You’ve spent months scrolling through property apps, attending open houses every weekend, and dealing with the heartbreak of lost bids. Finally, you find it. The “perfect” home. It has the open-concept kitchen you’ve always wanted, a backyard big enough for a dog, and it’s in a neighborhood that’s just starting to buzz. You’re excited, perhaps a bit desperate, and you decide to go all in. You make an offer—maybe even a bit above the asking price—to “seal the deal.”

But then, a week after moving in, you start to notice things. The neighbor’s almost identical house just sold for $50,000 less than what you paid. You realize the “up-and-coming” neighborhood is actually three miles away from the nearest grocery store. Suddenly, that excitement turns into a heavy pit in your stomach. You start asking yourself the question that keeps thousands of homeowners awake at night: “Am I overpaying for a house?”

Why Homebuyers Overpay – Market Pressures and Common Traps

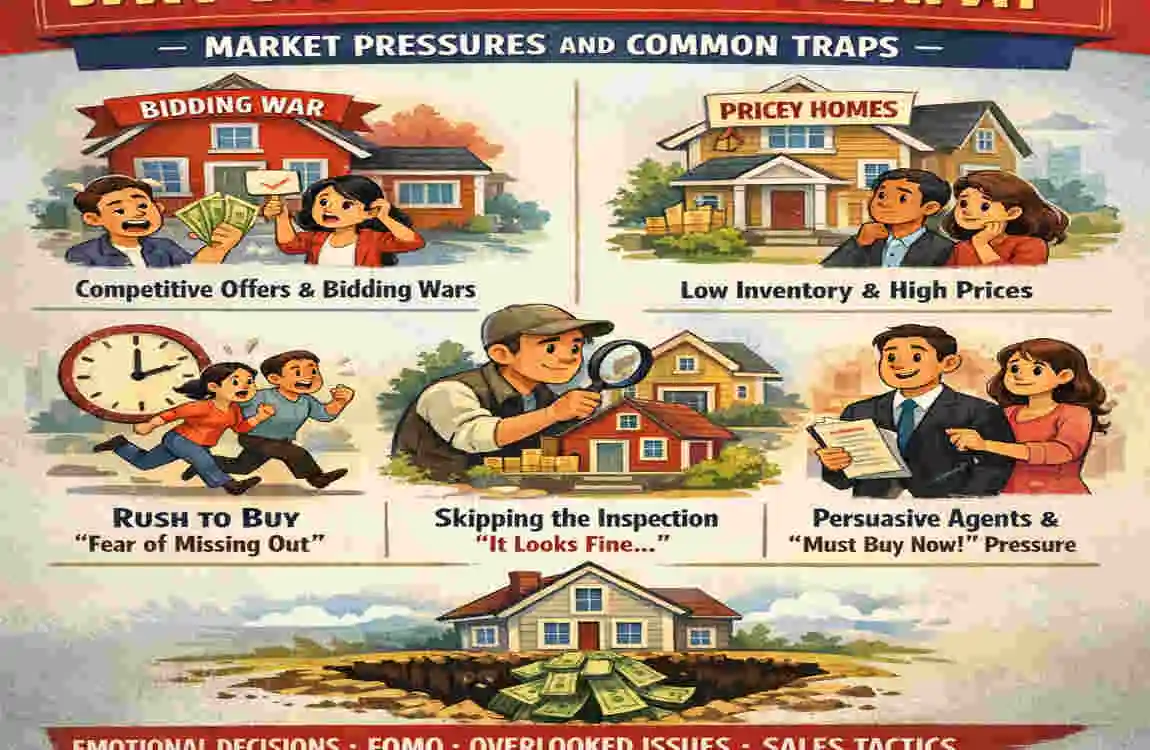

Before we dive into the red flags, we need to understand why overpaying happens so often. It’s rare because buyers are “bad” at math. Usually, it’s a result of high-pressure environments and psychological traps that even the most seasoned investors can fall into.

The Power of FOMO (Fear of Missing Out)

We’ve all felt it. When you see twenty other people at an open house, your brain stops looking at the home as a “building” and starts seeing it as a “prize.” In hot markets—whether you’re looking at the suburbs of Lahore or major U.S. metros—bidding wars are the norm. This creates a “win at all costs” mentality. You aren’t just buying a home; you’re trying to beat the other guy. This is the primary reason people end up overpaying on a house.

Low Inventory and Seller’s Markets

When there are more buyers than houses, sellers hold all the cards. In 2025 and early 2026, data from platforms like Zillow and Redfin showed that roughly 15% of homes sold for 10% or more above their appraised value. When options are slim, you might feel like you have to pay the premium to get a roof over your head. But remember, a seller’s market doesn’t change the intrinsic value of the bricks and mortar.

The “Staging” Illusion

Professional stagers are wizards. They know precisely how to use lighting, minimalist furniture, and a specific vanilla candle scent to make a cramped space feel like a palace. Many buyers fall in love with the lifestyle the house offers rather than the house itself. You might be overpaying for a home because you’re actually paying for the $10,000 sofa and the clever lighting that won’t be there when you move in.

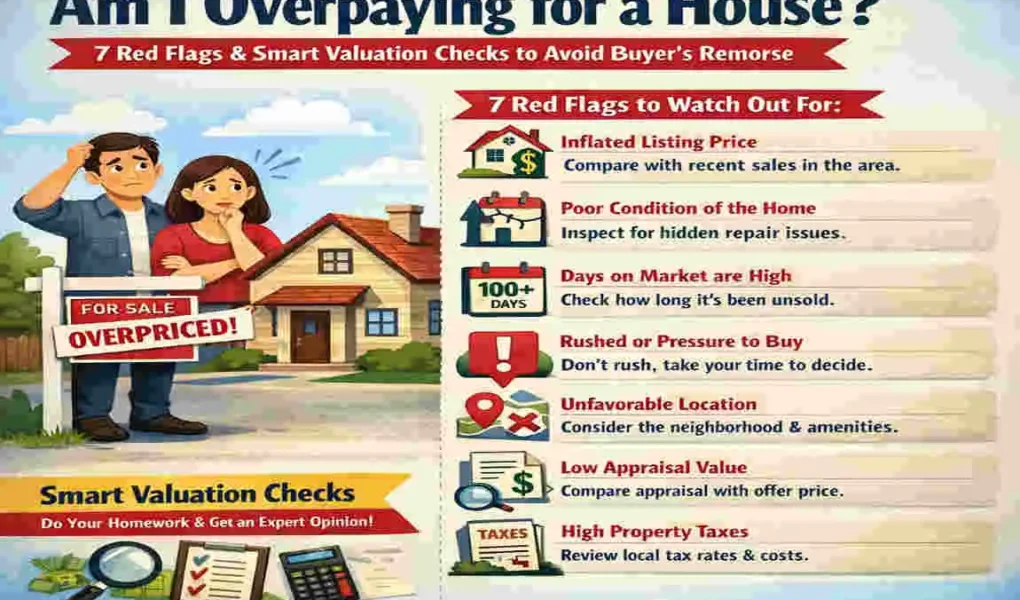

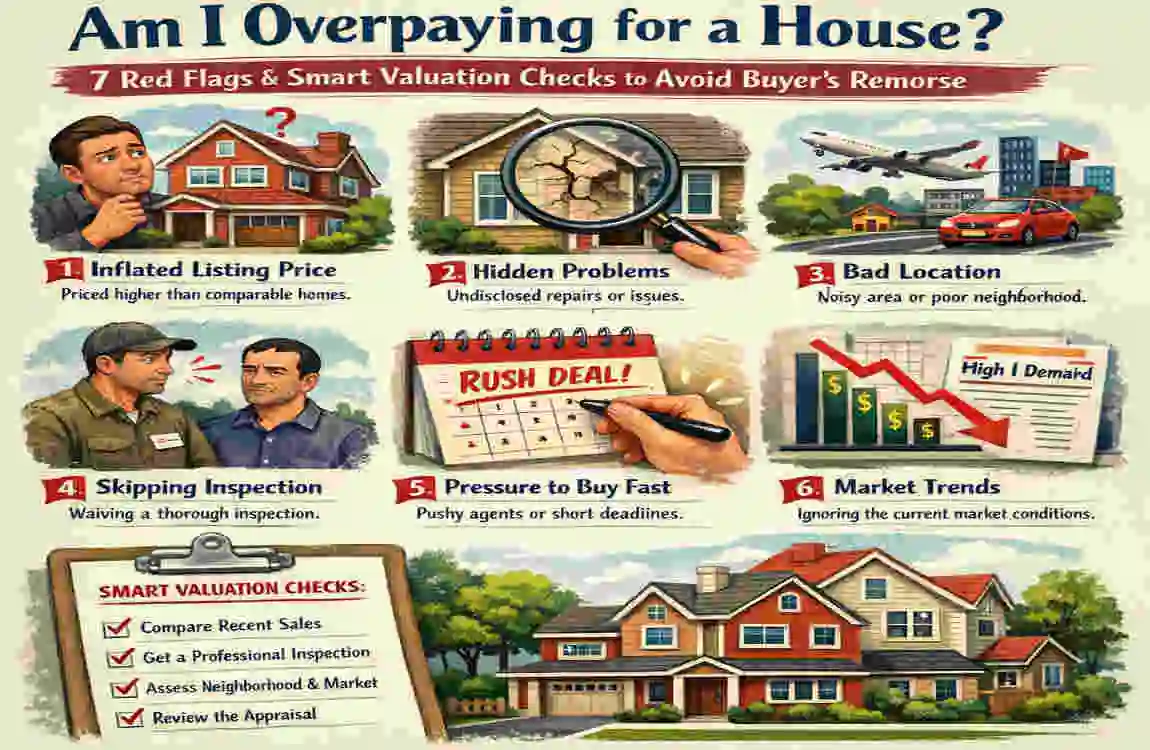

The Price Jumps Way Above Comps

The most reliable way to tell if a house is overpriced is to look at the comparable sales, or “comps.” These are similar homes in the same area that have sold in the last 3 to 6 months. If the house you’re eyeing is priced significantly higher than these comps without a very good reason, you are likely looking at a house overvaluation.

What Exactly Are “Comps”?

Think of comps as the “market’s truth.” If three houses on the same street, with the duplicate square footage and bedroom count, recently sold for $400,000, and the one you want is listed at $480,000, you need to ask why.

How to Perform a Quick Comp Check

You don’t need to be a pro to do this. Use sites like Realtor.com or Zillow to filter for “Sold” properties in the last 6 months within a 0.5-mile radius.

- Check the Square Footage: Is the price per square foot consistent?

- Assess the Condition: Does the $480,000 house have a brand-new roof and a finished basement, while the others don’t?

- The 20% Rule: If a listing is 20% higher than local comps without major, documented upgrades, it’s a massive red flag.

For example, if you are looking at a 3-bedroom home in a popular Lahore neighborhood like DHA, and the average price is PKR 40M, but your target house is PKR 50M, you are likely overpaying for a house unless that home is made of literal gold.

Seller’s Desperation Masked as Urgency

Have you ever walked into a house and the agent told you, “We already have three offers, and the seller wants a decision by tonight”? This is a classic tactic. While sometimes true, it is often used to bypass your logical thinking and force you into overpaying for a house.

The “Quick Close” Pressure

When a seller or agent pushes for a quick close and asks you to waive inspections or financing contingencies, they are often hiding something. This urgency is designed to make you feel like you don’t have time to do your due diligence.

Verify the Days on Market (DOM)

A great way to smoke out this red flag is to check the Days on Market (DOM). If an agent tells you there is “immense interest,” but the house has been sitting on the market for over 60 days, their story doesn’t hold water. In a healthy market, a reasonably priced home usually sells within 21 to 30 days. If it’s been sitting there for months, it’s almost certainly because other buyers realized the price was too high.

Neighborhood Mismatch – The Location Value Gap

There is an old saying in real estate: “Buy the worst house on the best street, not the best house on the worst street.” One of the most significant signs you’re overpaying for a house is when the property is vastly superior to everything else in the immediate area.

The “Up-and-Coming” Trap

Developers love to use the term “up-and-coming.” It sounds exciting. But “up-and-coming” often means “not there yet.” If you are paying a Premium price for a home in an area that lacks basic infrastructure—like good schools, grocery stores, or reliable public transport—you are gambling on the future.

Comparative Metrics Table

To help you visualize this, let’s look at how a “Green Flag” neighborhood compares to a “Red Flag” neighborhood where you are at risk of house overvaluation.

MetricGreen Flag (Fair Value)Red Flag (Overpay Risk)

School Ratings : Top-rated or steadily improving, Poor access or declining ratings

Commute Time Under 30 minutes to major hubs Over 45 minutes with no transit

Local Amenities: Parks, shops, and cafes within walking distance. Industrial zones or “food deserts.”

Price Appreciation Consistent 5%+ growth per year Flat growth or highly volatile

Neighborhood Consistency: Similar home styles and price points. One “mansion” surrounded by fixer-uppers

If your potential home falls into the “Red Flag” column but is priced like a “Green Flag” property, walk away. You are paying for a future that hasn’t arrived yet.

Hidden Repair Costs Eating Your Budget

When you ask, “Am I overpaying for a house?”, you have to look deeper than the purchase price. You have to look at the “True Cost of Ownership.” A house might look like a “deal” at $300,000, but if it needs $50,000 in structural repairs, you are actually paying $350,000.

The “Lipstick on a Pig” Scenario

Flippers are notorious for this. They put in cheap laminate flooring, paint the walls a trendy gray, and install a fancy-looking faucet. It looks great in photos! But underneath that “lipstick,” the HVAC system might be 20 years old, or the foundation might have cracks.

The Math of Real Value

To find the actual value, use this simple logic: True Value = Listing Price – Immediate Necessary Repairs.

If you have to spend your entire savings account to make the house livable in the first six months, you didn’t buy a home; you purchased a liability. Always insist on a professional inspection, even if the market is “hot.” A $500 inspection can save you $50,000 in buyer’s remorse, house purchase regret.

Emotional Pricing – Love at First Sight Blindness

We’ve all been there. You walk into a house, and you can already see your Christmas tree in the corner. You imagine your kids playing in the yard. This is emotional buying, and it is the enemy of financial health.

Upgrades vs. Value

Just because a seller spent $50,000 on a custom Italian marble backsplash doesn’t mean the house is worth $50,000 more. Upgrades usually only return about 50-70% of their cost in actual home value. If a seller is trying to recoup 100% of the cost of their expensive (and perhaps niche) tastes, they are overpricing the home.

The 1% Rule for Sanity

If you are worried about overpaying on a house, use the 1% Rule as a quick sanity check. Could this house rent for roughly 1% of its purchase price? While this is more of an investment metric, if the gap between the mortgage payment and the potential rent is massive, it’s a sign the price is disconnected from the local economy.

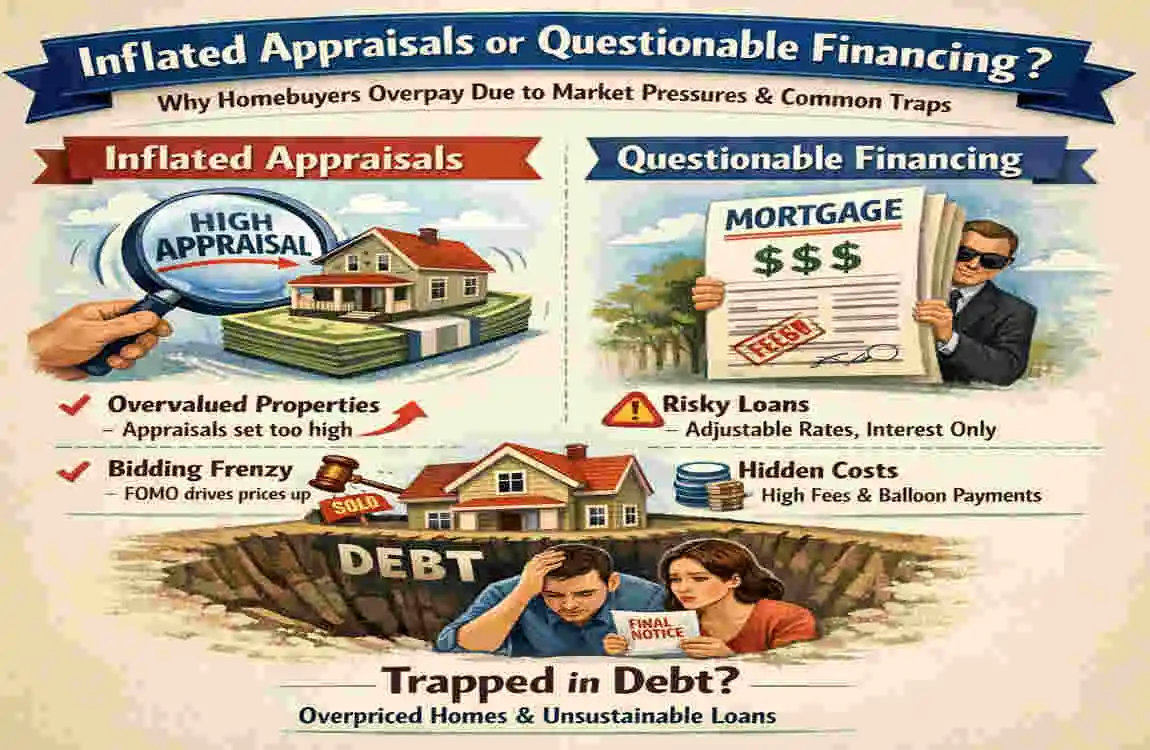

Inflated Appraisals or Questionable Financing

Sometimes, the system itself can lead you astray. During the heights of real estate bubbles, appraisals can sometimes lag or, worse, be “pushed” to meet a sale price.

The Role of the Independent Appraisal

Your bank will require an appraisal because they don’t want to lend you $500,000 for a house that is only worth $400,000. If the appraisal comes back lower than your offer, listen to it! This is the universe (and a professional data analyst) telling you that you are overpaying for a house.

Watch Out for Seller-Paid Appraisals

If a seller offers you an appraisal they “already had done,” ignore it. Always hire your own independent appraiser. You need someone whose only job is to tell you the cold, hard truth, not someone trying to help the seller get a higher price.

Ignoring Broader Market Trends

A house doesn’t exist in a vacuum. It exists within both the global and local economies. One of the most significant signs you’re overpaying for a home is buying at the absolute peak of a cycle right before a shift.

Macro Indicators to Watch

In 2026, we are seeing the effects of fluctuating interest rates. Suppose the Federal Reserve (or your local central bank) is hiking rates, and buyers’ purchasing power drops. This usually leads to a price decline. If you buy a house at a record-high price just as interest rates are peaking, you might find yourself with “negative equity”—where you owe more than the home is worth—within just a year or two.

Use the Case-Shiller Index

Look up the Case-Shiller Home Price Index for your region. It tracks the growth of home prices over decades. If the current graph for your city looks like a vertical line, be very careful. What goes up quickly often levels off or dips just as fast.

Smart Valuation Checks: 5 Tools to Confirm You’re Not Overpaying

Now that you know the red flags, how do you actually verify the price? Use these five steps to ensure you’re getting a fair deal.

Automated Valuation Models (AVMs)

Start with tools like Zillow’s Zestimate or Redfin’s Estimate. While they aren’t 100% accurate, they provide a great “ballpark” figure based on public data. If the asking price is 15% higher than all the AVMs, you need an excellent explanation for it.

The Price-Per-Square-Foot (PPSF) Analysis

This is the great equalizer. Calculate the PPSF of the home you want: PPSF = Total Price / Total Square Footage. Compare this number to the average PPSF of similar homes sold in the area. If the average is $200 and your target house is $275, you are likely overpaying.

Request a Comparative Market Analysis (CMA)

Ask your real estate agent for a CMA. A good agent will provide a detailed report showing the active, pending, and sold listings most similar to your target home. If your agent refuses to do this or tells you, “trust me, it’s a good deal,” it might be time to find a new agent.

Professional Independent Appraisal

As mentioned before, this is your best line of defense. Spend the $300-$600 for a private appraisal before you finalize your offer. It is a tiny price to pay for the peace of mind that you aren’t losing tens of thousands of dollars on day one.

The “Stress-Test” Affordability Check

Check your Debt-to-Income (DTI) ratio. Most financial experts recommend that your total housing costs (mortgage, tax, insurance) should not exceed 28-36% of your gross monthly income. If buying this house pushes you to 45% or 50%, you are overpaying relative to your own financial safety.

Real-Life Case Studies: Buyers Who Spotted Overpayment

Case Study A: The Negotiator

In early 2025, a couple in Lahore was looking at a villa in Phase 6. The asking price was PKR 65M. After doing a PPSF analysis, they realized the home was priced 12% higher than the house next door, which had better finishes. They presented this data to the seller, who eventually dropped the price to PKR 58M. They saved PKR 7M just by doing 20 minutes of homework.

Case Study B: The Heartbroken Buyer

Another buyer in a U.S. suburb fell in love with a “modern farmhouse” remodel. They ignored the basement’s slight musty smell and bid $40,000 over asking to beat out three other offers. Six months later, the basement flooded due to a foundation crack. Between the overpayment and the repairs, they were $70,000 “underwater” on their investment. This is the definition of buyer’s remorse in a house purchase.

FAQ: Common Questions About Overpaying for a House

How do I know if I’m overpaying for a house in a bidding war?

In a bidding war, the “market value” is technically whatever someone is willing to pay. However, you should set a “walk-away price” based on the appraisal and comps before the bidding starts. If the price goes $10,000 above your walk-away number, let someone else overpay.

Does a high asking price always mean a house is overpriced?

Not necessarily. A house might have unique features, such as a double lot, a custom pool, or Premium energy-efficient upgrades, that aren’t immediately obvious. This is why a detailed inspection and comp check are vital.

Can I negotiate the price after a low appraisal?

Yes! A low appraisal is actually a powerful negotiation tool. Most buyers use it to ask the seller to drop the price to the appraised value, as the buyer’s bank won’t lend more than that amount anyway.