must be the principal place of business

Full Business Property Yes (100%) Used exclusively for business

Rental Property Yes Protects the landlord’s investment

The Home Office Deduction: Turning Your Alarm into a Tax Break

This is where things get interesting for the millions of freelancers, consultants, and small business owners working from home. If you have a dedicated space in your house used exclusively for work, you can deduct a portion of your security costs.

The “Exclusive and Regular Use” Rule

To claim a home office security deduction, your office must be your principal place of business. This means you can’t just work from your kitchen table and claim a deduction. You need a specific room or identifiable space used only for business.

If you meet this “exclusive use” requirement, the IRS allows you to deduct a prorated portion of your home security system. This includes the cost of the equipment, the installation, and those monthly monitoring fees that keep you safe.

The Math Behind the Deduction: Square Footage 101

The IRS doesn’t let you deduct the whole bill just because you have a desk in the corner. You have to do some simple math based on the size of your office relative to the rest of your house.

Let’s look at an example: Imagine your home is 2,000 square feet. Your dedicated home office is 200 square feet. This means your office takes up 10% of your home’s total area.

- If you spent $5,000 on a top-of-the-line security system (cameras, sensors, smart locks), you can deduct $500 (10%) as a business expense.

- If your monthly monitoring fee is $50, you can deduct $5 every single month.

Simplified vs. Actual Expenses: Which Should You Choose?

The IRS offers two ways to claim home office deductions:

- The Simplified Method: You claim $5 per square foot (up to 300 sq. ft.). While easy, this method does not allow you to deduct security systems separately.

- The Actual Expenses Method: This is where you track every receipt. If you have an expensive security setup, the actual expenses method is almost always the better choice because it allows you to include those specific security costs.

A Warning for Remote W2 Employees

Are you a remote worker employed by a large company? Unfortunately, since the 2018 tax reforms, W2 employees can no longer claim the home office deduction. Even if your boss requires you to work from home and you pay for your own security, you generally cannot write these costs off on your federal taxes. This deduction is available only to the self-employed and small business owners.

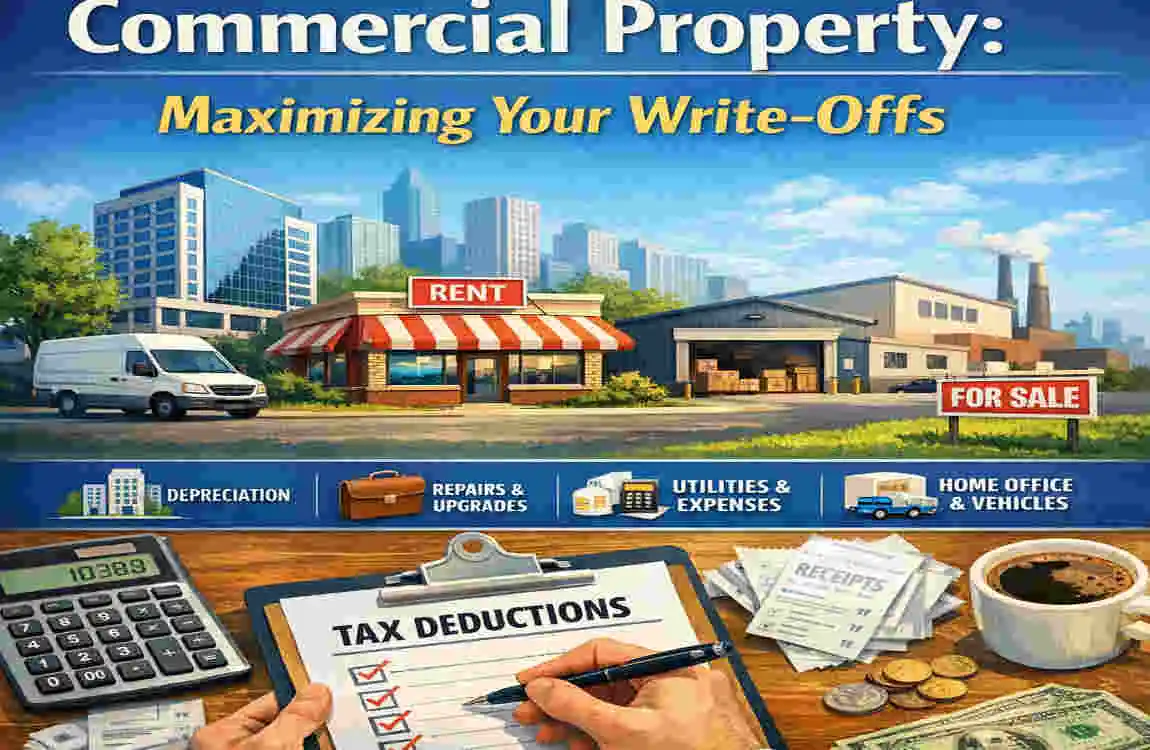

Business and Commercial Property: Maximizing Your Write-Offs

If you own or rent a dedicated commercial space—like a retail shop, a warehouse, or a standalone office—the rules are much more generous. In this case, are home security systems tax-deductible? Absolutely, and usually at 100%.

Section 179: The Small Business Secret Weapon

Section 179 of the tax code is a powerful tool for growth. In 2026, the deduction limit for equipment remains high (often exceeding $1.2 million). This allows you to buy a comprehensive security system—complete with AI-driven cameras, biometric access control, and motion sensors—and write off the entire cost in the first year.

Instead of waiting five years to recoup your investment through depreciation, you get the tax break immediately. This is a massive “win” for cash flow.

Monitoring Fees as Operating Expenses

Don’t forget the ongoing costs! While the cameras are a one-time purchase, your monthly monitoring fees are considered operating expenses. These are fully deductible on Schedule C (for sole proprietors) or your corporate tax return.

Case Study: A Local Success Story

Consider a small boutique owner in a busy metropolitan area like Lahore. They decide to upgrade their shop’s security to prevent shoplifting and protect their inventory after hours. They spend PKR 500,000 on a high-definition CCTV system and a smart alarm.

- Because the system is used 100% for the shop, the entire PKR 500,000 can be used to reduce their taxable income.

- Additionally, the monthly PKR 5,000 monitoring fee is deducted as a recurring business cost.

This effectively reduces the “real” cost of the security system by thousands of dollars come tax season.

Smart Home Technology: Ring, Nest, and the IRS

In 2026, the line between “home security” and “smart home” is blurrier than ever. We use Ring doorbells, Nest cameras, and Arlo sensors. But does the IRS view a “smart doorbell” the same way it views a traditional ADT alarm?

The Business Integration Rule

If you use a Ring Video Doorbell to see who is at your front door, and your front door is where you meet clients or receive business packages, it qualifies as a business expense (prorated for home offices).

However, if you buy a smart hub (like an Amazon Echo or Google Home) that controls your lights, plays music, and manages your security, you have to be careful. You can only deduct the portion of the cost that is directly related to security and business use.

AI and Advanced Surveillance

The latest trend in 2026 is AI-powered surveillance. These systems can distinguish between a stray cat and a potential intruder. Because these are considered “high-tech equipment,” they often qualify for bonus depreciation. This allows businesses to take an even larger deduction upfront, especially if the equipment helps lower insurance premiums, which is another excellent way to save money!

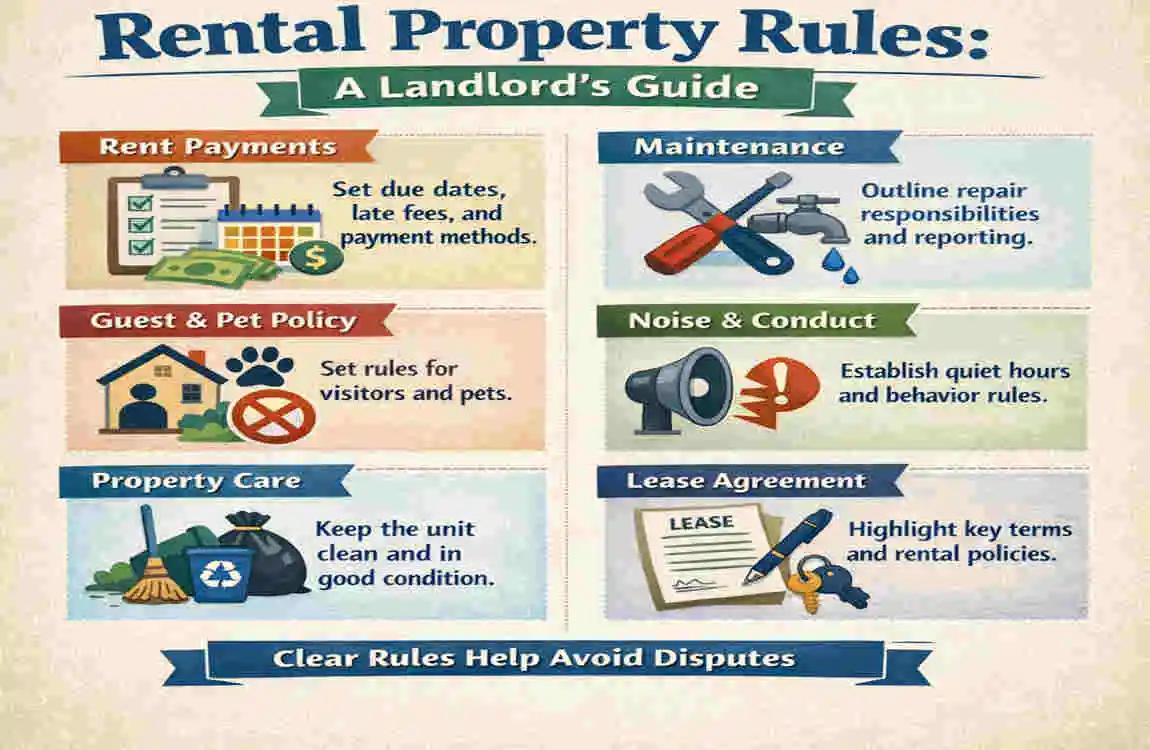

Rental Property Rules: A Landlord’s Guide

If you are a landlord, security is one of the best investments you can make. Not only does it protect your property value, but it also makes your listing more attractive to high-quality tenants.

Repairs vs. Improvements

The IRS looks at rental property expenses in two ways:

- Repairs: Fixing a broken sensor on an existing alarm. This is usually deductible in the year you pay for it.

- Improvements: Installing a brand-new, whole-property security system. This is often considered a “capital improvement” and may need to be depreciated over several years.

Regardless of which category it falls into, the cost is 100% deductible against your rental income on Schedule E. Even if your tenant pays the monthly monitoring fee, the initial installation and equipment costs remain deductible for you.

Step-by-Step: How to Claim Your Security Deduction

Ready to save some money? Follow these steps to ensure you do it correctly and stay “audit-proof.”

- Qualify Your Space: Ensure your home office meets the “exclusive use” test. If it’s a dedicated business property, you’re already good to go.

- Calculate Your Percentage: If you work from home, divide your office’s square footage by your home’s total square footage.

- Gather Your Receipts: Keep a digital and physical folder for:

- The original equipment purchase receipt.

- Installation labor costs.

- Monthly monitoring invoices.

- Repair bills.

- Choose the Right Form: Form 8829: For home office expenses.

- Schedule C: For general business expenses.

- Schedule E: For rental property owners.

- Consult a Pro: Tax laws change, and a CPA (Certified Public Accountant) can help you find extra savings you might have missed.

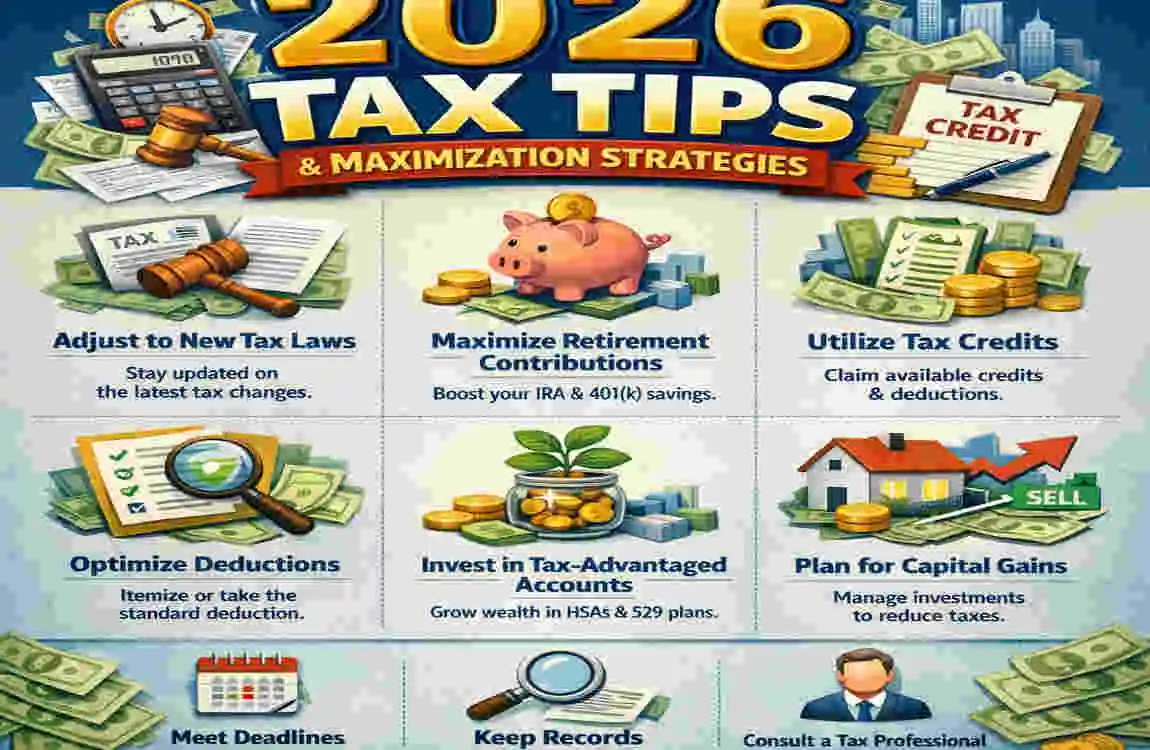

2026 Tax Tips & Maximization Strategies

As we look toward the future of tax planning, here are a few pro tips to help you maximize your 2026 return:

- Bundle with Insurance: Many insurance companies offer discounts for homes and businesses with monitored security. While the insurance discount isn’t a “tax deduction,” it’s another way security pays for itself.

- Look for Local Incentives: In some regions, there are local tax credits or grants for small businesses that install security to improve neighborhood safety. Check with your local Chamber of Commerce.

- Use Active Language in Your Records: When documenting the expense, describe it as “Security for Business Assets” rather than “Home Alarm.” This clarity helps if the IRS ever asks questions.

Frequently Asked Questions (FAQs)

Are home security systems tax-deductible for home offices?

Yes, but only a prorated portion based on the square footage of your dedicated office space. You must use the “Actual Expenses” method on Form 8829 to claim it.

Can I deduct a Ring Doorbell on my taxes?

Only if it is used for a business or a home office, if it’s to see your neighbors walking their dogs, it is a personal expense and not deductible.

What about business monitoring fees?

These are 100% deductible as ordinary business operating expenses if the system protects business property.

Are there any 2026 changes to security deductions?

While the core rules remain the same, the limits for Section 179 expensing have been adjusted for inflation, allowing for even larger immediate write-offs for high-end systems.