The real estate landscape is constantly evolving, and the demand for quick home sales is on the rise. Whether you’re facing foreclosure, dealing with an inherited property, or need to relocate urgently, selling to a real estate investor can be a fast and convenient solution. By understanding how to sell your house to a real estate investor, you can navigate the process with confidence and achieve a successful outcome.

Understanding Real Estate Investors

Before we delve into the specifics of selling your house to an investor, let’s take a moment to understand who these buyers are and what motivates them.

Who are Real Estate Investors?

Real estate investors are individuals or companies that purchase properties with the intention of generating a profit. They may buy homes to rent out, flip for a higher price, or hold as part of their investment portfolio. Investors come in various forms, each with their own strategies and goals.

Different Types of Investors

- Cash Buyers: These investors have the funds readily available to purchase properties without relying on financing. They can close deals quickly, often within days or weeks.

- Rehabbers: Also known as “fix-and-flip” investors, rehabbers buy properties that need repairs or renovations. They aim to improve the property and sell it for a profit.

- Wholesalers: Wholesalers act as middlemen, finding distressed properties and assigning the contracts to other investors for a fee.

Why Investors Prefer Quick Sales and Cash Deals

Real estate investors thrive on speed and efficiency. By purchasing properties quickly and with cash, they can:

- Secure the best deals before other buyers

- Avoid the delays and uncertainties of traditional financing

- Minimize holding costs and maximize their return on investment

Benefits of Selling Your House to an Investor vs. Traditional Buyers

Selling your house to an investor offers several advantages over the traditional home-selling process:

- Faster Closing: Investors can often close the deal within days or weeks, compared to the months it may take with a conventional buyer.

- Sell “As-Is”: Investors typically purchase properties in their current condition, saving you the time and expense of repairs or staging.

- Less Paperwork and Contingencies: Investor transactions often involve fewer legal hurdles and contingencies, streamlining the process.

- Potential for Fewer Fees and Commissions: By selling directly to an investor, you may avoid paying real estate agent commissions and other fees associated with a traditional sale.

Why Sell Your House to a Real Estate Investor?

Now that we understand who real estate investors are and what they offer, let’s explore the specific reasons why selling your house to an investor might be the right choice for you.

Speed of Sale

One of the most compelling reasons to sell your house to an investor is the speed of the transaction. While a traditional home sale can take months, an investor can often close the deal within days or weeks. This rapid timeline can be a game-changer if you’re facing time-sensitive circumstances.

Selling “As-Is” Without Costly Repairs or Staging

When you sell your house to an investor, you typically don’t need to worry about making repairs or staging the property. Investors are accustomed to purchasing homes in their current condition, which can save you significant time and money. This “as-is” approach is especially beneficial if your house needs extensive repairs that you can’t afford or don’t have time to complete.

Less Paperwork and Fewer Contingencies

Investor transactions often involve less paperwork and fewer contingencies compared to traditional home sales. This streamlined process can make the selling experience smoother and less stressful. With fewer hurdles to overcome, you can focus on moving forward with your plans rather than getting bogged down in legal complexities.

Potential for Fewer Fees and Commissions

When you sell your house to an investor, you can avoid paying real estate agent commissions and other fees associated with a traditional sale. This can result in more money in your pocket at the end of the transaction. However, it’s essential to carefully review the terms of any offer to ensure you understand all the costs involved.

Situations Where Selling to Investors is Ideal

Selling your house to an investor can be particularly beneficial in certain situations:

- Foreclosure Risk: If you’re facing the possibility of foreclosure, selling to an investor can help you avoid the negative consequences and move on with your life.

- Inherited Property: If you’ve inherited a property that you don’t want to keep, selling to an investor can be a quick and easy way to liquidate the asset.

- Urgent Move: If you need to relocate quickly due to a job change, family situation, or other urgent circumstances, an investor can help you sell your house fast.

How to Sell Your House to a Real Estate Investor – Step-by-Step Process

Now that you understand the benefits of selling your house to an investor, let’s walk through the step-by-step process to help you navigate the transaction successfully.

Research Local Real Estate Investors Specializing in Your Property Type

Start by researching local real estate investors who specialize in purchasing properties like yours. Look for investors with experience in your property type (e.g., single-family homes, multi-family units, or commercial properties). You can find investors through online searches, real estate investment clubs, or by asking for referrals from friends, family, or real estate professionals.

Understand What an Investor Looks for in a Property

To attract the right investors, it’s crucial to understand what they look for in a house property. Key factors include:

- Location: Investors often prioritize properties in desirable neighborhoods with strong rental demand or appreciation potential.

- Condition: While investors may purchase properties in various conditions, they’ll assess the cost and effort required to make the property profitable.

- Price: Investors aim to buy properties at a price that allows them to generate a profit after repairs, holding costs, and other expenses.

Get a Fair Market Valuation

Before reaching out to investors, it’s wise to get a fair market valuation of your property. You can use online tools like Zillow or Redfin to estimate your home’s value, but keep in mind that these are just starting points. Consider getting a professional appraisal or consulting with a real estate agent to get a more accurate assessment.

Prepare Necessary Documents

To streamline the selling process, gather all necessary documents for your property. These may include:

- Title: Proof of ownership and any liens or encumbrances on the property

- Mortgage Information: Details about your current mortgage, including the outstanding balance and payment history

- Tax Records: Recent property tax statements and any outstanding tax obligations

Contact Investors and Submit Property Details

Once you have your valuation and documents ready, start reaching out to potential house investors. Please provide them with the key details about your property, including its location, condition, and your desired selling price. Be prepared to answer questions and provide additional information as needed.

Compare Offers

As you receive offers from investors, take the time to carefully compare them. Look beyond just the price and consider factors like:

- Closing Speed: How quickly can the investor close the deal?

- Contingencies: Are there any conditions that need to be met before the sale can proceed?

- Terms: Are the payment terms and closing costs favorable to you?

Negotiate Terms and Clarify the Closing Process

Once you’ve selected an offer that meets your needs, it’s time to negotiate the terms and clarify the closing process. Work with the investor to ensure you both understand the timeline, payment details, and any other vital aspects of the transaction. Don’t hesitate to ask questions or seek legal advice if needed.

Closing the Deal

When you’ve reached an agreement with the investor, it’s time to close the deal. This typically involves signing the necessary paperwork, receiving payment, and transferring ownership of the property. Work closely with the investor and any professionals involved (e.g., title company, attorney) to ensure a smooth and successful closing.

Proven Tips to Sell Your House Faster to Investors

To maximize your chances of selling your house quickly to an investor, consider implementing these proven tips:

Price Competitively but Realistically

To attract investors, price your house competitively but realistically. Consider the current market conditions, the condition of your property, and the potential profit an investor could make. Pricing too high may deter investors, while pricing too low could leave money on the table.

Provide Clear and Honest Property Disclosures

When selling to an investor, it’s crucial to provide transparent and honest property disclosures. Be upfront about any known issues or repairs needed, as this will help build trust and streamline the transaction process. Investors appreciate transparency and are more likely to move forward with a deal when they have all the necessary information.

Enhance Curb Appeal Cost-Effectively

While you may not need to make extensive repairs when selling to an investor, enhancing your home’s curb appeal can still make a positive impression. Simple, cost-effective improvements like mowing the lawn, trimming bushes, and cleaning up the exterior can help your property stand out to potential buyers.

Be Flexible with Showings and Inspections

To sell your house quickly to an investor, be flexible with showings and inspections. Accommodate the investor’s schedule as much as possible, and be prepared to allow them to view the property at short notice. The more accessible your home is, the more likely an real estate investor will be to make an offer.

Have All Paperwork Ready in Advance

To streamline the selling process, have all your paperwork ready in advance. Gather documents like the title, mortgage information, and tax records, and keep them organized and easily accessible. Having everything prepared can help speed up the transaction and demonstrate your readiness to sell.

Choose Reputable Investors with Proven Track Records

When selecting an investor to work with, choose one with a reputable track record. Look for investors who have experience in your local market and a history of successful transactions. You can research an investor’s reputation by reading online reviews, asking for references, or consulting with real estate professionals.

Leverage Multiple Offers to Negotiate Better Terms

If you receive multiple offers from investors, use them to your advantage. Having several options on the table, you can negotiate better terms and potentially secure a higher price or more favorable closing conditions. Don’t be afraid to play the offers against each other to get the best possible deal.

Highlight Unique Selling Points that Investors Value

When marketing your property to investors, highlight any unique selling points that they may value. For example, if your house has a desirable location, a large lot, or potential for rental income, be sure to emphasize these features. The more you can showcase your property’s investment potential, the more attractive it will be to investors.

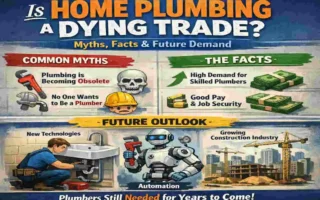

Common Myths and Misconceptions About Selling to Investors

Despite the many benefits of selling your house to an investor, there are still some common myths and misconceptions that can deter homeowners from pursuing this option. Let’s debunk these myths and provide clarity on the realities of selling to investors.

Investors Only Want Distressed Properties

While some investors specialize in distressed properties, not all limit themselves to them. Many investors are open to buying properties in various conditions, from well-maintained homes to those in need of minor repairs. By understanding what different investors are looking for, you can find the right buyer for your property.

Selling to Investors Means Selling at a Low Price

Another common misconception is that selling to an investor always means accepting a low price for your home. While it’s true that investors need to buy properties at a price that allows them to generate a profit, this doesn’t necessarily mean you’ll receive a lowball offer. By pricing your home competitively and negotiating effectively, you can secure a fair price from an investor.

Investors Are Not Trustworthy Buyers

Some homeowners worry that investors are untrustworthy buyers who may try to take advantage of them. While it’s true that there are unscrupulous individuals in every industry, most real estate investors are legitimate businesspeople looking to make a profit. By doing your due diligence and working with reputable investors, you can have a positive and trustworthy selling experience.

The Process Is Complicated or Risky

Selling your house to an investor doesn’t have to be a complicated or risky process. By following the steps outlined in this guide and working with a reputable investor, you can navigate the transaction smoothly and confidently. Remember to ask questions, seek professional advice when needed, and stay informed throughout the process to minimize any potential risks.

How to Avoid Getting Scammed and Ensure a Smooth Transaction

To avoid getting scammed and ensure a smooth transaction when selling to an investor, follow these tips:

- Research the investor: Before working with an investor, research their reputation and track record. Look for online reviews, ask for references, and consult with real estate professionals to ensure you’re dealing with a legitimate buyer.

- Get everything in writing: Always have a written contract that outlines the terms of the sale, including the purchase price, closing date, and any contingencies. Review the contract carefully and don’t hesitate to seek legal advice if needed.

- Be wary of red flags: If an investor pressures you to sign a contract quickly, asks for upfront fees, or makes promises that seem too good to be true, proceed with caution. Trust your instincts and don’t be afraid to walk away from a deal that feels risky.

- Work with professionals: Consider working with a real estate attorney or agent to guide you through the process and protect your interests. These professionals can review contracts, negotiate on your behalf, and ensure that the transaction is handled correctly.

Risks and Considerations When Selling to Real Estate Investors

While selling your house to an investor can be a fast and convenient option, it’s essential to understand the potential risks and considerations. By understanding these factors, you can make an informed decision and take steps to protect yourself throughout the process.

Potential Lower Sale Price Than Traditional Sale

One of the principal risks of selling to an house investor is the potential for a lower sale price compared to a traditional sale. Investors need to buy properties at a price that allows them to generate a profit, which may mean offering less than what they could get on the open market. However, this lower price is often offset by the speed and convenience of the transaction.

Importance of Vetting Investors Carefully

To minimize the risks of selling to an investor, it’s crucial to vet potential buyers carefully. Research their reputation, ask for references, and look for any red flags that may indicate an untrustworthy or inexperienced investor. By working with a reputable buyer, you can increase your chances of a smooth and successful transaction.

Legal and Contractual Aspects to Watch For

When selling to an investor, pay close attention to the legal and contractual aspects of the transaction. Review the purchase agreement carefully, and make sure you understand all the terms and conditions. If you’re unsure about any aspect of the contract, don’t hesitate to seek legal advice from a real estate attorney.

When to Seek Professional Advice

Throughout the process of selling your house to an investor, there may be times when it’s wise to seek professional advice. Consider consulting with a real estate agent, attorney, or financial advisor in the following situations:

- Unclear or complex contracts: If you’re unsure about any aspect of the purchase agreement or other legal documents, seek advice from a real estate attorney.

- Negotiating the sale price: A real estate agent can help you determine a fair price for your home and negotiate with the investor on your behalf.

- Tax implications: If you’re concerned about the tax implications of selling your house, consult with a financial advisor or tax professional.

- Unsure about the process: If you’re new to selling a house to an investor and feel uncertain about any aspect of the process, seek guidance from a real estate professional.