Have you ever opened your mail, pulled out a government-stamped envelope, and felt your heart sink just a little bit? You see the numbers, the deadlines, and the terminology that seems designed to confuse you. You might see the phrase “Property Tax” on one line and “Real Estate Tax“ on another.

It is a fair question. In casual conversation, even real estate agents and tax professionals use these terms as if they are identical twins. But when you dig into the legalities and the fine print of your financial obligations, you realize some nuances can affect your wallet.

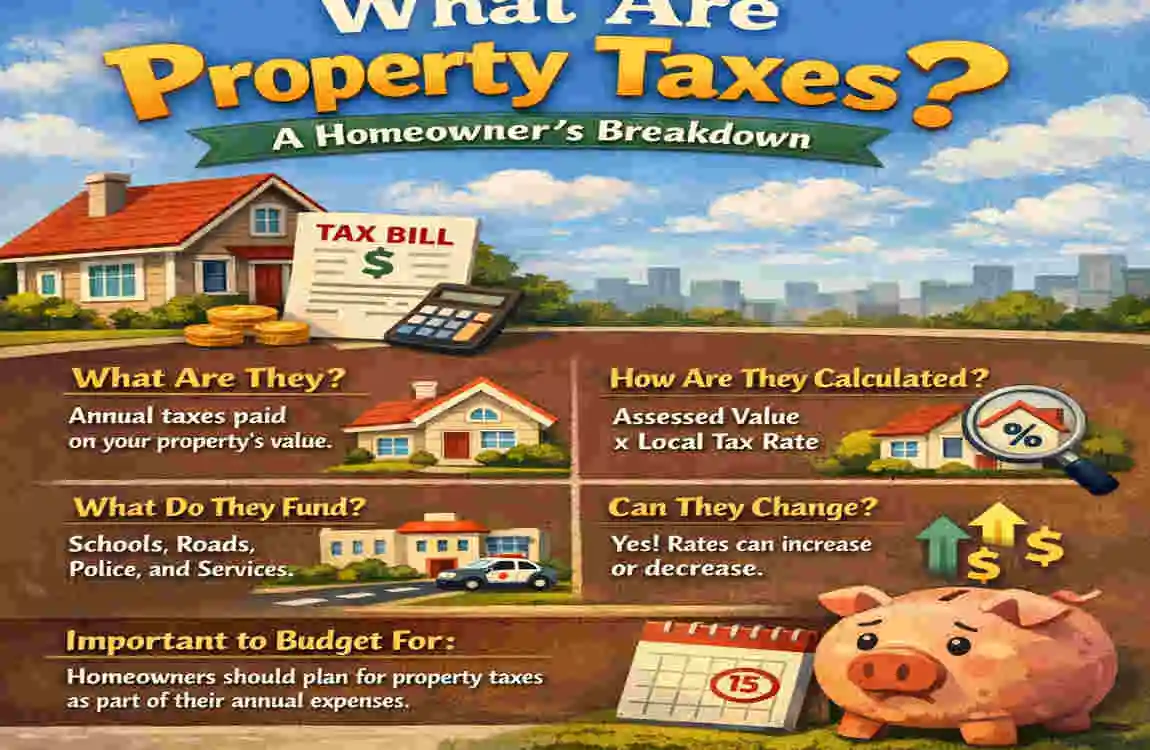

What Are Property Taxes? A Homeowner’s Breakdown

To understand the big picture, we first have to look at the most common tax you deal with as a homeowner: the property tax.

In simple terms, a property tax is a “levy” or a fee that a local government charges you just for owning a piece of land and the buildings on it. It is an “ad valorem” tax, which is just a fancy Latin way of saying “according to value.” Basically, the more your home is worth, the more the government asks you to pay.

Definition and How They’re Calculated

The way your local government decides how much you owe isn’t a random guess. They use a specific formula. Most jurisdictions calculate your tax bill by multiplying the assessed value of your home by the mill rate.

The Formula:

Tax Bill = Assessed Value × Mill Rate

Let’s look at a real-world example. Imagine you own a beautiful home valued by the local tax assessor at $300,000. If your local tax rate (the mill rate) is 1%, your annual property tax bill would be $3,000.

It is important to remember that the “assessed value” is often different from the “market value” (what you could sell it for). Some towns assess property only every few years, which can lead to “sticker shock” when a new assessment finally occurs.

Who Collects Them and Why?

You might wonder where all that money goes. Does it just disappear into a black hole? Not quite. Property taxes are the lifeblood of your local community.

Unlike federal income taxes, which go to Washington D.C., property taxes stay right in your neighborhood. They fund the things you use every day:

- Public Schools: Usually the largest portion of your bill.

- Road Maintenance: Paving those potholes and clearing snow.

- Emergency Services: Paying for the salaries and equipment of firefighters and police officers.

- Public Parks: Keeping the local green spaces clean and safe.

Because these services are local, the rates vary wildly. If you live in New Jersey, you might pay some of the highest rates in the country. If you move to Hawaii or Alabama, you might find your tax bill is significantly lower.

Average Rates and Recent Trends in 2026

As we move through 2026, we are seeing some interesting trends. According to recent data from the National Association of Realtors (NAR), the national average property tax bill is hovering around $2,800 to $3,000 per year.

However, because home values skyrocketed between 2022 and 2024, many homeowners are now seeing “lagging” tax increases. Even if the housing market cools down, tax assessments often catch up a year or two later, leading to unexpected spikes in your monthly mortgage payment if you use an escrow account.

State Average Property Tax Rate Estimated Annual Tax ($300k Home)

New Jersey 2.47% $7,410

Illinois 2.23% $6,690

Texas 1.74% $5,220

Florida 0.91% $2,730

Hawaii 0.29% $870

Unpacking Real Estate Taxes: More Than Meets the Eye

Now, let’s talk about real estate taxes. If you ask a CPA, they might tell you that “real estate tax” is just another name for the annual property tax on your home. While that is true in most casual settings, the term “real estate tax” can also encompass a broader range of meanings.

Core Definition: Broader Than Just Property

In the eyes of the law, real estate refers to the land and anything permanently attached to it. When we talk about “real estate taxes,” we often refer to a collection of costs associated with owning, selling, or transferring land.

While property tax is an annual fee, real estate taxes can include transactional fees. These are the “hidden” costs that pop up only when something changes—like when you buy a house, sell a house, or pass it on to your children.

Key Components Beyond Annual Levies

If you only look at your yearly bill, you are missing part of the picture. Real estate taxes often involve these three specific areas:

Transfer Taxes

When you sell your home, the state or local government often wants a “cut” of the transaction. This is a transfer tax. It is usually a small percentage of the sale price (often 1% to 2%). If you sell a home for $500,000, you might owe $5,000 in transfer taxes alone.

Estate and Inheritance Taxes

This is where things get serious for high-net-worth individuals. If you pass away and leave a valuable piece of real estate to your heirs, it may be subject to an estate tax. For 2026, the federal threshold is roughly $13.61 million, but many states have much lower thresholds. This means your family could owe taxes on the “real estate” value before they even get to move in.

Special Assessments

Sometimes, your local government decides to improve the neighborhood—like adding new streetlights or a sewer system. Instead of raising everyone’s property taxes, they might hit specific homeowners with a special assessment. This is technically a real estate tax, but it is a one-time (or limited-time) fee for a specific project.

Real-World Calculation Example

Let’s say you are buying a new home for $500,000. You need to budget for more than just the mortgage.

- Annual Property Tax: $5,000 (at a 1% rate).

- Transfer Tax: $7,500 (at a 1.5% rate, often split between buyer and seller).

- Recording Fees: $500.

In this scenario, your first-year “real estate tax” hit is actually $13,000, even though your “property tax” is only $5,000. This is why understanding the difference is so vital for your bank account!

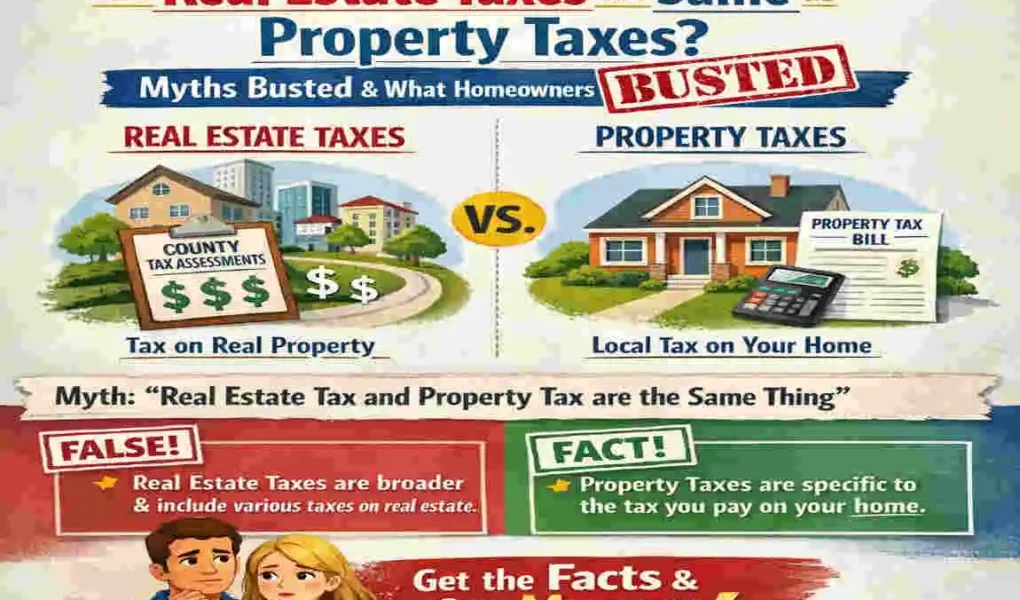

Are Real Estate Taxes the Same as Property Taxes? The Direct Answer

If you are looking for a “Yes” or “No” answer, the truth is: It depends on who you are talking to.

Short Answer: Mostly Yes, But Not Always

In everyday American English, the terms are used interchangeably. If you look at IRS Form 1040, you will see that they often lump these together when discussing deductions. For most homeowners, the “real estate tax” you pay is simply your “property tax.”

However, technically speaking:

- Property Tax is the broad category (which can include taxes on boats, cars, or business equipment).

- Real Estate Tax is a type of property tax that applies only to land and buildings.

Regional Variations and Global Differences

It is also helpful to know that these terms change depending on where you live.

- In the U.S.: There is a 99% overlap. People use both terms to mean the same thing.

- In the UK or Canada: They use terms like “Council Tax” or “Stamp Duty.” In these countries, the “property tax” (Council Tax) differs significantly from the “transaction tax” (Stamp Duty).

Comparison Table: Property Tax vs. Real Estate Tax

To make this as clear as possible, let’s look at how they stack up side-by-side.

FeatureProperty TaxReal Estate Tax

What is taxed? Can include “Personal Property” (cars, boats) and “Real Property” (land). Only “Real Property” (land and structures).

Frequency Usually paid annually or semi-annually. Paid annually, PLUS during sales or transfers.

Deductibility Deductible on federal taxes (up to $10k SALT cap). Usually deductible (with same SALT limits).

Who pays? The current owner of the asset. The owner, buyer, or seller (depending on the tax).

The Bottom Line: If you are talking about your yearly house bill, you can use either term. If you are talking about the taxes you pay when selling a house, “real estate tax” is the more accurate term.

7 Common Myths About Real Estate Taxes vs. Property Taxes—Busted!

There is a lot of “bad advice” floating around the internet and at neighborhood BBQs. Let’s set the record straight by busting the seven biggest myths homeowners believe.

They Are Always Identical Everywhere

Many people think that if they know the property tax rules in California, they know them in New York. Busted! Every state—and even every county—has its own definitions. Some states charge a “property tax” on your car every year, while others only charge a “real estate tax” on your home. Always check your local county assessor’s website.

Renters Don’t Pay Property Taxes

This is a classic misconception. Renters often think, “I don’t own the building, so I don’t pay the tax.” Busted! Your landlord isn’t a charity. They include property tax in your monthly rent. Generally, about 25% to 30% of your rent goes directly toward paying the landlord’s property tax bill.

You Can’t Deduct Them Anymore

After the tax law changes a few years ago, many people thought the deduction went away. Busted! You can still deduct your property/real estate taxes on your federal return. However, there is a $10,000 cap (the SALT cap). If you itemize your deductions, you can still save a significant amount of money.

New Builds Avoid Taxes for the First Year

Some buyers think that because the house is “new,” it isn’t on the tax rolls yet. Busted! While it might take a few months for the assessor to update the value from “vacant land” to “completed home,” you will eventually get a bill. In fact, many new homeowners get a “supplemental tax bill” that can be thousands of dollars, catching them completely off guard.

They Are Optional or Non-Negotiable

Most people think the bill they get in the mail is final. Busted! You have the right to appeal your assessment. If you can prove that your home is worth less than the government says it is (perhaps by showing photos of damage or lower-priced “comps” in your area), you can get your bill lowered. Success rates for appeals are surprisingly high—often between 50% and 70%.

Real Estate Taxes Only Hit the Seller

When a house sells, people assume the seller pays all the “real estate taxes.” Busted! Depending on your state, buyers often have to pay “recording fees” and their portion of the year’s property taxes upfront at the closing table.

Inflation Doesn’t Affect Your Tax Rate

You might have a “fixed-rate” mortgage, but your taxes are not fixed. Busted! As inflation drives up the cost of local services (such as police car gas or teachers’ salaries), local governments often raise the “mill rate.” Between 2024 and 2026, many markets saw tax spikes of 5% to 10% even without a change in home value.

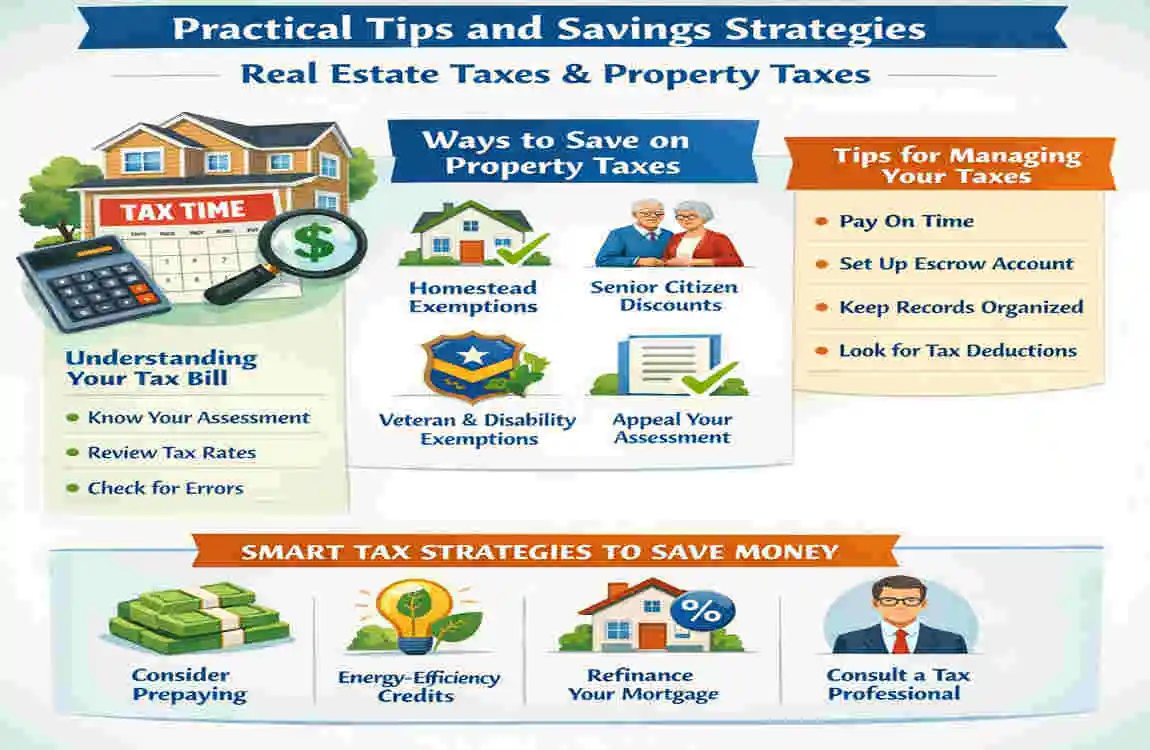

What Homeowners Need to Know: Practical Tips and Savings Strategies

Now that we’ve cleared up the confusion, let’s talk about your money. You shouldn’t blindly pay any bill that comes your way. Here is how you can take control.

How to Check and Appeal Your Bill

Do not wait until the bill is due to look at it. Most counties send out an Assessment Notice a few months before the bill.

- Check the Data: Does the county think you have 4 bedrooms when you only have 3? Errors are common.

- Look at “Comps”: See what similar houses in your neighborhood sold for. If they sold for less than your assessed value, you have a case.

- File the Appeal: There is usually a 30-to-60-day window to file. It often requires a simple form and a small fee.

Deductions, Exemptions, and Tax Breaks

There are “hidden” discounts that many homeowners never claim. You have to ask for them; the government won’t just give them to you!

- Homestead Exemption: Many states offer a discount if the home is your “primary residence.”

- Senior Citizen/Veteran Discounts: If you are over 65 or a disabled veteran, you could see your tax bill cut by 50% or even 100%.

- Energy Upgrades: Under the 2026 tax rules, installing solar panels or heat pumps can often net you a direct credit against your taxes.

Planning for 2026 and Beyond

The political landscape is shifting. There are ongoing talks in Congress about extending or expanding the SALT deduction cap. Keep an eye on the news. If the $10,000 cap is raised, it could mean a much bigger tax refund for you next year.

Future Outlook: Real Estate and Property Taxes in 2026 and Beyond

As we look toward the end of the decade, the trend is clear: Taxes are likely going up.

Why? Because home values have hit record highs, and local governments are feeling the pinch of inflation. However, there is a silver lining. Many states are seeing “taxpayer revolts” in which citizens are voting for “caps” on how much property taxes can increase each year (similar to California’s famous Proposition 13).

Our advice? Budget 1% to 2% of your home’s total value for taxes every year. If you live in a high-tax state, aim for the higher end of that range. By setting this money aside (or keeping it in your escrow account), you ensure that your “dream home” doesn’t become a “financial nightmare.”

FAQ: Are Real Estate Taxes the Same as Property Taxes?

Are real estate taxes the same as property taxes?

Yes, in most everyday situations, real estate taxes and property taxes refer to the same annual tax you pay for owning a home or land.

Why do people confuse the two terms?

Because both taxes apply to land and buildings, many states and the IRS use the terms interchangeably, which leads to confusion.

Are there any differences between them?

Yes. “Property tax” can include taxes on personal property (like cars or boats in some states), while “real estate tax” refers only to land and buildings. Also, real estate taxes may include transfer taxes during a sale.

Are both tax types deductible?

Generally yes, but they fall under the same SALT deduction limit of $10,000 on federal tax returns.

Do all states treat them the same?

Mostly, but some states include additional taxes—like transfer or recording fees—under “real estate taxes.”